Let’s imagine a friendly financial advisor available in your pocket, ready to answer your burning questions about money anytime, anywhere. That’s the power of Conversational AI in banking! These solutions are shaking up the financial world, offering instant support and personalized guidance that goes beyond just checking your balance. Forget waiting on hold or navigating endless menus – banking chatbots can answer user questions about loans, investments, or even suspicious activity on their account. These tools can even help make secure transactions and payments in a flash.

Insurance and financial companies like Wells Fargo, Citigroup, Bank of America, JPMorgan Chase & Co., American Express, and Fidelity Investments own the largest call centers in the US and include over 3.3 million support specialists nationwide. However, we’ve seen a shift in how enterprises are investing in technology to reduce client costs and automate the bulk of customer requests. According to Juniper Research these operational cost savings will reach $7.3 billion globally with the help of Conversational AI solutions for the banking sector.

But virtual assistants (VAs) aren’t just about convenience; they’re helping banks operate smarter. By automating routine tasks, bots free up human advisors to tackle complex financial needs. This not only improves user experience but also allows organizations to scale their services efficiently. So, buckle up for a ride into the future of finance, where an AI chatbot for banks is transforming how we manage our money.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Table of Contents

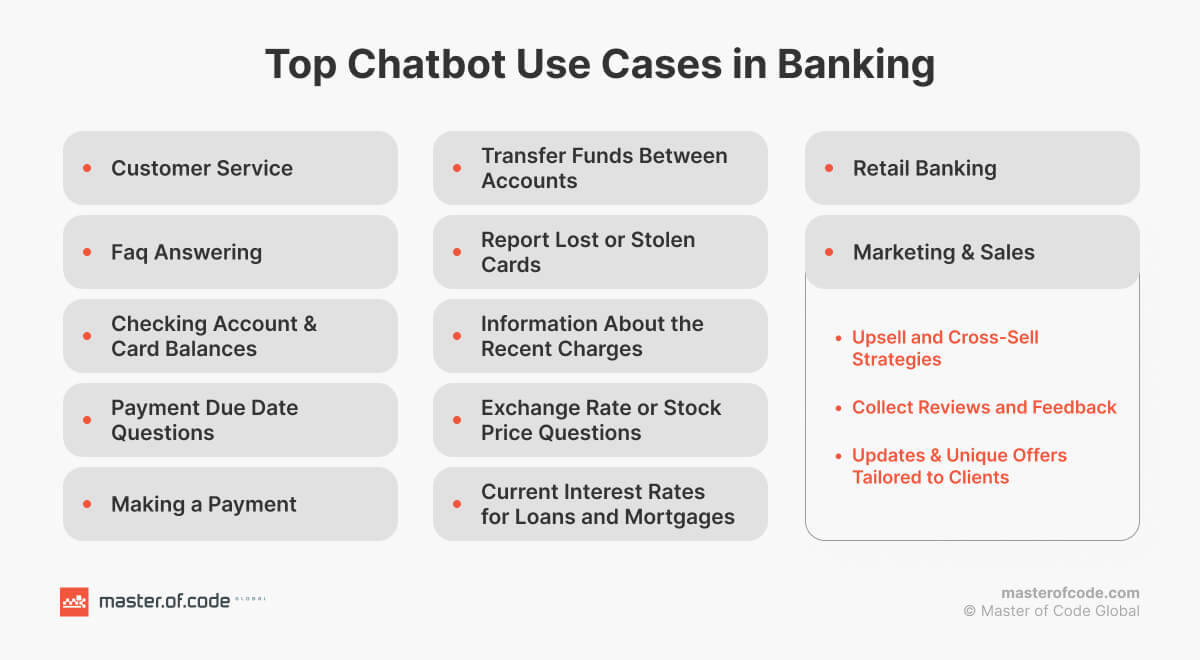

Chatbot Use Cases in Banking That Revolutionize Customer Experience

Gone are the days of endless phone queues and frustrating hold music. The future of finance is here, and it’s powered by friendly, intelligent bots. These digital helpers are transforming how we interact with our accounts and transaction history, offering a dynamic and personalized journey that’s both convenient and secure.

Checking account or card balances is a top user request, as 36% of Americans take a look at their balance daily. Let’s delve into the potential use cases and top ways banking chatbots are revolutionizing the way enterprises serve their customers.

24/7 Customer Support

How often do your clients need help with password reset or have a question about a recent transaction? Chatbots in banking are your on-demand customer support advisors, available 24/7 to answer customer queries and address concerns. Users can simply chat with the bot for assistance with pin reset or get the information they need instantly with the help of Conversational AI for customer service.

FAQs Automation

According to the FRS, Delinquency Rates under Consumer loans rose to 1.43% in 2024. Do you regularly get questions about account information like fees or minimum balance requirements? An AI virtual assistant can be programmed with a comprehensive library, offering instant answers to the most common inquiries. An FAQ-based chatbot not only enables your employees to focus on more complex issues but also empowers people to find solutions independently.

Balance & Financial Info Access

Peeking into accounts’ status shouldn’t be a chore. Virtual assistants allow your financial clients worldwide to effortlessly view their expenses or savings, recent transactions, and account history in a matter of seconds through seamless account information retrieval. Let them forget logging into the online portal and start simply asking the bot, and get an instant update with detailed spending insight.

Payment & Due Date Assistance

Staying on top of on-time bill-related transactions may be a hassle. Banking chatbots can act as a personal financial reminder, providing your customers with upcoming due dates and even allowing them to schedule automatic payments to avoid late fees and ensure peace of mind. By integrating Generative AI and payments, these intelligent assistants can also analyze spending patterns, predict upcoming payment amounts, and offer tailored suggestions to help users manage their finances smartly.

Instant Money Transfers

The number of victims of credit or debit card fraud has risen to 52 million people in the United States by 2024. People all over the world transfer money between your checking and savings account and want this process to be flawless and smooth. Chatbots in banking have your organization’s needs covered for seamless fund transfers. Now, your clients can simply initiate a chat, specify the amount they want to send, and the bot will handle the rest, ensuring a smooth and secure transaction.

Lost Card Reporting

Is your call center flooded with requests regarding missed debit cards? Fret no more. Chatbots in banking also allow your users to quickly report a lost or stolen asset, and get immediate help without distracting your employees from more complex queries. Help them safeguard finances, prevent fraud and unauthorized transactions on a go and without the need to visit your office. This immediate action minimizes risk and ensures peace of mind during such stressful situations.

Clear Financial Status

According to CNBC, 42% of Americans have forgotten that they’re still paying for a subscription they no longer use, and it messes with the charge on their accounts. An AI chatbot for banks can provide your financial services consumers with detailed information on recent transactions, helping them stay on top of their spending and identify any potential discrepancies. This way, you will be able to grow a more loyal customer base that trusts you.

Market & Interest Rate Updates

Whether your bank serves seasoned investors or newcomers, your on-site AI banking chatbots can be their comprehensive window into the world of finance. Digital solutions provide real-time exchange rates, current stock prices, loan and mortgage rates, and financial news snippets – all within the familiar chat interface. This makes essential financial information easily accessible, allowing users to compare interest rates on various products and make informed decisions while saving precious time for your agents.

Marketing & Sales

- Cross-Sell and Upsell Strategies: Banking chatbots analyze a customer’s habits and provide personalized financial recommendations about products or services that align with their needs. This targeted approach leverages entity extraction to understand customer preferences and can lead to increased satisfaction and higher sales for the bank.

- Customer Feedback Collection: AI assistants engage people in quick post-interaction surveys, gathering valuable reviews about their journey. This insight loop allows banks to constantly improve user help and tailor offerings to better meet consumer needs.

- Latest Updates and Exclusive Offers: 72% of customers rate personalization as “highly important” in financial organizations. Here, a chatbot in the banking sector serves as a communication channel to keep people informed about new products and special offers. These targeted messages lead to increased engagement and brand loyalty.

Voice-Enabled Banking

Voice-enabled AI banking chatbots represent the next frontier in customer interaction, allowing users to perform banking tasks through natural speech commands. Customers can check balances, review recent transactions, and even initiate transfers simply by speaking to their device. This hands-free approach enhances accessibility for users with mobility challenges and provides a more convenient banking experience while driving or multitasking. Advanced recognition technology ensures secure authentication through biometrics, making interactions with voice assistants in banking both convenient and safe.

Loan Application Support

Banking chatbots streamline the loan applications process by guiding customers through each step with personalized assistance. These intelligent systems can pre-qualify applicants by gathering essential information, explaining documentation requirements, and providing real-time updates on application status. By automating initial screening and document collection, chatbots in banking significantly reduce processing time while ensuring customers understand loan terms and requirements. This digital-first approach to loan support reduces branch visits and phone calls, creating a more efficient experience for both customers and loan officers.

Banking Efficiency

Modern virtual assistants automate routine tasks and optimize the customer onboarding process. They can handle multiple customer interactions simultaneously, reducing wait times and operational costs. Through intelligent routing, AI banking chatbots can identify when human intervention is needed and seamlessly transfer complex cases to appropriate specialists. At the same time, the integration of machine learning allows these systems to continuously improve their responses, learn from customer interactions, and provide increasingly accurate support. This translates to cost savings for financial institutions together with internal process automation and delivering faster, more reliable service to clients.

Use Cases for Various Banks

Retail Banking

As you have already guessed, bots aren’t just for client service. Banks can leverage them to enhance the retail experience by providing users with product information, eligibility checks for loan and credit card products, and even initiating account opening processes – all through an interactive retail banking chatbots interface.

Credit Unions

Such organisations use VAs to build stronger community connections while cutting costs. These bots help members understand their benefits, check dividend payments, and access shared branch services. They’re great at explaining why credit unions offer better rates and lower fees than big banks. With a chatbot for credit unions, members get quick answers to common questions without waiting for staff, making the cooperative experience smoother and more personal.

Mortgage Banks

Home lending specialists use AI banking chatbots to make the mortgage process less stressful. These assistants collect your income documents, work history, and property information before sending everything to human loan officers. They break down confusing mortgage terms, show you different payment options, and keep you updated on your application status. This cuts the usual 30–45 day wait time and makes home buying much clearer.

Commercial Banking

They use powerful assistants to handle busy corporate clients efficiently. These bots manage cash flow questions, process wire transfers, and create detailed account reports. They connect with business banking systems to monitor cash levels, send payroll alerts, and handle international transactions. Your company’s operations keep running smoothly even outside banking hours.

Wealth Management

Investment firms use AI banking chatbots to give personalized financial recommendations to wealthy clients. These solutions track how your investments are doing, suggest when to rebalance your portfolio, and find tax-saving opportunities. They schedule meetings with your advisor, send quarterly reports, and explain complex investment strategies in simple terms. This makes professional wealth management available to more people.

Digital Banks

Online-only financial institutions make the most of banking chatbots since they don’t have physical branches. These bots help you open accounts using secure ID verification, process instant payments between friends, and categorize your spending with budget tips. They can read receipts through your phone camera, set up automatic savings based on your habits, and connect with other financial apps that traditional banks can’t easily use.

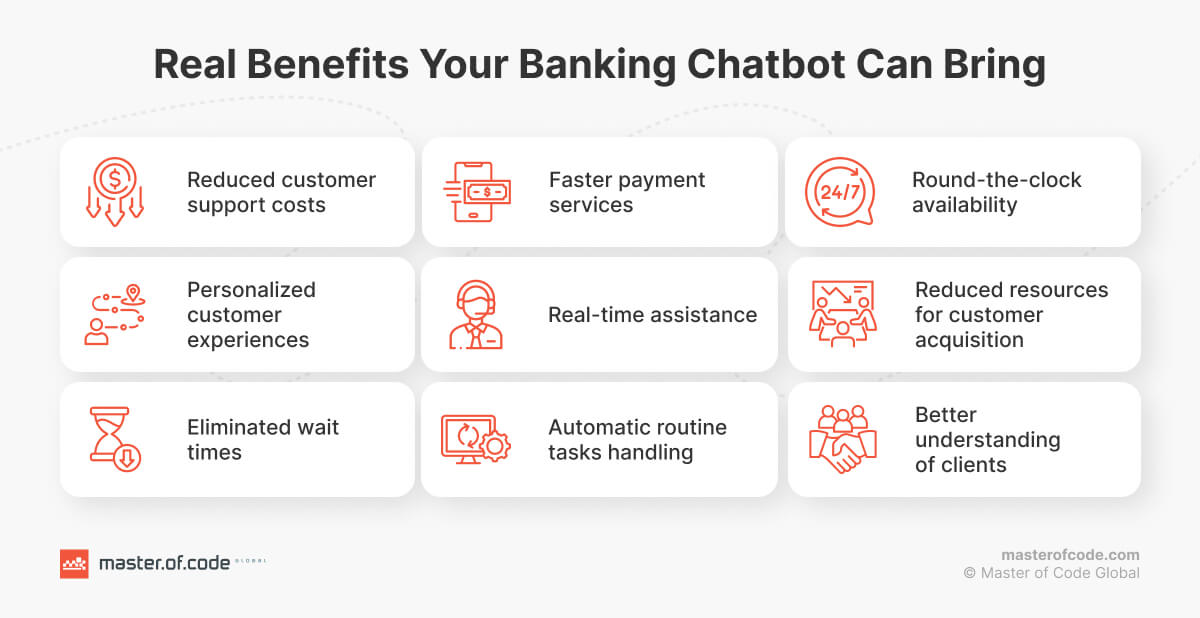

Benefits of Chatbots in Banking You Should Consider

Fraud Detection & Prevention

Suspicious activity gets caught faster than ever with AI-powered monitoring systems, protecting both your institution and customers. These intelligent guards watch transactions 24/7, spotting unusual spending patterns or login attempts from new locations across your entire customer base. When something looks off, customers receive instant alerts from the banking chatbot, while your fraud team gets real-time dashboards. This rapid response means your bank stops malicious activity within minutes instead of days, reducing liability and chargebacks while building customer trust through proactive protection.

Credit Score Assessment

Understanding credit health becomes effortless for your customers with automated monitoring tools that position your bank as a financial wellness partner. Regular score checks happen behind the scenes, with clear explanations about factors affecting ratings delivered through your branded interface. Instead of directing customers to third-party credit sites, your AI chatbot for banking provides plain English breakdowns about payment history and credit usage. Your institution becomes the go-to source for financial guidance, increasing customer engagement and loyalty while reducing call center inquiries about credit-related questions.

Personalized Investment Options

Customer financial goals drive smart investment recommendations tailored specifically to their situations, expanding your wealth management reach. Whether clients are planning for retirement, saving for homes, or building education funds, your platform suggests suitable products that match their timelines and risk tolerance. Complex investment terms get translated into simple language through your banking chatbot, making wealth management accessible to mass market customers. Your institution captures more assets without adding expensive human advisors.

Product Recommendation

User spending patterns reveal opportunities for your bank to offer better solutions at exactly the right moments. Frequent overdrafts trigger automatic suggestions for your line of credit products, while consistent saving habits lead to recommendations for your higher-yield accounts or CDs. These suggestions focus on genuine customer benefits while driving product adoption and fee income. Your bank appears thoughtful and customer-centric rather than sales-focused, building trust while cross-selling becomes a natural part of the overall experience.

Upsell & Cross Sell Strategies

Chatbots in banking transform raw data into meaningful upgrade opportunities that drive revenue when they actually make sense for customer lifestyles. Premium account features get suggested only when customers would truly benefit, improving satisfaction and retention rates. Your travel rewards cards get promoted to frequent travelers, while mortgage refinancing options reach new homeowners at optimal timing. These strategic recommendations generate higher conversion rates because they’re rooted in actual user behavior rather than generic sales campaigns.

Cost Savings

Now there’s no need in expensive call centers with lengthy hold times. AI chatbots for banking can handle a significant portion of inquiries, from basic account balance checks to resolving simple issues. This not only frees up human representatives for more complex concerns but also reduces overall help costs for banks. What’s more, quickly handled payments are directly tied to higher revenues across the industry.

Banking Chatbot Examples That Inspire

The traditional image of the banking industry is this: long lines, impersonal interactions, and limited hours. Fortunately, it is rapidly fading into the past. Intelligent banking virtual assistants are ushering in a new era of personalized, convenient, and accessible financial experience. Let’s delve into some of the leading examples of how smart bots are reshaping the landscape.

North American

- Voice AI Agent for Financial Services. Since its launch, Master of Code Global’s Voice AI agent has been transforming how financial institutions manage credit account inquiries. Designed to handle everything from authentication to transaction processing, this AI-powered assistant engages customers through natural voice interactions, offering a seamless and secure experience. It operates 24/7, providing customers with fast, reliable assistance whenever they need it. In just one month, the Voice AI manages over 156,000 calls, ensuring high efficiency with a 94% first-call resolution rate. By automating routine tasks, it saves financial institutions $7.7M annually in operational costs, while delivering an 88% customer satisfaction rating—proving its powerful impact in streamlining credit account management.

- Wells Fargo: This company integrated their digital assistant within the mobile app, allowing clients to ask questions and get basic banking tasks done conversationally. This shift towards AI-powered tools signifies a broader trend in the financial sector. It streamlines service, offering 24/7 access to information and potentially reducing wait times for human representatives. While Fargo can’t handle complex transactions yet, it paves the way for a future where AI personalizes and simplifies the ways we manage budgets.

- Bank of America’s Erica: Launched in 2018, Erica has become a trusted companion for nearly 32 million Bank of America clients. Available 24/7, AI banking chatbot can personalize assistance, offering features like proactive spending insights, real-time notifications about bills, and even FICO score checks. This translates to a huge range of real-world benefits. For instance, Erica users monitor recurring charges 2.1M times per month and stay informed about refunds over 863,000 times during the same period.

- JPMorgan Chase’s Powerhouse Duo: This conversational banking bot isn’t just one player in the game; JPMorgan Chase are fielding two innovative solutions. COiN, their “Contract Intelligence” bot, tackles complex commercial loan agreements, analyzing documents and reducing processing time from 360,000 hours to mere seconds! Meanwhile, IndexGPT is designed to empower individual investors, simplifying decisions and guiding clients towards suitable stocks and funds based on their financial health.

Global Chatbot Champions

- Bradesco Bank (Brazil): Watsonx Assistant, Bradesco Bank’s hero, tackles over 10,000 customer questions daily. This Portuguese-speaking AI whiz is specifically trained in the intricacies of banking, ensuring efficient and accurate support for Brazilian clients.

- Asteria (Global): This isn’t a single chatbot; it’s a testimony to Generative AI in banking. Imagine tools that can not only answer questions but also generate personalized reports or suggest relevant investment opportunities – Asteria is making that future a reality.

Europe

- Crédit Mutuel: Overwhelmed by online inquiries? Crédit Mutuel’s banking chatbot successfully solved this problem for the French bank. This virtual assistant handles an impressive 350,000 online inquiries daily, freeing up human advisors and streamlining customer help. The result? Client advisors can respond 60% faster, leading to a more positive process.

- Nordea: This leading Nordic bank with operations across Scandinavia boasts 12 virtual agents serving clients in their local languages. Nordea’s chatbot development in Norway even sparked a knowledge-sharing initiative, allowing the Finnish team to triple their agent’s answer capabilities!

- DNB: Norway’s biggest bank is at the forefront of AI-powered user journey with a digital assistant deployed across eight departments. This bot handles over 80,000 conversations monthly, answering a wide range of questions. DNB’s success with this technology shows how finance AI chatbots can streamline the banking sector, improve efficiency, and enhance customer assistance. Their expansion plans indicate a future where artificial intelligence plays a major role in financial services.

Digital Banks

- NOMI from Royal Bank of Canada (Canada): Transaction management just got easier with this chatbot. The tool goes beyond basic transactions by offering personalized spending insights and budgeting assistance. It can even analyze your monthly expenditure and identify additional funds for automated savings!

- Eno from Capital One (US): Your friendly neighborhood advisor in chatbot form! Eno simplifies the banking industry with an intuitive interface and insightful analysis of your spending habits. It tracks account activity, sends alerts on recurring charges, and even helps you manage shopping habits by creating unique virtual card numbers.

Risks and Limitations You May Face

Banking chatbot implementation can carry risks when handled improperly, potentially impacting your bottom line and customer retention. Understanding these challenges helps you recognize why choosing the right service provider matters from day one.

Technical Limitations

Poorly designed virtual assistants may struggle with syntax interpretation, which could lead to user frustration and support ticket escalation. Even worse, unreliable systems might experience downtime during critical moments – like market volatility or month-end processing. Furthermore, when institutions work with inexperienced teams, outdated bot technology can create performance bottlenecks that damage your Net Promoter Score.

That’s why trustworthy banking AI consultants and developers always invest in enterprise-grade infrastructure and implement quarterly system updates to prevent these issues entirely.

Accuracy and Reliability Concerns

Inadequately trained AI banking chatbots might provide wrong information, potentially leading to poor client financial decisions and liability issues. However, the bigger risk occurs when bots aren’t properly configured to understand complex queries about loan terms, investment options, or account disputes. As a result, this could create customer confusion and increase call center volume, defeating the original cost-saving purpose.

Fortunately, proper training protocols and expert implementation prevent these financial guidance mistakes that could otherwise harm relationships with your consumers.

Customer Experience Risks

The key insight is that trust erosion happens quickly when systems aren’t properly designed, but experienced teams know how to balance automation with human touch. For instance, clients facing divorce, job loss, or investment losses need human empathy – something skilled developers build into their escalation protocols.

Usually, badly configured banking chatbots might block human agent access, potentially frustrating users during emergencies like fraud alerts or account lockouts. Moreover, inexperienced implementation teams may create over-automated systems that damage relationship banking, especially for high-value clients who expect personal service.

Security and Privacy Risks

It also happens that low-secured virtual assistants could become targets for cybercriminals seeking to steal customer data and commit fraud. In addition, poorly implemented systems might expose sensitive information like account numbers and transaction history. Consequently, security vulnerabilities could trigger regulatory investigations and massive legal costs if proper safeguards aren’t in place.

Since financial institutions face constant cyber threats, we ensure every bot interaction includes robust protection through:

- End-to-end encryption – Protecting all user data during transmission and storage;

- Multi-factor authentication – Preventing unauthorized account access through robust verification.

The good news is that proper security measures prevent breaches that could otherwise cost millions in fines, legal fees, and compensations.

Regulatory and Compliance Challenges

Unfortunately, inexperienced and trustless tech vendors might create systems that violate consumer protection laws if they fail to provide required disclosures or handle complaints properly. Beyond that, such banking chatbots could miss legal nuances in complex regulations like fair lending practices or privacy requirements.

Therefore, working with compliance-experienced partners prevents CFPB investigations, regulatory fines, and reputation damage. This means choosing qualified teams with regulatory expertise ensures your systems meet all legal obligations across federal and state jurisdictions.

The Future of AI Banking Chatbots

Today, breakthrough innovations reshape how financial institutions serve customers. These emerging technologies promise to transform simple query-response systems into intelligent financial advisors that understand context, anticipate needs, and deliver personalized experiences at scale.

Smarter Intent Recognition Models

Advanced intent recognition moves beyond keyword matching to true understanding of user goals and emotional context. Next-generation models will interpret complex financial scenarios and provide nuanced guidance that considers competing priorities.

Key capabilities include:

- Emotional context detection – Recognizing when people are confused, frustrated, or ready to make major financial decisions;

- Multi-layered processing – Understanding not just what customers are asking, but why they’re asking and what outcomes they really want;

- Scenario differentiation – Distinguishing between routine planning conversations and actual financial crises to adjust response tone accordingly.

For example, when someone asks about “emergency funds,” the banking chatbot will recognize whether this is casual planning or a real financial crisis, then respond with appropriate empathy and urgency.

Next-Gen Generative AI

Generative AI transforms chatbots in banking from scripted responders into creative problem-solvers that explain complex financial concepts in personalized ways. These systems generate custom content tailored to individual clients’ situations and literacy levels.

Revolutionary applications of Generative AI in banking include:

- Personalized financial education – Creating custom explanations of complex topics like mortgage terms or investment strategies;

- Dynamic market insights – Generating real-time reports showing how current conditions affect specific portfolios;

- Adaptive communication – Adjusting language style (formal, conversational, educational) based on user preferences and financial sophistication.

Instead of generic advice, clients receive AI-generated reports that explain exactly how market changes impact their personal financial goals and investment timelines.

Autonomous Agentic AI Systems

The future belongs to autonomous banking chatbots that complete entire financial processes independently. These intelligent systems handle multi-step tasks without constant human oversight, while learning from each interaction to improve decision-making.

Game-changing features include:

- Internal process automation – Handling complete loan applications, investment rebalancing, or fraud resolution workflows;

- Proactive optimization – Monitoring profiles and executing approved actions like moving funds to higher-yield accounts;

- Intelligent coordination – Scheduling advisor appointments, initiating document reviews, and communicating with external institutions;

- Predictive assistance – Identifying spending patterns and suggesting budget adjustments or merchant negotiations.

The ultimate vision is banking agents that act as 24/7 financial partners, making smart decisions within predefined parameters. At the same time, they will seamlessly escalate complex situations to human experts when this is truly needed.

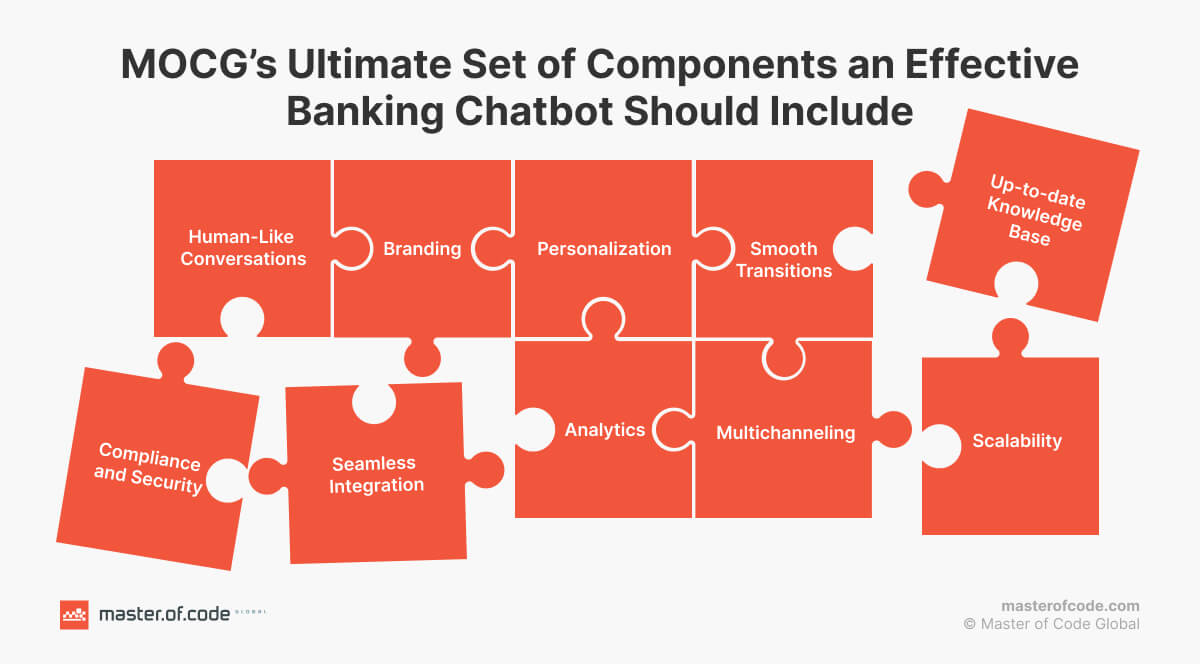

Building the Perfect AI Banking Bot: Master of Code Global’s Approach

Creating enterprise-grade conversational solutions requires more than basic scripting – it demands deep financial industry expertise and sophisticated technical architecture. Our proven methodology transforms complex requirements into intelligent banking AI chatbots. They may be seamlessly integrated with existing infrastructure while meeting stringent regulatory standards.

Our approach starts with comprehensive core systems integration analysis, ensuring your new AI chatbot for banking connects flawlessly with legacy platforms, customer databases, and transaction processing systems. We prioritize scalability requirements from day one, building solutions that grow with your institution and maintain performance under peak loads. Tech stack integration becomes seamless through our API-first architecture, connecting with everything from mainframe systems to modern cloud platforms.

Specialized intent models form the backbone of effective banking chatbots, trained specifically on financial terminology, regulatory language, and complex customer scenarios. Our conversation designers master diverse voicebot use cases for banking so your future tool will be able to handle everything from account inquiries to loan pre-qualification. At the same time, we empower the bot with robust secure handover procedures when human intervention becomes necessary. Advanced context switching capabilities ensure users never lose conversation history when transitioning between automated responses and live agents.

Nevertheless, maintaining current and accurate responses requires systematic knowledge base updates that reflect changing products, policies, and legal obligations. An AI chatbot for banks continuously learns from interactions and adheres to compliance requirements across multiple jurisdictions. Banking chatbots on WhatsApp and other messaging platforms extend your reach, maintaining security standards that protect sensitive financial data.

Our Clients’ Success Stories

Microsoft-Native AI FAQ Chatbot for Financial Institution

Our client, a leading member-owned banking institution, sought to enhance internal knowledge access and improve operational efficiency. Our AI Readiness Audit revealed that manual processes for searching policy information and handling regulatory inquiries were slowing down staff productivity. This set the stage for the development of a more efficient, intelligent solution.

We engineered a Microsoft-native AI-powered knowledge assistant integrated with Power Automate’s AI capabilities, which allowed the bot to access SharePoint libraries, document repositories, and knowledge bases through natural conversations. This integration eliminated the need for additional tools or authentication systems, making the solution easy to deploy within their existing infrastructure. The bot was trained in financial terminology, ensuring accurate responses to both simple and complex inquiries.

Key achievements:

- 85% reduction in time spent searching for policy information

- 42% decrease in internal support tickets related to procedure questions

- 93% of AI responses rated as accurate and helpful by users

This solution streamlined internal processes, increased staff efficiency, and ultimately improved customer service through quicker, more reliable information access.

Agentic AI Revenue Engine for B2B Financial Services

Our client sought to integrate AI for their competitive advantage in the North America region. Our AI Readiness Audit revealed critical data fragmentation preventing holistic business performance analysis. It set the stage for further project scaling and development of something really special. We engineered an integrated analytics platform with a custom dashboard powered by an Agentic AI assistant that unified marketing data, CRM information, and transaction values.

Key achievements: 35% increase in overall ROMI within six months and 40% faster recognition and capitalization on high-performing marketing initiatives. This all enabled data-driven budget allocation decisions that improved campaign efficiency.

AI Voicebot for Mid-Sized Retail Bank

A forward-thinking retail bank partnered with Master of Code Global to address rapid growth challenges and increasing consumer demands. Our team developed a comprehensive speech-enabled FAQ system that integrated with their existing CRM, providing personalized account information and proactive alerts. This banking chatbot delivered 24/7 multilingual support while incorporating advanced sentiment detection for seamless escalation to human agents.

Key achievements: 26% reduction in call center volumes and 79% first-call resolution rate while maintaining high security standards through voice recognition and multi-factor authentication.

RCS Messaging Platform for Global Payment Processor

A global payment processor needed to break free from fragmented communications with clients, with existing channels creating friction and driving up support costs. Master of Code Global created a unified RCS Business Messaging platform that brought all customer interactions into continuous conversation threads. This banking chatbot featured secure authentication meeting financial industry standards while providing rich media transaction details and interactive payment verification.

Key achievements: 42% reduction in customer service calls; 27% improvement in satisfaction scores within 6 months and $1.2M annual savings from reduced call center operations.

Why Master of Code Global

With ISO 27001 certification and a track record of 1000+ successfully delivered projects, our 200+ seasoned specialists bring unmatched expertise to banking technology challenges and create a really efficient chatbot for payments.

Our strong team of conversation designers understands the nuances of financial communication, creating natural interactions that build trust, as well as achieving business objectives. As a part of our custom AI chatbot development services, every solution undergoes rigorous testing to meet banking industry security requirements and deliver exceptional user experiences across all touchpoints.

Conclusion

The rise of Conversational AI chatbots in banking is revolutionizing the way financial institutions interact with their clients. From streamlining daily tasks to offering personalized financial guidance, these software solutions are creating a more efficient, convenient, and engaging experience.

As technology continues to evolve, we can expect even more exciting applications that empower consumers, improve operational efficiency, and unlock new growth opportunities for the financial sector. This is why we recommend embracing the innovation here and now. At Master of Code Global, we can help your business build a strong and feasible roadmap for the future chatbot implementation, as well as accompany you on its development and implementation. Share your concerns and ideas with us to get a tailored solution that helps.

FAQs

How many banks use chatbots?

Currently, 72% of finance leaders report their departments incorporated AI in some form. Major institutions like Bank of America, JPMorgan Chase, and Wells Fargo deploy advanced Conversational AI across multiple channels. At the same time, industry research reveals that 91% of financial institutions are either assessing AI or have already adopted it, with the majority of banking executives (55%) expressing strong confidence in artificial intelligence’s transformative potential for their organizations.

How AI chatbot solutions help the banking sector?

They dramatically reduce operational costs by handling 80–90% of routine customer inquiries automatically. They provide 24/7 availability, eliminate wait times, and improve satisfaction scores through instant responses. Additionally, these solutions increase revenue through intelligent cross-selling, reduce human error in account information delivery, and free up staff to focus on complex financial advisory services that require human expertise.

How do AI chatbots integrate with existing banking systems?

This can be done through secure APIs that connect to core banking platforms, CRM databases, and transaction processing systems. Modern integration uses microservices architecture, allowing seamless data exchange while maintaining security protocols. The process typically involves connecting to customer databases, account management systems, and payment processors through encrypted channels, ensuring real-time access to account information.

Ready to build your own Conversational AI solution? Let’s chat!