Today investment-related institutions are grappling with a customer experience revolution. The pressure is on to deliver personalization, all while fine-tuning operations for maximum efficiency and profit. It’s a high-stakes juggling act, and traditional methods are simply not cutting it anymore.

Client expectations are soaring, competition is relentless, and the need for innovation is palpable. 65% of banking customers report that 24/7 availability is the top benefit of using digital agents, driving higher satisfaction with monetary services (World Metrics). The organizations are on the hunt for solutions that can bridge the gap between what users crave and what financial management can present. Enter finance chatbots: the digital dynamos poised to reshape the economical landscape.

Gen AI in payments is changing the game, especially the way institutions connect with their consumers. They offer personalized advice, streamline internal processes, and provide round-the-clock support. By tapping into the power of artificial intelligence and natural language processing, these bots automate routine tasks and foster engagement, delivering a truly modern journey.

For C-suite leaders and decision-makers, finance AI chatbot presents a golden opportunity. They can slash costs, and even unlock new revenue streams. These advanced virtual assistants are the key to gaining a competitive edge in a digital-first world. This article explores the myriad benefits of finance chatbots and uncovers how they can empower economical institutions to flourish in today’s dynamic market.

Table of Contents

What is a Financial Chatbot?

In a world where time is money and budgetary decisions are paramount, bots are emerging as digital assistants revolutionizing the way we interact with our money. By 2024, finance chatbots are expected to handle 90% of routine inquiries in the banking industry, streamlining customer support (World Metrics). Imagine having a 24/7 advisor at your fingertips, ready to answer your queries, offer personalized advice, and even help you manage your investments. That’s the power of chatbots in financial services!

At its core, a digital agent is a sophisticated computer program designed to simulate human conversation. It leverages the capabilities of artificial intelligence and natural language processing to understand and respond to your inquiries in a natural, conversational manner. Generative AI in fintech further refines this technology, enabling the digital agent to continuously learn and adapt, offering increasingly accurate and relevant insights.

Different Types of Finance Chatbots

The world of chat systems is diverse, with various kinds catering to specific needs:

- Personal Finance Chatbots: These bots act as your own coach, helping you set and achieve goals. They can assist with budgeting, tracking expenses, and even tell you more about saving and investing.

- AI-Based Agents for Financial Advice: Leveraging intricate algorithms, the assistants meticulously craft comprehensive wealth management and planning recommendations. They adeptly navigate the landscape, proposing strategic investment pathways to guide you toward your goals.

- Financial Advisory Chatbots: Virtual advisors are offering guidance on various products and services. They can help you compare options, understand the risks and benefits, and make informed decisions.

- Financial Reporting AI Bots: Empowering businesses to reclaim valuable time, intelligent agents automate the entire report lifecycle—from data compilation across disparate sources to generating bespoke analyses and delivering actionable insights into performance.

Chatbots in financial services are transforming the landscape, making economic management more accessible, efficient, and personalized than ever before. As technology continues to advance, we can expect even more sophisticated and capable finance chatbots to emerge, further revolutionizing the way we handle our accounting.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

The Most Promising Financial Chatbot Examples

The statistics show that 39% of all discussions between businesses and consumers include a bot. We can see now that finance chatbots are no longer a futuristic concept – they’re here, and they’re transforming the way we manage our money. Let’s take a look at some trailblazers in the field, showcasing the diverse and dynamic applications of this technology:

- Microsoft-Native AI FAQ Chatbot for Financial Institution: Developed by Master of Code Global, this AI-powered knowledge assistant has transformed internal operations at a leading member-owned banking institution. Integrated directly into Microsoft Teams, the bot helps staff access policy information and answer regulatory inquiries through natural, conversational dialogue. No more digging through documents – the AI provides quick, accurate answers, making the process faster and more efficient.

- Voice AI-Powered Solution for Credit Account Management: Master of Code Global’s Voice AI solution has revolutionized how a prominent financial institution handles credit account inquiries. With over 156,000 calls processed each month and a remarkable 94% first-call resolution rate, the system not only reduces costs by $7.7M annually but also delivers an 88% customer satisfaction rate, ensuring both operational efficiency and a superior customer experience.

- Erica by Bank of America: This AI-powered virtual assistant has been hailed as a game-changer. Erica helps customers with everything from tracking expenses to making payments, all in a conversational and user-friendly manner. Need to find that ATM fee you were charged last week? Erica’s got you covered.

- Eno by Capital One: Eno is your vigilante sidekick, monitoring your accounts for unusual activity and sending you real-time alerts. Suspicious charges? Eno’s on it, helping you stay one step ahead of fraudsters.

- Cleo: This witty chatbot helps you budget and save, and even playfully reminds you when you overspend. Cleo’s playful personality makes managing your money feel less like a chore and more like a fun challenge.

- Plum: This AI-powered savings assistant analyzes your spending habits and automatically sets aside small amounts of money you won’t miss. Plum helps you build your savings effortlessly, even if you’re on a tight budget.

- Eva by HDFC: It’s an AI-powered chatbot providing instant answers to customer inquiries on banking services, account details, loans, and more, delivering 24/7 support with fast and efficient responses.

These are just a few examples of the innovative finance chatbots making waves in the industry. As artificial intelligence and natural language processing continue to advance, we can expect even more sophisticated and capable Conversational AI in finance to emerge. Whether you’re looking to budget better, save more, or simply have a more convenient banking experience, there’s a financial chatbot out there ready to help you achieve your goals.

Addressing Common Pain Points with Finance Chatbots

The economic world is riddled with bottlenecks, from frustrated customers waiting on hold to overwhelmed staff juggling endless tasks. Thankfully, financial chatbots are emerging as digital superheroes ready to tackle these challenges head-on. Today 62% of respondents would prefer to interact with a virtual assistant than wait for an agent to react. So, let’s explore how these AI-powered allies are revolutionizing the industry.

Elevating Customer Service to New Heights

- 24/7 Support: Gone are the days of limited business hours and frustrating voicemail loops. Finance chatbots are available around the clock, ready to assist users whenever they need it, boosting enjoyment and loyalty.

- Lightning-Fast Response Times: Say goodbye to lengthy wait times. Bots provide instant responses, resolving queries and issues in a flash. Clients feel valued and heard, fostering positive interactions.

- Enhanced Satisfaction: With quick, efficient, and personalized assistance, digital agents leave consumers feeling empowered and informed. This translates to improved fulfillment scores and a stronger reputation for your institution.

Streamlining Operations for Maximum Efficiency

- Automation of Routine Tasks: Mundane duties like balance inquiries, password resets, and transaction history checks can bog down staff. Chatbots automate these processes, freeing up valuable time for more complex issues.

- Empowering Staff: With recurring activities handled by bots, employees can focus on providing in-depth advice and tackling intricate problems. This leads to a more engaged and productive workforce.

- Cost Reduction: By automating tasks and optimizing workflows, digital tools help institutions reduce operational expenses. It allows for reinvestment in growth initiatives and improved experiences.

Personalized Financial Advice at Your Fingertips

- Tailored Recommendations: Chatbots analyze data to offer individualized guidance, such as budgeting tips, savings strategies, and investment hints. Clients then can make wise decisions and achieve their goals.

- Financial Literacy Boost: Digital agents can educate people on complex topics in a clear and engaging manner. It results in improved skills, leading to better decision-making and increased confidence.

- Engagement that Sticks: By providing relevant and timely advice, bots foster ongoing involvement with users. As a result, you get strong relationships, and people are encouraged to turn to their institutions for all their needs.

Intelligent Insights for Smarter Decisions

- Data-Driven Perception: Digital tools collect and analyze valuable information, providing insights into preferences, pain points, and behavior patterns. That’s how institutions make informed decisions and tailor their offerings.

- Targeted Marketing: By understanding customer needs, chatbots can deliver unique messages and offers. It increases conversion rates and drives revenue growth.

- Proactive Problem Solving: Bots can identify potential issues and address them before they escalate, leading to improved satisfaction and reduced churn.

Benefits of Implementing Finance Chatbots for Decision-Makers

C-level executives are constantly on the lookout for innovative solutions that can propel their organizations to new heights. Larger companies are using digital assistants more quickly, currently holding over 46% of the market. In today’s digitalized age, where efficiency, customer journey, and data-driven decision-making are paramount, finance chatbots emerge as a strategic tool that can deliver a significant competitive advantage. Let’s explore how these AI-powered tools can help you achieve your business objectives:

Unleashing the Power of Efficiency

- Supercharged Productivity: Finance chatbots handle routine tasks with lightning speed and unwavering accuracy, freeing up valuable employees to focus on strategic initiatives and complex problem-solving.

- Optimized Resource Allocation: By automating repetitive processes, AI assistants enable you to streamline operations and allocate resources more effectively, maximizing efficiency and minimizing waste.

- Cost Reduction: There’s no need to return to the high expenses associated with manual labor and traditional facility channels. Bots deliver 24/7 help at a fraction of the cost, contributing directly to your bottom line.

Elevating the Customer Experience to Win Hearts and Wallets

- Unmatched Convenience: Your clients expect instant gratification. Virtual assistants provide round-the-clock support, personalized recommendations, and seamless interactions, contributing to higher retention and satisfaction rates.

- Attracting New Customers: A superior user interaction is a powerful magnet for new business. Bots deliver the kind of frictionless, engaging conversations that today’s consumers crave, setting you apart from the competition.

- Gaining a Competitive Edge: In the race to win audience loyalty, AI-powered bots give you a boost. By delivering exceptional service and exceeding expectations, you can position your organization as a leader in the industry.

Channeling Data for Strategic Growth

- Informed Decision-Making: Financial chatbots collect and analyze vast amounts of data, providing invaluable insights into preferences, pain points, and behavior patterns. This enables you to make data-driven decisions that fuel growth.

- Identifying New Opportunities: By understanding your audience on a deeper level, you can uncover hidden chances for new products or marketing campaigns, driving innovation and revenue.

- Refining Strategies for Success: Bots provide a continuous feedback loop, allowing you to track interactions and measure the effectiveness of your approach. This helps you refine your strategy and optimize your performance.

Embracing Innovation to Lead the Pack

- Forward-Thinking Leadership: Implementing finance chatbots demonstrates your commitment to innovation and staying ahead of the curve. That’s how you position your organization as a thought leader and attract top talent.

- Future-Proofing Your Business: The economic landscape is constantly evolving. Tools help you stay agile and adaptable, ensuring your company is well-equipped to thrive in the digital age.

- Inspiring Confidence: By embracing cutting-edge technology, you instill assurance in your customers, employees, and stakeholders. This fosters trust and loyalty, contributing to long-term success.

Why Choose Custom Development for Your Finance Chatbot?

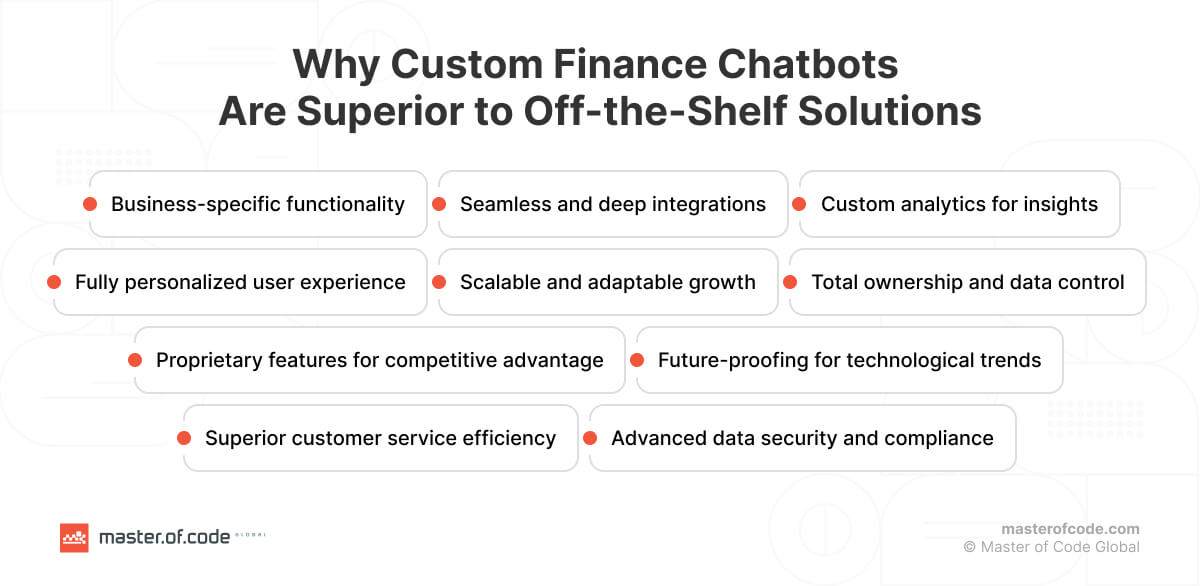

In the commercial world, one size rarely fits all. Off-the-shelf solutions may offer a quick fix, but they often fall short when it comes to meeting the unique needs and goals of your institution. This is why AI in financial services consulting becomes essential — helping organizations align chatbot capabilities with regulatory requirements, legacy systems, and long-term business objectives before any code is written.

That’s why custom development is the key to unlocking the full potential of your finance AI chatbot.

Let’s delve into why a bespoke solution is the smarter choice:

Beyond the Cookie-Cutter: Tailored to Your Exact Objectives

- Unique Brand Identity: Your trademark is your signature. A custom-built bot can seamlessly integrate with your brand voice, messaging, and visual style, creating a cohesive and memorable user experience.

- Industry-Specific Functionality: The financial world is complex. Custom chatbot development services are designed to handle the specific products and regulations that are relevant to your institution.

- Seamless Integration: Your assistant should work harmoniously with your existing systems and workflows. Tailored development ensures smooth sync with your CRM, databases, and other critical tools.

Break Free from Limitations: Overcome the Off-the-Shelf Bottleneck

- Restricted Feature Set: Off-the-shelf chatbots in the financial industry often come with pre-defined components that may not align with your specific requirements. A custom approach allows you to build exactly what you need, no more, no less.

- Scalability Challenges: As your business grows, so do your needs. Ready-made bots may struggle to scale with you, leading to performance issues. A custom solution is built for growth, ensuring it can handle increased demand.

- Lack of Control: With a generic app, you’re at the mercy of the provider’s updates and roadmap. Custom development puts you in the driver’s seat, giving you full authority over the evolution of your bot.

The Power of Flexibility: A Chatbot that Grows with You

- Adapting to Change: The economic landscape is constantly shifting. A custom solution can be easily updated and modified to adapt to new regulations, market trends, and customer needs.

- Expanding Usability: As your company evolves, you may want to add new features and capabilities to your chatbot. Custom development allows you to seamlessly expand your virtual assistant’s functionality, ensuring it remains relevant and valuable.

- Future-Proofing Your Investment: A custom bot is a long-term investment in your organization’s success. It’s built to last and can be continuously enhanced to stay ahead of the curve.

At Master of Code Global, we specialize in crafting bespoke solutions that empower institutions to thrive in the digital age. Our team of experts will work closely with you to understand your unique needs and goals, designing and developing a bot that delivers exceptional results.

From concept to deployment, we’ll guide you through every step of the process, ensuring a seamless and successful implementation. If you want to discover how Generative AI in financial services can revolutionize your business, contact us right now!

Conclusion

In the digital age, where financial institutions face the dual challenge of delivering superior experiences and maximizing operational efficiency, finance chatbots have emerged as a game-changing solution. These AI-powered conversationalists streamline operations, empower staff, and provide personalized guidance, leading to increased satisfaction and loyalty.

Finance tools are not just a tool for customer service; they are a strategic asset that can transform approaches and boost profitability. By embracing custom development, organizations can unlock the full potential of this technology, tailoring techniques to their specific needs and goals.

The horizon of economics is conversational. Unlock the potential of finance chatbots and set off on a path toward a more streamlined, customer-focused, and profitable future.

Ready to build your own Conversational AI solution? Let’s chat!