As the insurance industry grows increasingly competitive and consumer expectations rise, companies are embracing new technologies to stay ahead. A key innovation in this space is artificial intelligence.

According to a report by Sprout.ai, 59% of organizations have already implemented Generative AI in insurance. It brings multiple benefits, including enhancing staff efficiency and productivity (61%), improving customer service (48%), achieving cost savings (56%), and fostering growth (48%).

While these statistics are promising, what actual changes are occurring within the sector? Let’s delve into the practical applications of AI and examine some real-world examples. As the CEO and founder of one of the top Generative AI integration companies, I will also share recommendations for the successful and safe implementation of the technology into business operations.

Table of Contents

Generative AI in Insurance Market Overview and Growth Predictions

Artificial intelligence is making significant strides in the sector, as the following data demonstrates. Both customers and businesses show keen interest in advancing this technology to improve the operations:

- Client attitudes towards Generative AI (GAI or Gen AI) are generally positive, with 47% in the UK and 55% in the US expressing favorable opinions. Additionally, 44% of consumers are comfortable using insurance chatbots for claims, and 43% prefer them for coverage applications, according to Statista.

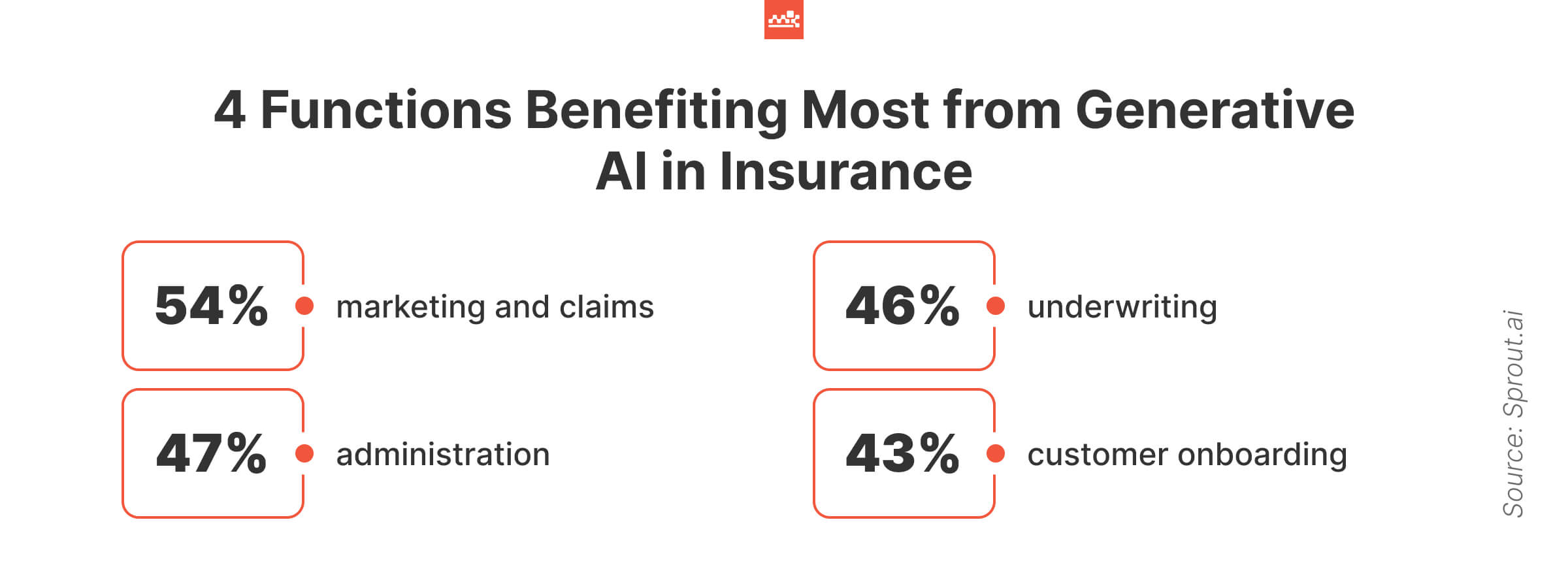

- Over half (54%) of respondents identified marketing and claims as the areas most likely to benefit from GAI. Administration (47%), underwriting (46%), and customer onboarding (43%) followed closely. Actuarial and legal/regulatory functions also show potential for its integration, at 22% and 21% respectively.

- Major barriers to adopting such systems include staff training (47%) and cost (35%).

The future impact of this technology, as per insights from BCG, looks equally promising:

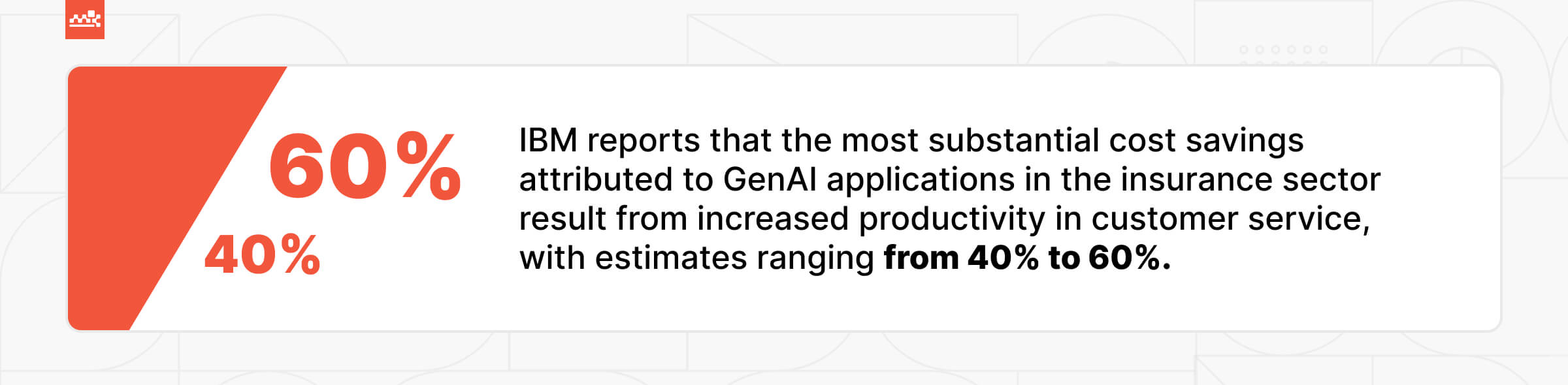

- Customer service stands to benefit the most, with productivity soaring by 40-60%. This is largely due to Gen AI’s ability to reduce the time agents spend retrieving information, currently consuming up to 35% of their workday.

- Streamlining documentation can unlock efficiency gains of 20-30%.

- The biggest cost savings, however, will come from automated claims appraisals. The technology can significantly lower assessor-related expenses.

As the chief executive officer, I also envision the following advancements in the sector:

- Enhanced customer experience. Generative AI will continue to personalize client care, offering tailored insurance policies based on individual risk appraisals. Bots and virtual assistants will become even more sophisticated, providing 24/7 support, answering queries, and handling policy event analysis.

- Advanced risk assessment and pricing. The technology’s ability to analyze huge datasets will lead to more accurate risk evaluation. By leveraging data from a wide range of sources, insurers will be able to offer rates that are closely aligned with the actual profile of policyholders.

- Claims processing automation. GAI will streamline the request adjudication process, making it faster and more efficient. With image recognition and computing capabilities, Gen AI can assess damages from photos, automate their assessments, and even approve indemnity without human intervention for straightforward cases.

In summary, Generative AI in insurance represents a valuable investment and an area ripe for further development. However, it’s crucial to recognize both the pros and cons associated with its adoption. A balanced and comprehensive understanding will enable businesses to maximize benefits and mitigate risks.

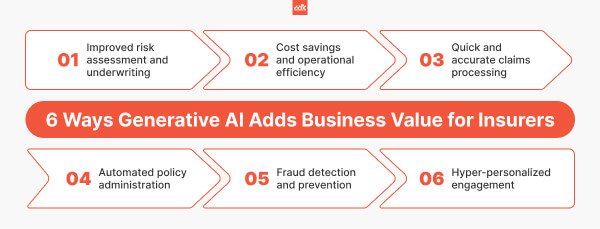

Benefits of AI in Insurance

Picture an insurance specialist juggling endless paperwork, manual data entry, and hours spent cross-checking claims or customer profiles. It’s a routine filled with repetitive tasks and constant pressure to stay accurate.

Now imagine the same professional empowered by the potential benefits of using Generative AI, from automated document processing and instant policy summaries to predictive claim assessments and personalized customer interactions. Instead of drowning in administrative work, they can focus on strategic decisions, faster claim resolutions, and building stronger client relationships.

Automated Underwriting

AI helps insurers process applications faster and with fewer blind spots. It evaluates income patterns, lifestyle signals, medical data, and historical claims in seconds. That consistency reduces manual reviews, allowing underwriters to focus on unusual or high-risk scenarios. Early adopters in the insurance industry already use these models to cut decision times while improving risk accuracy.

Individualised Policies

With richer behavioral and contextual data, insurers can generate personalized insurance policies that reflect real usage instead of broad demographic assumptions. This leads to fairer pricing, stronger engagement, and higher retention. When customers see why a recommendation fits their situation, they’re more likely to trust the decision and stay with the provider.

Claims Management

AI speeds up insurance claims processing by extracting details from forms, recognizing damage through images, and comparing submissions with past cases. Standard applications move quickly with automation, while complex ones get routed to specialists with all relevant data attached. The result is shorter cycle time, fewer errors, and clearer communication during the entire journey.

Customer Service

AI systems in insurance respond instantly to routine questions, explain coverage, and guide clients through tasks like document submission or policy updates. This reduces load by automating call center operations and gives teams more time for sensitive or high-value interactions. People also get consistent answers across channels without waiting on hold.

Sales and Marketing

Intelligent solutions identify which prospects are most likely to convert and which existing clients need proactive outreach. It clusters audiences based on behavior and intent, helping teams run targeted campaigns instead of broad, generic pushes. Sales reps also gain recommendations that point to the next best offer, improving close rates without manual analysis.

Risk and Compliance

Teams benefit from AI tools that monitor transactions, detect unusual activity, and predict emerging exposure patterns early. These systems help compliance units review communication logs, verify document accuracy, and generate audit-ready records without heavy manual work. Insurance firms get increased transparency and stronger controls without slowing operations.

Challenges and Risks

Data Security

Imagine an insurer launching a new automation program and discovering halfway through that its customer data flows through three outdated systems no one has touched in years. That’s a real scenario we’ve seen in the insurance sector, and it highlights the biggest risk: sensitive information scattered across disconnected tools.

When AI enters that environment, the exposure multiplies. Models need clean, permissioned data, yet many insurance businesses still operate with legacy databases, unclear access rules, and old integration layers. Without tightening data governance first, even the strongest controls can leave gaps, especially when the system processes health histories, income data, or claim evidence.

Inaccuracy and Bias

Now, picture a claims agent reviewing a flagged case. The system marks it as high-risk, but the agent has a nagging feeling the model got it wrong. After digging, they realize the dataset the tool learned from underrepresented certain communities. This is where AI’s speed can become a liability.

When training data carries historical bias, or when a Generative AI solution for an insurance company makes confident predictions with limited context, the result can be unfair pricing, inconsistent decisions, or unnecessary investigations. Tools meant to help can unintentionally undermine trust if insurers rely on them without proper validation and human oversight.

Ethical Considerations

A common scenario inside large insurance firms starts with a single question: “Just because the model can predict this, should we use it?”

One team wants to use behavioral signals to refine pricing. Another one worries that the same signals might cross ethical boundaries or feel intrusive to customers. The tension is real and growing as Gen AI becomes more capable.

Ethics is about deciding where the line sits. Your clients deserve clarity about what data is used, how it shapes decisions, and how to challenge outcomes if something seems off. When insurers communicate openly and establish strong guardrails, AI becomes a tool that supports fairness rather than replacing judgment.

Navigating the Pitfalls of Generative AI in Insurance

Besides the benefits, implementing Generative AI comes with risks that businesses should be aware of. If overlooked, insurance companies may face serious consequences. A notable example is United Healthcare’s legal challenges over its AI algorithm used in claim determinations. They were accused of using the technology, which overrode medical professionals’ decisions.

To mitigate such threats while maximizing the advantages of Generative Artificial Intelligence in insurance, I recommend the following measures:

- Choose reputable Generative AI solution providers to handle technological complexities.

- Regularly update GAI governance policies, ensuring they meet evolving regulatory and ethical benchmarks.

- Conduct frequent risk assessments to pinpoint and address potential AI-related risks.

- Invest in ongoing education, equipping staff to proficiently oversee artificial intelligence applications.

While these are foundational steps, a thorough implementation will involve more complex strategies. Choosing a competent partner like Master of Code Global, known for its leadership in Generative AI development services, can significantly ease this process. At MOCG, we prioritize robust encryption and access controls for all AI-processed data in the insurance industry.

Our team diligently tests Gen AI systems for vulnerabilities to maintain compliance with industry standards. We also provide detailed documentation on their operations, enhancing transparency across business processes. Coupled with our training and technical support, we strive to ensure the secure and responsible use of the technology.

A Guide to Implementing Generative AI in Insurance

Define Clear Objectives

Think of a team meeting where everyone agrees AI is the “next step,” but no one can articulate why. One underwriter wants faster risk scoring. A claims manager wants fewer backlogs. Marketing wants better segmentation. Without alignment, projects tend to drift, and budgets often evaporate. This becomes even more important as Generative AI for insurance organizations’ business strategies begins shaping decisions around underwriting, customer experience and operational efficiency.

We recommend starting by choosing one measurable outcome: faster underwriting, shorter claims cycles, or improved customer satisfaction. That clarity drives the roadmap and prevents AI from becoming an expensive experiment instead of a revenue-shaping capability.

Data Collection and Integration

Generative AI in insurance only works as well as the data it learns from. Many specialists still juggle legacy systems, scattered documentation, and inconsistent formats. Imagine trying to train a model when half the policy data lives in PDFs and the rest sits in an old mainframe no one wants to touch.

Cleaning, structuring, and unifying this information is the most time-consuming stage, but it enables every downstream improvement. Once data pipelines are stable, insurers unlock reliable predictions, consistent decision-making, and easier compliance reporting.

Select the Right AI Tools and Platforms

This stage works a lot like hiring a new employee: the résumé may look impressive, but fit matters more. Some platforms excel at natural-language generation, while others are better at image analysis or workflow automation.

At Master of Code Global, we often run small experiments to compare performance, operational load, and compatibility with existing systems. The best choice isn’t the flashiest model; it’s the one that integrates smoothly and supports long-term insurance operations without adding hidden complexity.

Train and Deploy AI Models

Deployment usually surprises insurers with how iterative it feels. A model might perform well in testing but stumble when exposed to real customer questions or messy case files.

Picture a pilot where the AI drafts claim summaries. At first, adjusters reject half the outputs. By week three, after tuning prompts and feeding additional examples, accuracy jumps. That’s the reality: training, deploying, observing, and refining until the system becomes a trusted assistant rather than a novelty.

Ensure Compliance and Ethical Use

Compliance teams often enter the conversation with caution, and for good reason. AI decisions touch pricing, eligibility, claims reviews, and communications. One misstep can invite regulatory pressure or erode customer trust.

To avoid this, insurers together with a tech service provider should set explicit guidelines around data usage, transparency, explainability, and decision review. Ethical frameworks aren’t barriers; they’re safety rails that let teams innovate without crossing sensitive boundaries.

Monitor and Optimize AI Performance

AI models shift as market conditions, customer behavior, and internal processes change. A model trained on last year’s claims might misinterpret new fraud patterns or stop recognizing emerging risks.

You should treat AI like a living system: monitored daily, audited monthly, and retrained as needed. This ensures consistent accuracy, stronger resilience, and long-term reliability. At Master of Code Global, we don’t stop at deployment; our team provides ongoing support, optimization, and strategic guidance to help your AI solution evolve alongside your business.

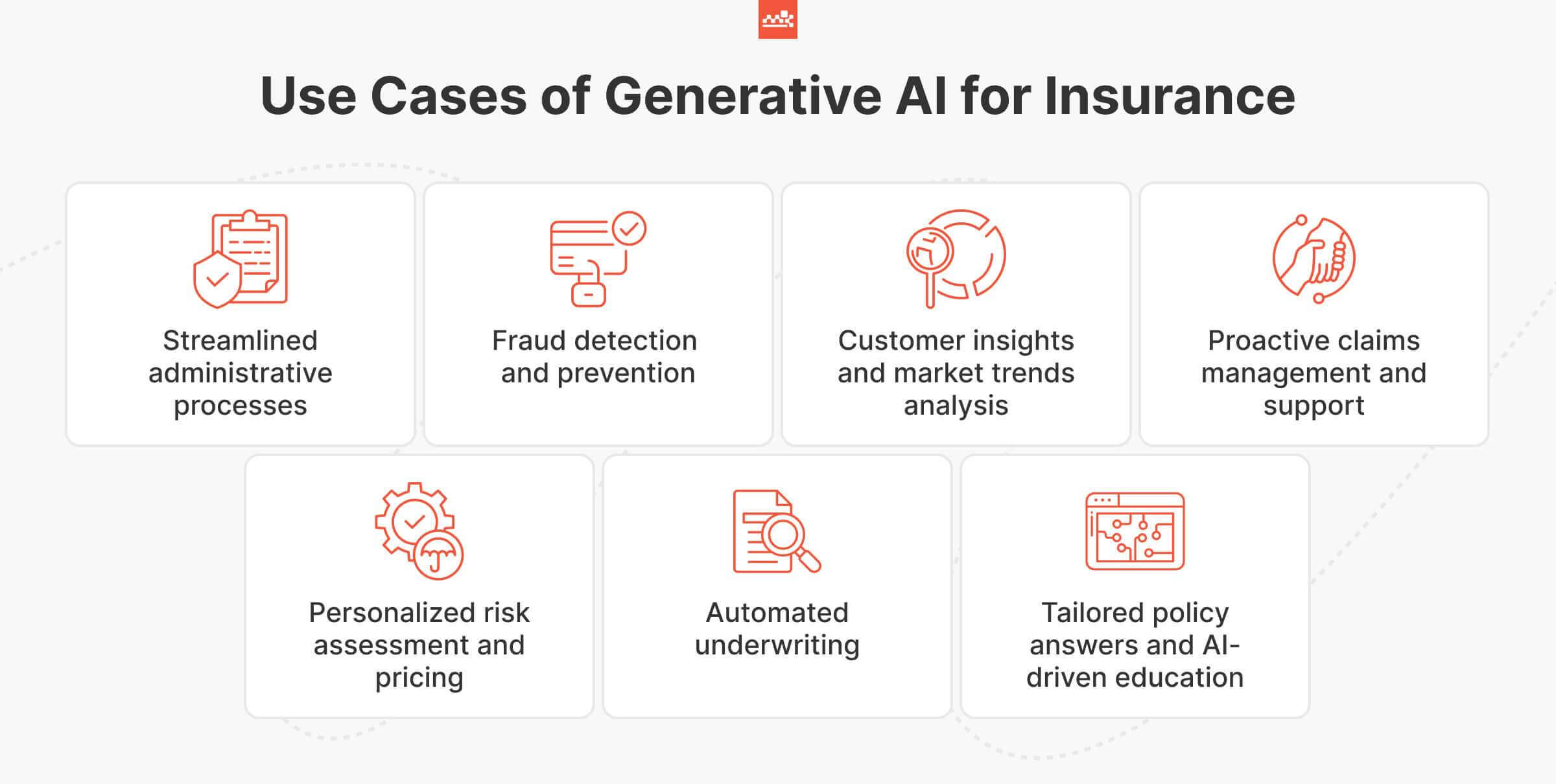

Top Applications of Generative AI in Insurance

Selecting the right Gen AI use case is crucial for developing targeted solutions for your operational challenges. For example, AI in the car insurance industry has shown significant promise in improving efficiency and customer satisfaction. So now that we’ve delved into both the benefits and drawbacks of the technology, it’s time to explore a few real-world scenarios where it is making a tangible impact.

Automated Underwriting

Gen AI in insurance gives teams a faster, clearer way to evaluate risk without drowning in paperwork or conflicting data. Instead of manually reviewing forms, medical notes, and financial statements, models scan everything at once and surface the factors that matter most for each applicant. This helps professionals make decisions that feel fairer and more precise, especially in life insurance, where accuracy and transparency directly affect pricing and trust.

For brokers, this shift is just as valuable. Generative AI for insurance broker workflows means they can instantly compare applicant profiles, draft preliminary assessments, or highlight coverage gaps before submitting a case. It removes the back-and-forth guesswork and shortens the time it takes to guide clients toward the right product.

The technology also spots patterns most humans would miss, such as subtle inconsistencies in medical histories or risk indicators linked to lifestyle behavior. With each review, the model continues learning from outcomes, which strengthens future predictions and reduces uncertainty over time.

Wearables, EHRs, and verified third-party data sources add another layer of insight. When real-time information flows into the underwriting process, insurers stay aligned with changing health trends and can adjust criteria without rebuilding their scoring logic from scratch. The result is underwriting that’s faster, more consistent, and built on a richer evidence base, giving both parties a smoother experience from the start.

Customer Insights and Market Trends Analysis

Insurers hold years of client information, but turning it into useful insight has always been slow. GenAI insurance analytics changes this by scanning behaviors, claim patterns, conversations, and purchase history at the same time. It reveals what customers value, what they avoid, and what they are most likely to seek next.

This directly strengthens sales performance. With AI, sales agents no longer rely on intuition or broad assumptions. They receive clear signals about who is ready to buy, who may churn and which product fits each individual profile. This makes every interaction more relevant and helps shorten sales cycles.

Customer profiling and segmentation also become far more accurate. Instead of sorting people by basic demographics, models group them by life events, financial habits, communication style, and risk behavior. These detailed segments make it possible to create offers that feel personal and practical.

Predictive analytics supports strategic planning by revealing trends before they reach the market. It may catch rising interest in lifestyle-based coverage or shifts in claim frequency that point to new product needs. This turns raw data into guidance that helps insurers choose what to build, who to target, and when to act.

Effective Claims Management and Support

Gen AI in claims processing helps insurers move from slow manual reviews to fast, consistent evaluations. Models scan documents, medical reports, policy details and past outcomes to understand the context of each case. This reduces the time it takes to approve routine claims and helps adjusters focus on the ones that truly need expert review.

Car insurance claims benefit from this approach as well. When an accident is reported, image and video analysis for swift processing can detect damage severity, match it with past cases, and estimate repair costs within minutes. Customers get quicker answers, and insurers reduce the back-and-forth that usually slows everything down.

The same applies to real estate property claims. AI reviews photos of broken pipes, structural damage or storm impact and identifies what is new and what is pre-existing. This gives property teams an accurate starting point, lowers disputes, and improves payout accuracy. For general insurance claims, the technology helps categorize events, verify policy coverage, and highlight any warning signs that suggest unusual or inconsistent patterns.

An AI copilot in insurance supports agents throughout the process. It assists with document summarization, highlights missing information, and prepares draft responses for customer communication. Virtual claims assistants work on the clients’ side, offering updates, collecting documents, and answering common questions without long waits. This is especially valuable when speed matters, such as in medicine-related cases supported by Generative AI in health.

Read also: Generative AI in Pharma: Pioneering Advances in Drug Development and AI-Driven Strategic Planning

Personalized Risk Assessment and Quotes

AI can evaluate far more than age, location, or income. It studies driving habits, health indicators, spending patterns, and other real behaviors to create an accurate profile for each customer. This helps insurers identify which applicants present greater risk and which ones deserve lower premiums.

How car insurance companies use AI illustrates this shift clearly. Driving data from telematics, braking patterns, mileage, and even weather conditions helps models understand real-world behavior. Safe drivers receive better pricing, while high-risk patterns are flagged early. The result is pricing that feels fair for buyers and more predictable for insurers.

Gen AI for insurance operations follows a similar approach. Instead of broad categories, it reviews lifestyle markers, long-term trends, and verified medical data to estimate potential outcomes more accurately. Customers gain coverage that reflects their situation, and businesses manage exposure with clearer insight.

Risk assessment and premium calculation benefit the most from this evolution. AI highlights the specific factors influencing risk, tests different pricing scenarios, and supports portfolio management with stronger forecasting. Insurers build a more stable book of business, and policyholders receive quotes that match their real level of risk rather than a generic benchmark.

Streamlining Administrative Processes

Generative AI helps insurers clear administrative bottlenecks by automating tasks that previously demanded hours of manual work. Policy generation and document automation become significantly faster as models create drafts, fill standard fields, and check documents for missing information. This removes delays during renewals, onboarding, and application review.

Agent assistants and knowledge management tools also play a major role. They deliver quick answers, prepare summaries, and surface relevant policy details so teams do not have to search across multiple systems. This reduces the cognitive load on agents and allows them to focus more on advising consumers rather than hunting for information.

With these processes running smoothly, administrative errors decrease and operational reliability increases. Staff gain more time for meaningful, customer-focused activities while the overall workflow becomes more predictable and efficient.

Tailored Policy Answers and AI-Driven Education

Insurance documents often leave people unsure about what their coverage actually includes. Generative AI in insurance customer service helps close that gap by giving clients clear explanations at the moment they need them.

When someone has a specific scenario or an unusual question, digital assistants analyze policy language, interpret context and offer personalized responses that match the customer’s intent. They highlight relevant clauses, explain exceptions in simple terms and guide clients through each step of the claims process.

This level of clarity builds confidence. Customers feel understood, not dismissed, because the information is tailored to their situation rather than copied from a generic FAQ. The trust formed through these interactions strengthens long-term loyalty and improves the overall service experience.

AI also supports internal teams. Learning platforms powered by advanced models identify where agents struggle, whether it is understanding exclusions, interpreting new products or handling sensitive communication. The system then delivers targeted training sessions that improve knowledge, reduce compliance errors and make onboarding faster for new staff.

Together, these capabilities create a more informed and empowered customer base while elevating agent performance. Insurers move beyond transactional interactions and become genuine advisors who guide clients through complex decisions with clarity and empathy. This shift leads to faster resolutions, fewer misunderstandings and a more engaged audience that feels supported from the first question to the final claim.

Fraudulent Activities Threat Management

Insurers also actively use Gen AI for fraud detection. The technology analyzes patterns and anomalies in the insured data, flagging potential scams. This AI application reduces malicious claim payouts, protecting businesses’ finances and assets. It continuously learns from new datasets, enhancing suspicious activity identification and prevention strategies..

Real-World Examples of Businesses Using Generative AI

After exploring various use cases of GAI in the insurance industry, let’s delve into six inspiring success stories from global companies.

A Pocket-Sized AI Pharmacy for a Canadian Insurance Giant

A leading Canadian life assurance company worked with Master of Code Global to create an AI-powered iOS app that helps families manage medications with confidence. The solution analyzes medical histories, allergies and treatment plans to alert users about potential drug interactions and build personalized schedules.

It also tracks symptoms, answers medical questions through an intelligent chatbot and supports voice commands for accessibility. The insurer saw a 43% drop in medication-related support inquiries, more than one million records processed securely and a 320% expansion of its drug database through AI-driven content aggregation.

GenAI FAQ Bot for Reimagined Insurance Support

A major business insurance provider partnered with Master of Code Global to introduce a Generative AI-powered FAQ chatbot that delivers instant, compliant answers to complex coverage questions. The assistant interprets unclear requests, provides accurate information within licensing limits and reduces pressure on customer service teams.

The solution improves lead qualification, keeps FAQs up to date through real-time learning and supports regulatory consistency. It helped the insurer reduce compliance risk, streamline claims support and increase cross-selling opportunities while strengthening policyholder engagement.

Clara from Helvetia

Helvetia has become the first to use Gen AI technology to launch a direct customer contact service. They conducted a seven-month trial of their upgraded chatbot Clara. Powered by GPT-4, it now offers advanced 24/7 client assistance in multiple languages.

This AI-enhanced assistant efficiently handles queries about insurance and pensions. Bot’s integration of Generative AI improves accuracy and accessibility in consumer interactions. Such an enhancement is a key step in Helvetia’s strategy to improve digital communication and make access to product data more convenient.

Allianz AI-Powered Chatbot

At Allianz Commercial, Generative AI also plays a multifaceted role in enhancing customer service and operational efficiency. They use intelligent assistants to answer user queries about risk appetite and underwriting. These bots are available 24/7, operate in multiple languages, and function across various channels. Additionally, Gen AI is employed to summarize key exposures and generate content using cited sources and databases.

In the underwriting process, smart tools are embedded to assess and price risks with greater accuracy. The instruments also streamline back-office operations and claims management. For instance, GAI facilitates immediate routing of requests to partner repair shops. This approach saves customers time and effort, raising their satisfaction.

Anthem’s AI-Generated Medical Data

Let’s also explore the potential of Generative AI in health insurance. Anthem Inc. partnered with Google Cloud to create a synthetic data platform. Their strategy involves generating an immense 1.5 to 2 petabytes of information. The records will encompass AI-generated medical histories and healthcare claims. The aim is to refine and train artificial intelligence algorithms on these extensive datasets, while also addressing privacy concerns around personal details.

Anthem’s use of the data is multifaceted, targeting fraudulent claims and health record anomalies. In the long term, they plan to employ Gen AI for more personalized care and timely medical interventions.

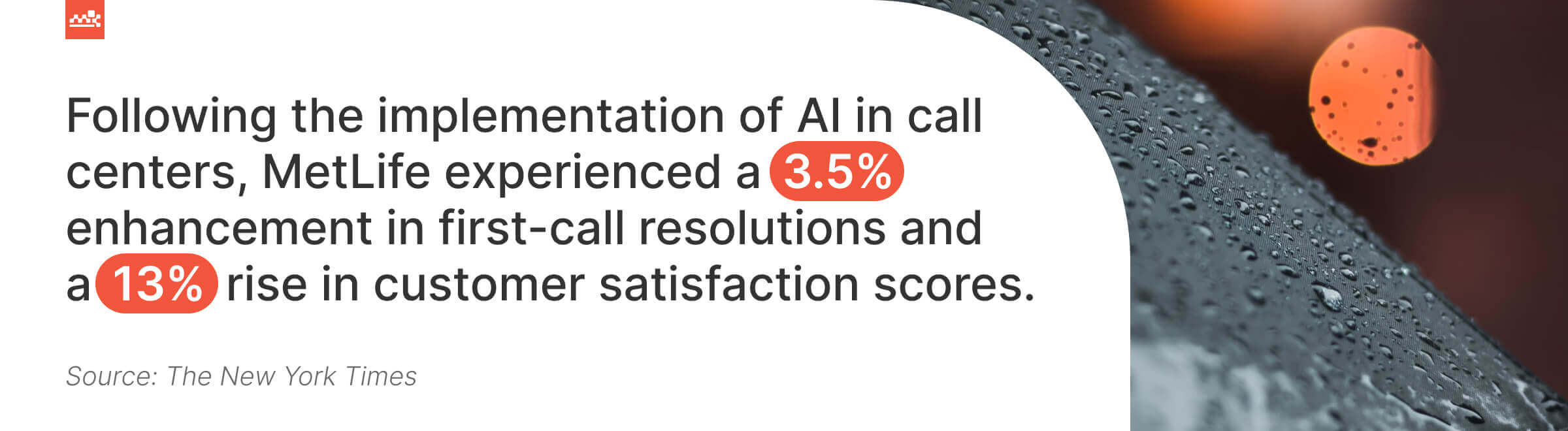

MetLife’s Use of AI in Call Centers

Generative AI in life insurance opens new avenues for enhancing customer support, as demonstrated by MetLife’s innovative application. The company has strategically implemented the technology in its call centers. Their focus is on coaching agents for improved consumer interactions. Thus, the instrument ensures clients receive empathetic and efficient service.

Indeed, MetLife’s AI excels in detecting customer emotions and frustrations during calls. The tool guides employees to adjust their communication style in real time. Such an approach is particularly impactful in sensitive discussions about life insurance, where understanding and addressing buyer concerns promptly is vital.

The effectiveness of this solution is evident from the reported results:

- 3.5% improvement in first-call resolutions;

- 13% increase in customer satisfaction scores;

- 50% reduction in average call time;

- 7% enhancement in net promoter score;

- 5% increase in first-call resolutions.

Conclusion

Having explored the benefits, risks, and practical applications of conversational AI in insurance, one thing is clear: its impact on businesses is undeniable. Your clients are also ready for GAI and expect further advantages from its adoption.

With the strategies, recommendations, and Gen AI use cases in insurance discussed, your company can navigate the technological advancements more effectively. Embracing Gen AI will make your services more customer-centric.

By partnering with us, you can elevate your claim processing capabilities and bolster your defenses against fraud. Generative AI is not just the future – it’s a present opportunity to transform your business.

FAQ

How does integrating AI-based fraud detection reduce losses for insurance firms?

Intelligent systems analyze claim patterns, customer behavior, and historical data to identify unusual activity that traditional reviews often miss. This improves insurance fraud detection by flagging inconsistencies early, reducing payout errors, and preventing repeat offenses. For businesses, the result is lower operational losses and stronger protection against emerging fraud schemes.

Which insurers use AI to streamline claims processing?

Many global brands now use Gen AI in claims processing to accelerate evaluations and reduce manual work. Companies such as Allianz, Helvetia, and MetLife apply virtual claims assistants, image analysis, and automated triage to speed up decisions. Health insurance companies also adopt Generative AI to simplify medical claim reviews and provide faster support to customers.

What is the future of AI in the insurance industry?

The future of the insurance industry is shaped by the wider adoption of AI, from underwriting and pricing to customer service and regulatory monitoring. As the generative AI opportunity for insurers grows, tools will move from simple automation to deeper integration of AI operations, powering personalized policies, predictive insights, and more adaptive risk models. Insurers that align their long-term strategies with these capabilities will gain a significant competitive advantage.

How can Generative AI help insurers in detecting anomalies?

GAI can uncover anomalies by analyzing large volumes of structured and unstructured data, learning what “normal” looks like, and highlighting deviations. This supports workflows that monitor claims, transactions and customer communication. The integration of generative AI into insurance systems enables early detection of errors, suspicious activity, and compliance issues, giving teams clearer visibility and faster intervention capabilities.

Explore the advantages of Generative AI for your insurance company. POC will be done in 2 weeks to validate the business idea!