In the world of fintech, artificial intelligence has rapidly become a key player in the fight against cyberattacks—and not only them. This technology, far beyond traditional data analysis, is actively shaping the future of fraud detection using Generative AI.

Did you know that US fintech companies are currently facing significant losses to scam, with an average of $51 million lost annually, representing about 1.7% of total revenues? This stark reality underscores the critical need for more advanced and effective prevention strategies.

Generative AI for fraud detection offers a promising solution, but it also comes with some challenges. While holding the power to identify and anticipate complex illicit schemes, its sophisticated capabilities also open doors for misuse.

In this article, we will set the stage for a comprehensive exploration of how artificial intelligence is being leveraged in fraud detection, highlighting its potential to transform security measures across industries. Let’s embark on a journey through the intricate dance of technology, strategy, and survival in the face of ever-evolving digital threats. Read to the end to gain valuable insights into how businesses can benefit from the advantages of Generative AI to protect their operations and customers.

Table of Contents

Evolution of Gen AI Fraud Detection Approaches and Tools

The development of such technologies has been a dynamic and evolving process, mirroring the escalating sophistication of financial deception. This progression can be segmented into various stages, each characterized by notable technological advancements and shifts in approach.

- 1990s – Foundational Years with Simple Rules Engines: The fraud detection journey began with static systems. They used predefined guidelines to detect threats but struggled with complexity and required frequent updates.

- Early 2000s – Rise of Neural Networks and Statistical Models: Advancements in AI led to the integration of predictive analytics. These technologies delved into historical data to uncover complex fraud patterns that were not detectable by simple rules engines.

- First-Generation Systems Limitations: The initial platforms were rigid and prone to false positives. They were heavily reliant on manual processes, making them time-consuming and not scalable.

- Next-Generation Systems: This era saw the merger of rule-based detection with risk-centric approaches, using AI to analyze transaction data and assign threat scores. However, these methods faced challenges such as reliance on large datasets and high deployment costs.

- Emergence of Generative AI: Recently, artificial intelligence has begun to play a role in scam detection. It outputs synthetic data, crucial for creating detailed models. While it has been misused by con artists, its potential for businesses is significant.

- Fraud Detection AI Agent: The latest evolution involves the deployment of digital agents—autonomous systems trained to monitor transactions, user behavior, and system anomalies across platforms. These tools operate in real time, communicate with each other, and adapt based on detected threats, creating a responsive prevention ecosystem that minimizes the need for constant manual oversight.

- Recent Advancements: The latest breakthroughs in this field include device and behavioral biometrics, predictive analytics, and natural language processing, offering more sophisticated ways to identify and prevent deception.

Continuing along this trajectory, let’s offer a glimpse into what the near future may hold. According to a study by Juniper Research, the global expenditure on services for detecting and preventing fraud is projected to rise to over $11.8 billion by the year 2026.

Read also: Generative AI for Payments: 5 Use Cases to Address Business Challenges and Mitigate Risks

Generative AI for Fraud Detection: Benefits and Mechanisms

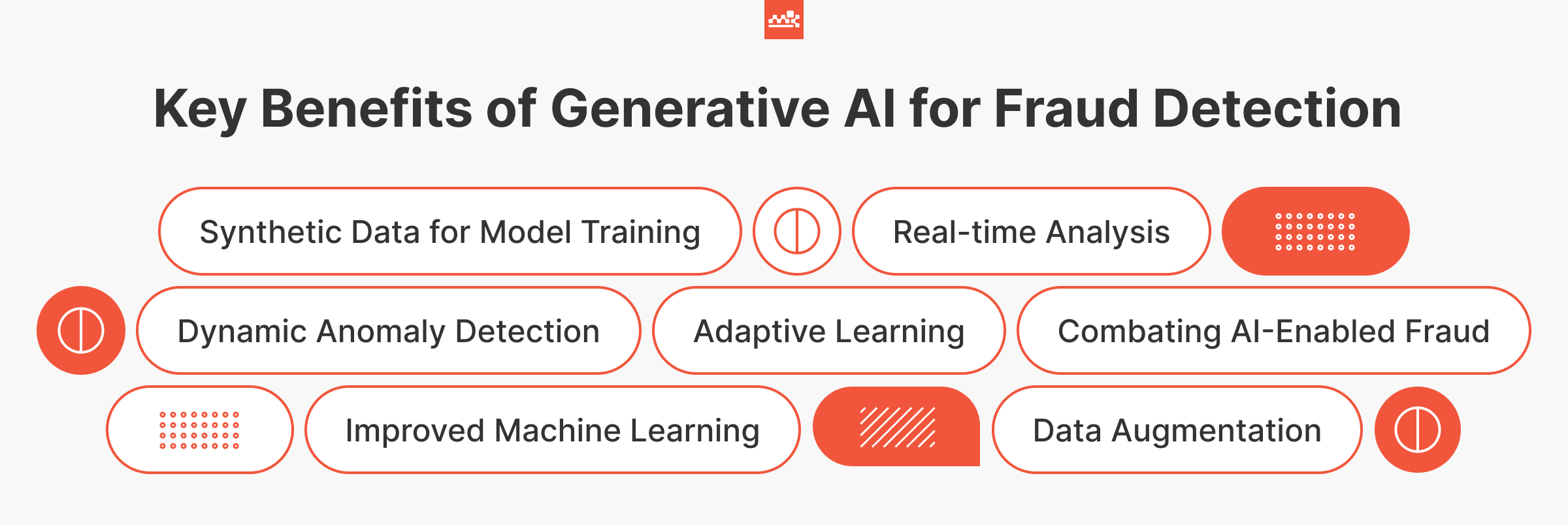

As we have already mentioned above, artificial intelligence has become a pivotal tool for detecting and preventing fraudulent activity, offering several advantages and instruments that traditional methods lacked. Its application is marked by adaptive learning, data augmentation, and sophisticated algorithms, leading to significant improvements in precision and a reduction in false positives.

Recent studies indicate that machine learning algorithms can achieve up to 96% accuracy in distinguishing illicit transactions from legitimate ones in real-time financial operations. This high level of precision significantly reduces losses for enterprises. And this is just the beginning! Let’s dive deeper into the real business benefits the technology holds for global markets.

Anomaly Detection and Real-Time Analysis

Digital tools excel in inspection of vast amounts of datasets. This capability is crucial in industries like finance and eCommerce, where transactions occur in high volumes. By processing this data instantly, artificial intelligence can flag or block suspicious activities as they happen, thereby preventing potential economic loss. It can recognize ‘normal’ behavior based on historical data and immediately flag deviations from this norm—a technique known as Generative AI in anomaly detection. This is a far more effective approach than previous systems were capable of. This practice also supports Generative AI transaction monitoring for scalable, real-time security operations.

Adaptive Learning

Unlike traditional systems that rely on static rules and models, Generative AI can learn and adapt from the data they process. They are capable of evolving to recognize new types of fraud as they emerge, often without the need for manual intervention. This adaptability is crucial for staying ahead of fraudsters who continually evolve their tactics.

Data Augmentation and Improved ML

Generative AI is particularly effective in creating synthetic datasets based on real info. This capability is valuable in scam prevention where viable examples are often limited, making it challenging for ML models to learn effectively. By generating synthetic samples that resemble real-life cases, artificial intelligence boosts the attention signal for core detection tools. This approach adds robustness to the deception model, enabling it to detect not only patterns but also similar attacks that could be missed using traditional methods.

Synthetic Data Generation for Model Training

These advanced AI technologies also facilitate the creation of synthetic datasets that mimic the behavior of scammers, enhancing existing data repositories for a more robust development of machine learning models. This results in a powerful tool that augments fraud detection capabilities, allowing for the simulation of different scenarios and conducting in-depth behavioral analysis.

Combating AI-Enabled Fraud

As fraudsters also use Gen AI for creating deepfakes, deceptive content, and synthetic identities, businesses must stay vigilant and adapt their security strategies. Using Generative AI for scam prevention helps analyze patterns in data and identify potential risk factors. This approach enables companies to spot early indicators of possible illicit behavior and speed up the development and testing of new detection models.

Read also: How to Use Generative AI in Data Analytics for Enhanced Decision-Making and Strategic Growth

How GenAI Is Fighting Fraud Across Industries

Banking

Generative AI fraud detection in banking is modernizing scam prevention by offering smarter, faster ways to spot unauthorized activity. Financial institutions are relying on this technology to strengthen internal controls, monitor real-time transactions, and simulate fraud scenarios using synthetic data to improve detection accuracy. As adoption grows, Generative AI for banking is becoming a strategic asset for building more resilient, responsive systems.

Generative AI in Credit Card Fraud Detection

By analyzing spending behaviors and identifying subtle anomalies in transaction patterns, digital models can instantly flag suspicious activity—often before the cardholder is even aware. These systems are also capable of generating synthetic transactions for training purposes, allowing institutions like American Express to stay one step ahead of increasingly sophisticated scam techniques.

Insurance

Generative AI in insurance helps detect deceptive requests through anomaly detection in documentation, behavior analysis during the claims process, and predictive modeling based on historical fraud cases. It can mimic realistic but fake claims to test detection models, train employees, and fine-tune algorithms. This not only reduces financial leakage but also boosts operational efficiency by automating the first level of claims review.

eCommerce

In this industry, Gen AI is helping online retailers combat payment fraud, fake reviews, and return abuse. By generating synthetic user behaviors and simulating malicious patterns, it enables platforms to train fraud models more effectively. Real-time anomaly detection and customer behavior profiling help identify and block suspicious transactions before they cause revenue loss—protecting both merchants and buyers.

Real-World Applications and Successful Business Outcomes

Generative AI helps with analyzing trends in stock markets and detecting financial anomalies with greater speed and precision. As adoption of this technology accelerates, many enterprises are collaborating with machine learning consultants to design, implement, and fine-tune fraud detection models that align with their risk profiles and regulatory needs. This is where financial services AI consulting plays a critical role — helping organizations translate advanced fraud detection capabilities into compliant, scalable systems with measurable business impact.

This technological advancement has been proven financially beneficial for major institutions. Jamie Dimon, the CEO of JPMorgan Chase, noted that these innovations have resulted in $150 million in annual savings for the bank.

PayPal

The company has used Gen AI and ML to boost its scam prevention capabilities. Their approach has led to impressive results, including a substantial reduction in losses. From 2019 to 2022, PayPal almost halved its loss rate, even as its annual payment volumes nearly doubled from $712 billion to $1.36 trillion. This achievement can be attributed to PayPal’s advances in algorithms and technology, which allow rapid adaptation to changing deception patterns and protect customers more effectively.

American Express

This major player in the financial industry has implemented generative modeling techniques to combat credit card fraud. By producing synthetic data, such as fake card numbers, and monitoring for discrepancies or similarities with actual deceptive transactions, American Express has been able to upgrade its strategies and remain competitive.

Mastercard

To improve its cybersecurity and fraud prevention efforts, Mastercard uses Generative AI to analyze large volumes of transaction data and simulate potential attack vectors. Its digital Decision Intelligence platform helps issuers assess risk in real time, reducing false declines and building greater trust.

NayaOne

This fintech platform applies GenAI to produce artificial financial datasets. These datasets allow banks and service providers to test fraud detection tools without compromising real customer data, enabling secure innovation at speed while ensuring compliance with privacy regulations.

Swedbank

By incorporating Generative AI into its scam prevention pipeline, Swedbank monitors behavioral patterns and transaction anomalies across channels. The integration of digital agents allows for early identification of suspicious activity and faster, more efficient incident response.

Bunq

The bank refines its fraud prevention capabilities by continuously analyzing client activity with Generative AI. Its adaptive systems perform real-time risk scoring and transaction blocking, helping detect account takeovers while maintaining a smooth user experience.

Fiserv

Through synthetic data generation and AI-powered pattern recognition, Fiserv delivers fraud management tools that detect threats beyond historical cases. This proactive approach reduces chargebacks and equips clients with scalable, intelligent scam prevention solutions.

Visa

Next-generation fraud detection models at Visa rely on GenAI to process over 500 transaction attributes per second, identifying anomalies in real time. The use of artificial data improves algorithm training without risking customer privacy, improving both performance and compliance.

FAQ

How does generative AI enhance fraud detection in banking?

Artificial intelligence refines fraud detection in banking by analyzing large volumes of transaction data in real time and identifying subtle patterns that traditional systems may miss. It creates synthetic data to simulate illicit behavior, enabling banks to train their models on a broader range of threat scenarios. This leads to faster reaction and better protection against emerging scheme techniques.

How does generative AI improve the accuracy of fraud detection?

Precision is improved through the use of adaptive learning algorithms and data augmentation. Generative AI can identify and learn from complex fraud patterns—even those not previously seen—by generating synthetic examples. This enriched training data allows fraud detection models to become more exact over time, minimizing gaps in pattern recognition.

How does generative AI reduce false positives in fraud detection?

Incorrect positives are reduced by teaching models to better distinguish between legitimate and suspicious behaviors. Artificial intelligence helps build more nuanced risk profiles by factoring in a wider variety of transaction patterns. With continuous learning and simulated testing, these models are less likely to flag normal customer behavior as deceptive, improving user experience without compromising security.

Conclusion

The integration of Generative AI for fraud detection purposes has brought about remarkable advancements, from real-time analysis to the development of sophisticated, adaptive learning models. These technologies have proven essential in the proactive identification and prevention of illicit activities, significantly reducing financial losses for businesses.

Being a leading Generative AI development company, Master of Code Global stands out for its innovative approach and commitment to delivering cutting-edge solutions. With a focus on crafting exceptional digital experiences, we combine expertise in artificial intelligence, machine learning development, and natural language processing to bring revolutionary apps to enterprises across various industries.

By continuously embracing new challenges and pushing the boundaries of technology, Master of Code Global is not just adapting to the digital landscape, but actively shaping it. Partner with us to level up your fraud detection and prevention strategy with bespoke AI approaches.