Fintech is reshaping the financial services with cutting-edge, technology-driven solutions. Its focus is on enhancing efficiency, accessibility, and the overall user experience. And one of the innovations gaining increasing traction is AI automation, with its adoption rate growing by 63% in finserv.

That’s because of artificial intelligence, a powerhouse in the global tech world. Businesses can now excel in fraud detection, risk management, and customer service personalization. These are just a few of the advantages that Generative AI in FinTech offers to an international.

Want to learn more about how your business can stay ahead of the curve and skyrocket profits using Gen AI? Read this comprehensive guide, and we’ll answer most, if not all, of the questions. You’ll learn more about AI use cases, benefits, a few real-world examples, and how to calculate ROI for your future projects.

Table of Contents

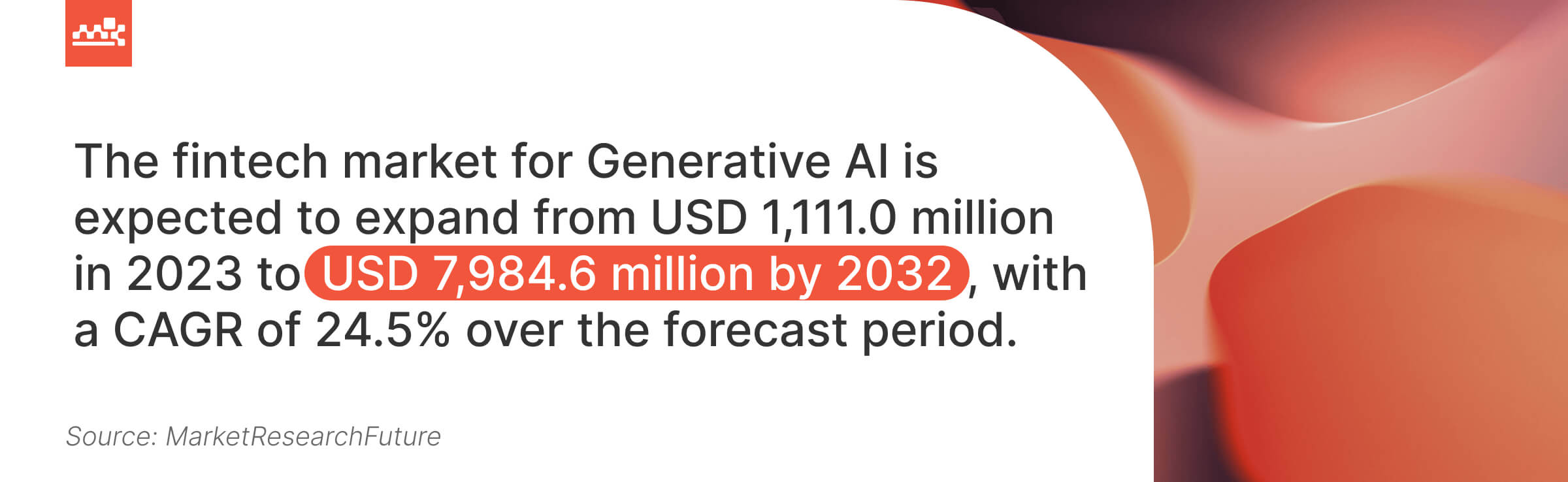

Market Overview of Generative AI in FinTech

Imagine a world where your financial services are smarter, more intuitive, and highly personalized. This is no longer a futuristic scenario, thanks to artificial intelligence’s entrance into the FinTech arena. Generative AI in banking is both about automating processes and creating a seamless, innovative user experience.

In fact, it could unlock between $200–$340 billion in annual value for banking alone, driven by improved productivity, faster decision-making, and intelligent automation. This potential isn’t hypothetical. It’s supported by aggressive industry adoption.

Supporting this momentum, recent forecasts estimate that Gen AI in the financial services market will grow at a CAGR of 28.1% through 2030. It’s fueled by demand for AI-driven solutions in fraud prevention, credit scoring, customer onboarding, and compliance automation. As competition intensifies, FinTech firms are leveraging this technology to both optimize internal workflows and launch entirely new product lines and revenue models. For organizations seeking a long-term strategic advantage, these smart solutions are emerging as a core driver of scalable growth, operational efficiency, and profitability at enterprise scale.

The consumer data reinforces this trend. Over a third (36%) of consumers are willing to manage their finances using Gen AI. And for those under 50, this number leaps to a striking 52%. It’s clear that the younger demographic is embracing this tech wave with open arms.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Meanwhile, from the business side, the sector isn’t just watching from the sidelines. Nearly half of industry leaders (48.2%) are pouring resources into artificial intelligence research. Plus, a notable 44.8% are already implementing these solutions. This enthusiasm stems from significant expectations: two-thirds of executives believe Gen AI could spike revenues by 10-30% in the next three years.

As Generative AI and FinTech continue to merge, they are forming a dynamic duo that is redefining financial services. This transformation goes beyond mere technological advancement; it represents a new era for FinTech providers. They are leading the way in this landscape where efficiency, responsiveness, and customer focus are paramount.

Now that we understand the integral role of technology in reshaping the industry, it’s time to examine its direct perks.

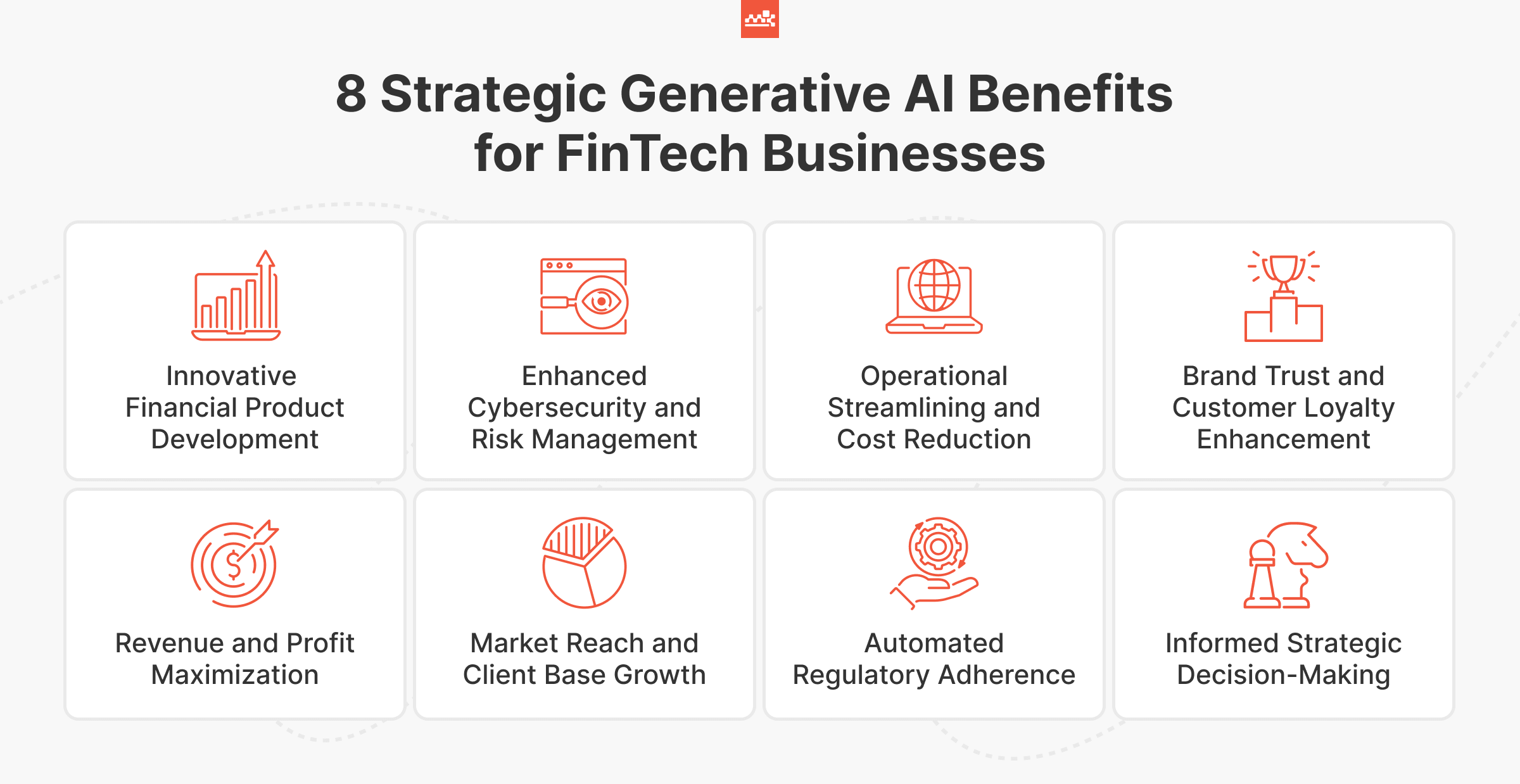

Strategic Advantages of Generative AI for Fintech

Artificial intelligence is a transformative force capable of redefining the sector’s future. Let’s explore Generative AI benefits that are pivotal for any forward-thinking FinTech enterprise.

- Accelerating revenue and profit growth. AI enables the identification of new market opportunities, enhancing product innovation and driving ROI. It also streamlines sales and marketing efforts, leading to cost-efficient expansion strategies.

- Fortifying security and mitigating risks. Implementing the technology in cybersecurity helps detect threats faster and more accurately. It offers predictive analysis for risk management, crucial for financial stability and customer trust.

- Boosting operational efficiency and reducing costs. The system automates routine tasks, freeing up resources for strategic projects. This leads to reduced expenses and enhances overall workflow effectiveness.

- Empowering strategic and informed decision-making. AI data breakdown capabilities provide deep insights for visionary planning. It allows leaders to make intelligent decisions according to the latest trends and internal performance metrics.

- Pioneering in innovative financial product development. The technology aids in developing tailored offers based on consumer behavior research. This approach ensures relevance and competitiveness in the rapidly evolving FinTech sector.

- Expanding market reach and enhancing customer acquisition. AI-driven analytics identify untapped markets and client segments. It customizes marketing campaigns, improving buyer engagement and conversation rates.

- Ensuring robust regulatory compliance and reporting. The tool guarantees adherence to regulations through automated monitoring and updates. This not only reduces the risk of violations but also streamlines the oversight process.

- Building and sustaining brand trust and loyalty. AI personalizes interactions, leading to enhanced satisfaction. Consistent and positive buyer experiences raise retention and strengthen the company’s reputation.

- Cultivating a data-driven organizational culture. The integration of artificial intelligence nurtures a mindset geared towards evidence-based choices. This approach enables insight-powered changes and ensures alignment with strategic long-term objectives.

- Facilitating scalable growth and continuous innovation. The technology’s adaptability supports business scaling without proportionate increases in resources. It fosters an environment of ongoing improvement, critical for staying ahead in the dynamic FinTech industry.

Next, we will navigate through various applications of Gen AI, demonstrating how these advantages manifest in real-world scenarios.

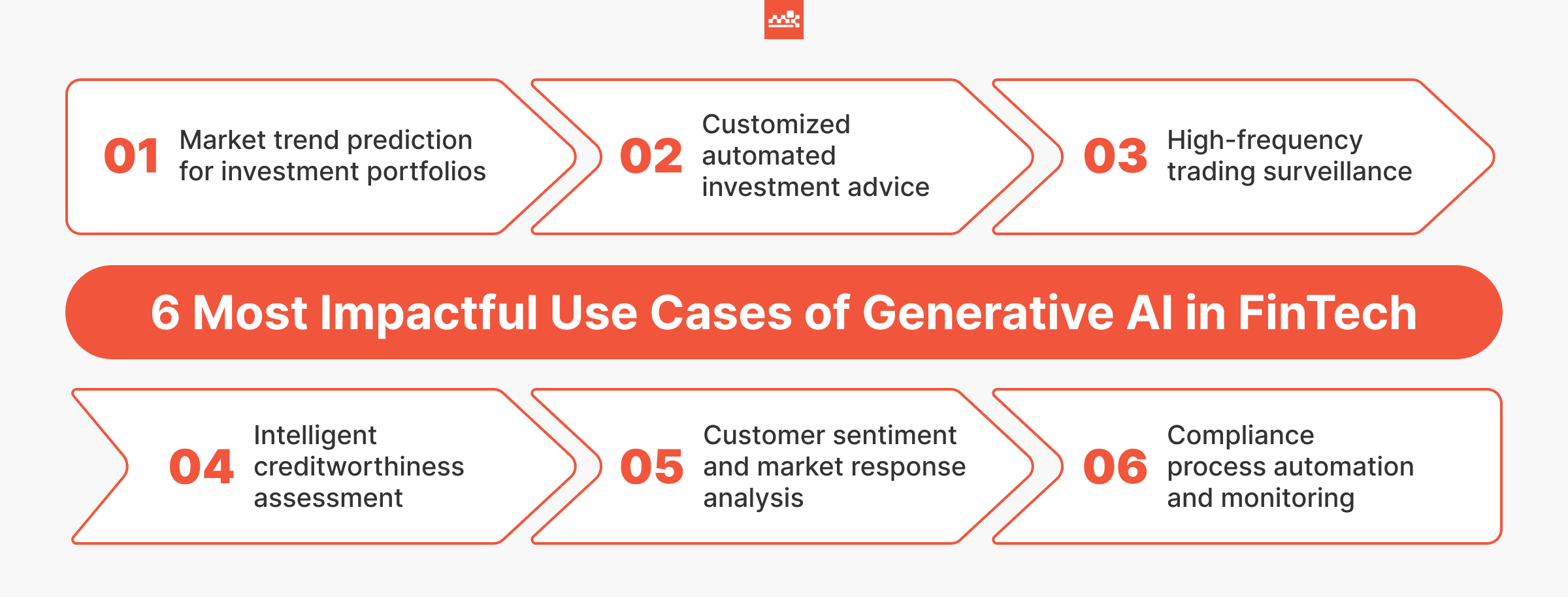

8 Top Use Cases of Generative AI in FinTech

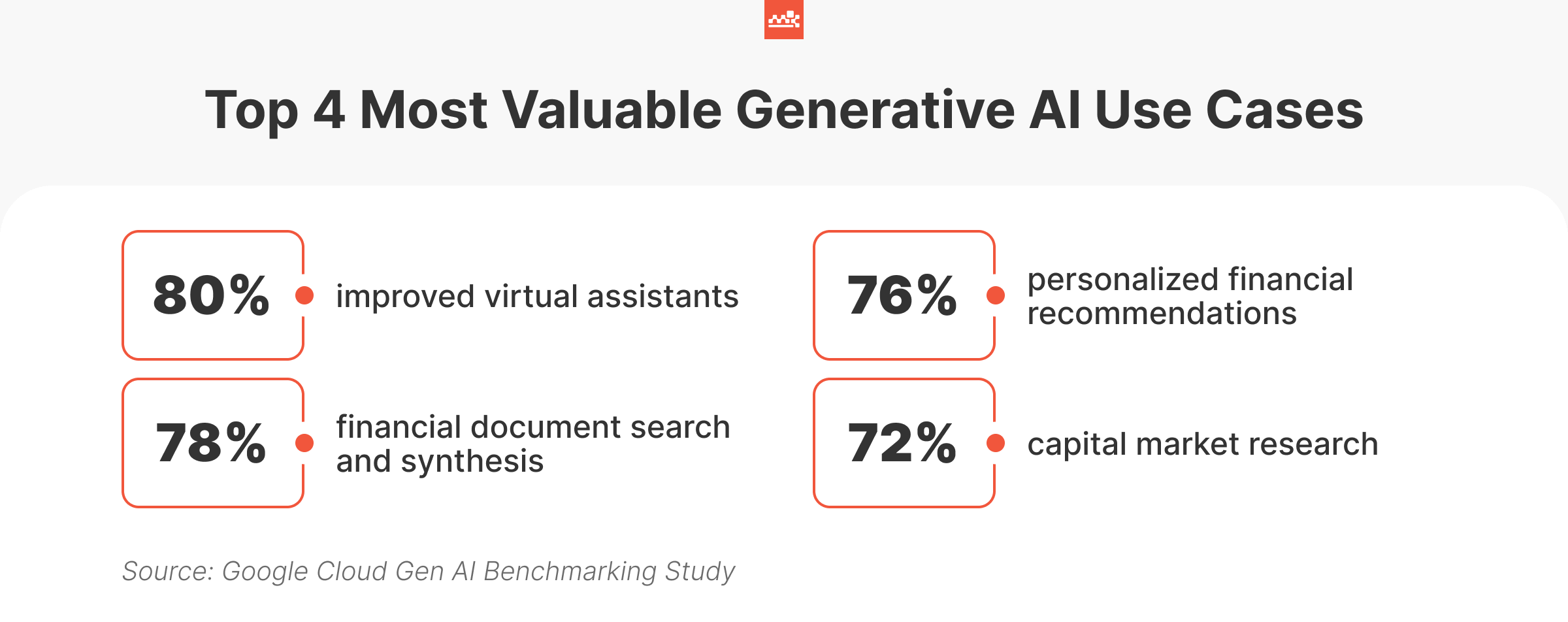

In the world of financial technology, artificial intelligence is carving out a significant niche. While its applications are diverse, top areas include security (around 13%), market research & data analytics (almost 15%), lending automation (17%), customer credit checks (13%), and claims assessment automation (almost 20%). These statistics highlight the growing reliance on Generative AI use cases in FinTech.

Market Trend Prediction for Investment Portfolios

Gen AI skillfully deciphers complex market data, identifying emerging trends. Its insights guide portfolio managers in strategic asset reallocation, ensuring timely responses to fluctuations. The technology’s predictive prowess extends to interpreting global economic indicators and historical factors. It empowers investment businesses to foresee and capitalize on opportunities, enhancing capital allocation strategies.

Portfolio managers optimize asset management, mitigating risks while seeking maximized returns. This approach translates to a competitive edge in the field, offering clients enhanced investment performance. Artificial intelligence is a game-changer for firms prioritizing informed decision-making and profitability. It allows them to navigate market complexities confidently, securing investor trust.

Example: AlphaSense’s platform processes over 100 million documents daily, enabling a 75% reduction in research time and a 20% increase in successful investment decisions.

Customized Automated Investment Advice

Generative AI reshapes how financial tips are delivered, customizing them to personal preferences. By analyzing profiles and history, the technology tailors advice to each client’s unique needs and goals. This personalized approach optimizes investment strategies, aligning with risk tolerances and return objectives.

The use of the system for wealth management guidance empowers investors with data-driven insights. It continuously adapts to market changes, providing timely and relevant recommendations. This automation ensures customers receive the most informed, strategic counseling, driving better portfolio outcomes.

Example: JPMorgan Chase’s IndexGPT is a model designed for tailored index fund best practices. The tool identifies a broader range of stocks beyond the obvious companies that everyone already knows about. The result is thematic investment baskets through automated keyword generation and news article analysis.

High-Frequency Algorithmic Trading Surveillance

Generative AI plays a critical role in monitoring rapid transaction activities. It swiftly identifies unusual patterns, flagging potential manipulations or irregularities. This real-time management is key to maintaining marketplace integrity and compliance. It ensures fair practices, safeguarding both the institution’s interests and market stability.

Example: HSBC implemented AI to automate anti-money laundering investigations. The technology achieved a 20% reduction in false positives while preserving thorough case review standards.

Intelligent Creditworthiness Assessment

Gen AI offers a more nuanced evaluation of borrower risk. The approach goes beyond traditional credit scoring, analyzing a broad spectrum of data points including transaction history, spending patterns, and even social data. This results in a more accurate assessment of an individual’s creditworthiness, leading to smarter lending decisions.

Such a method benefits both lenders and borrowers. Lenders gain a clearer picture of risk, reducing the likelihood of non-repayment. Borrowers, especially those with limited credit history, get a fairer opportunity to access financial products. This intelligent method of credit assessment is reshaping lending practices, making them more inclusive and efficient.

Example: Crediture employs Gen AI for dynamic scenario simulation in lending evaluations. Moreover, their models craft bespoke credit options suited to unique business needs. This strategy transforms commercial loans, offering tailored, practical solutions.

Customer Sentiment and Market Response Analysis

Utilizing Generative AI for data analytics, FinTech firms excel in deciphering client emotions and industry dynamics. By sifting through a vast number of datasets, the technology discerns patterns in user behavior and preferences. The examination is crucial for understanding how clients perceive products and services.

AI-driven intelligence also plays a significant role in monitoring market reactions. It evaluates the impact of financial trends, new items, and market changes on consumer attitudes. This insight helps businesses tailor their offerings and strategies to better meet demands.

Moreover, artificial intelligence’s predictive capabilities forecast future buyer behaviors and economic indicators. Through advanced algorithms, it anticipates shifts in sentiment, enabling proactive business decisions. The foresight ensures that FinTech providers stay ahead, adapting swiftly to evolving conditions.

Example: OCBC implemented AI to analyze customer data and enhance personalization capabilities through machine learning. The bank deployed Gen AI tools that help identify personal preferences and optimize service delivery. This approach enables the institution to push 250 million individualized recommendations yearly through their mobile banking app.

Compliance Process Automation and Monitoring

AI streamlines regulatory adherence, adapting swiftly to changing financial rules. It vigilantly tracks policy updates, mitigating violation risks. This technology simplifies compliance management, boosting operational precision. Its meticulous tracking reduces human error, protecting the institution’s credibility.

Example: JPMorgan’s COIN software automates commercial agreement reviews. The algorithm completes work in seconds that previously required 360,000 hours annually by lawyers and loan officers.

AI-Enhanced Customer Interaction Systems

Generative AI transforms the way FinTech firms interact with their clients. Chatbots and virtual assistants, embedded with artificial intelligence, deliver immediate, round-the-clock assistance. These tools efficiently manage queries and transactions, boosting user satisfaction.

Tailored interactions are a hallmark of the systems, adapting responses to individual histories and preferences. They offer bespoke financial guidance, enhancing service quality and deepening client relationships. Such a feedback analysis pinpoints opportunities for business improvement.

Integrating Generative AI into customer dialogues streamlines communication, minimizing wait times and reducing errors. This innovation fosters stronger consumer loyalty, a key driver of company success. Adopting the tool in support strategies marks a significant step in optimizing service delivery.

Example: FintechOS uses Generative AI to accelerate the development of hyper-personalized banking and insurance products. Their platform shortens the time to market for new offerings while tailoring experiences to one’s preferences. This aligns closely with Artificial Intelligence-enhanced customer interaction systems, where agility and personalization go hand in hand to elevate user satisfaction and competitive advantage.

Fraud Detection and Prevention

Generative AI in payments is revolutionizing anti-scam measures in financial institutions. In fact, 66% of organizations use AI and machine learning (ML) technologies, a significant jump from 34% in 2022. That’s because technology’s advanced algorithms enhance security, reducing fraud-related losses.

AI systems analyze spending behaviors and transaction histories in real-time. By identifying anomalies, they quickly flag potential illicit activity, alerting for immediate action. This proactive approach prevents fraud and minimizes false positives, enhancing overall safety.

Example: PayPal cut its fraud loss rate by nearly 50% over three years by using AI to adapt in real-time to evolving threats and improve customer protection. This success highlights how predictive intelligence can drastically reduce risk while ensuring safer transactions.

Dynamic Financial Scenario Modeling

Generative AI allows firms to simulate various economic and borrower scenarios. These models help optimize lending terms, manage portfolio risk, and support more resilient planning across unpredictable market conditions. Over 85% of fintech lenders now use AI to dynamically adjust lending criteria based on real-time borrower behavior, and AI-driven risk engines reduce underwriting manual intervention by up to 90%.

Hyper-Personalized Product Recommendations

By analyzing real-time user behavior, preferences, and financial goals, Gen AI delivers tailored product suggestions, from savings plans to investment bundles. This drives higher engagement, better conversion, and long-term customer satisfaction. While only 27% of bank customers fully trust AI for financial information, 62% say they would rely on customized smart alerts to avoid fees, signaling strong demand for well-targeted, context-aware recommendations.

Proactive Regulatory Compliance

AI tools track evolving regulations, flag potential issues, and automate documentation workflows. This proactive approach reduces compliance risk and ensures audit readiness without overwhelming legal or ops teams.

Risks and Solutions in the FinTech Industry

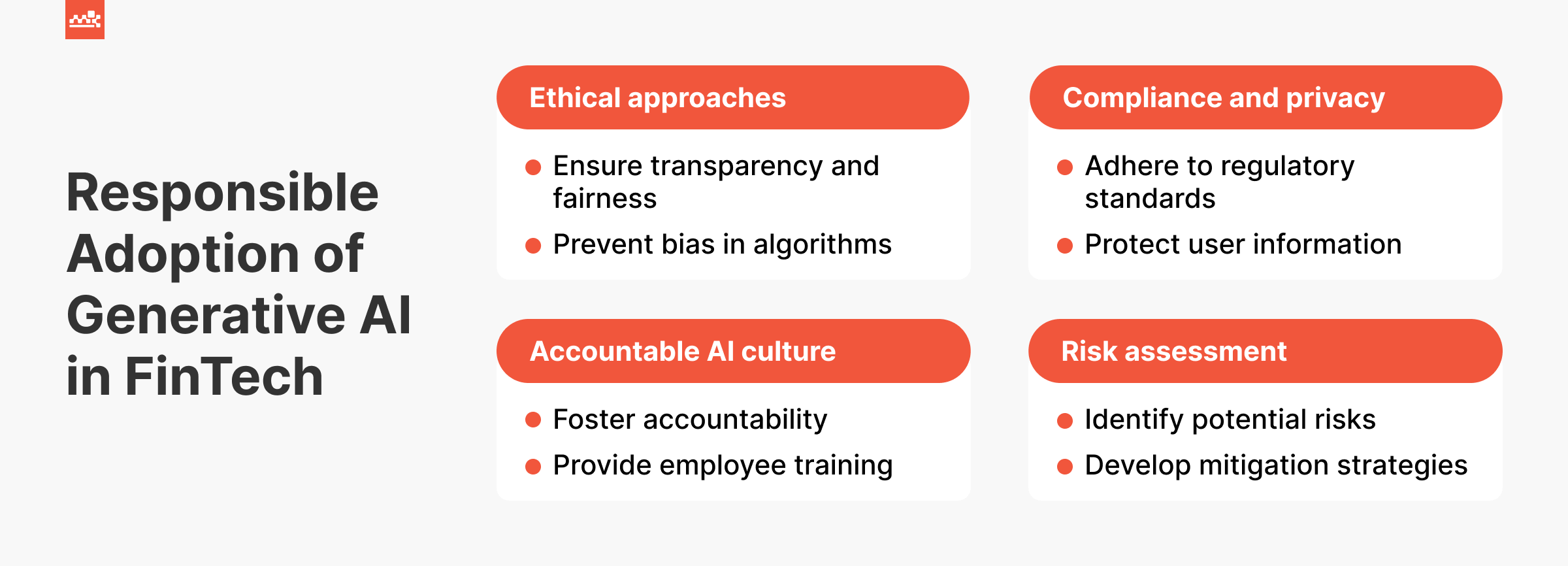

The adoption of artificial intelligence introduces a spectrum of difficulties, like safety, adherence to norms, and privacy. Addressing these issues is essential for maintaining a balanced and responsible AI ecosystem.

Ethical usage of Gen AI is a cornerstone. It’s vital to develop applications that are equitable and unbiased. This way businesses ensure that algorithms don’t perpetuate or exacerbate societal disparities. Such a commitment safeguards against the accidental creation of unfair practices or decisions.

Navigating the intricacies of conformity and confidentiality in artificial intelligence is also crucial. As regulatory frameworks evolve, AI-powered systems must adapt to adhere to stringent data protection laws. Vigilance in compliance is key to preserving customer trust and guaranteeing the integrity of apps.

Cultivating a culture of responsible artificial intelligence within organizations is equally important. This involves educating teams on the technology’s capabilities and ethical considerations. Moreover, companies should foster an environment that values continuous learning and conscientious AI application.

At Master of Code Global, our approach as Generative AI developers aligns with these principles. Our expertise lies in creating advanced AI technologies and ensuring the innovations are deployed ethically and responsibly. We understand the complexities of the FinTech sector and are committed to delivering solutions that are not just technologically progressive but also socially conscious and regulation-compliant.

AI as a Catalyst for Future FinTech Trends

As the financial technology domain evolves, artificial intelligence is poised to be a significant trendsetter. McKinsey predicts that technologies like Generative AI will revolutionize the sector’s competitive landscape over the next decade. These advancements hint at several critical tendencies.

Predicting market directions with artificial intelligence will become increasingly sophisticated. It will allow businesses to anticipate and adapt to economic shifts swiftly. The ability to foresee demand dynamics enables more strategic investment and operational decisions.

In the realm of regulatory compliance, the technology will play a crucial role. With regulations constantly evolving, AI’s capacity to interpret and comply with these transformations efficiently will be invaluable. This ensures adherence to legal standards and improves functional agility.

Innovations in AI-driven financial products are set to transform how services are delivered. Personalized solutions, tailored to individual buyer needs, will turn into the norm, navigated by deep learning capabilities. The change will lead to heightened customer engagement and satisfaction.

Furthermore, Gen AI will create new market opportunities and niches. In fact, 86% of executives are planning to boost their investments in such tools. Thus, we observe a shift towards exploring innovative services and business models previously unfeasible.

The emerging trends underscore the transformative impact of AI in FinTech. They paint a tomorrow where artificial intelligence not only enhances existing conditions but also spawns unexplored forms of economic interaction and industry benchmarks. For companies, these improvements will be key to staying ahead of the curve in a rapidly developing digital economy.

How to Calculate ROI Before Development and How to Choose a Service Provider

Achieving expected Return on Investments (ROI) is crucial in Generative AI projects, especially in FinTech. For 50% of executives, this is the primary measure of success. It requires a careful analysis of economic gains against the expenditures of artificial intelligence implementation.

Figuring ROI generally demands assessing the financial viability of AI-powered applications. It’s essential to take into account both development expenses and operational savings. This calculation also factors in conceivable revenue growth from the solution.

Finance chatbot, the most common use case of Gen AI, offers a clear example. To estimate a bot’s returns, companies need to understand its bottom-line impact. At Master of Code, we created a Chatbot ROI Calculator to aid businesses with this task. The tool estimates potential savings before implementing artificial intelligence systems.

Our calculator compares current costs with human agents to those with an AI solution. It considers characteristics like agent salaries, time spent per ticket, and service request volumes. This helps executives gauge the monetary benefits of a digital assistant. The instrument is designed to predict labor outlay reduction effectively.

In addition to calculating probable ROI, choosing the right AI service provider is another paramount factor. Key aspects to evaluate include expertise in a variety of artificial intelligence apps and a track record in the industry. It’s important to assess their ability to align solutions with your specific goals. Consider their understanding of FinTech’s unique challenges and opportunities.

Selecting a provider goes beyond technical competence. It involves evaluating their strategic approach to AI development. The ideal partner not only offers specialized skills but also brings forward-looking strategies. They help maximize the ROI of your Generative AI project, ensuring its alignment with your business’s long-term objectives.

Considering our responsible attitude to artificial intelligence, proven success stories, and the technological knowledge of our masters, Master of Code Global stands as a reliable partner. We assist in picking LLMs, training them, and integrating them with third-party services. Partnering with us means settling on a team committed to maximizing investment and aligning it with your strategic vision.

Key Takeaways

Gen AI in FinTech significantly enhances efficiency and personalized customer service. As its adoption increases, it brings improvements in critical areas like fraud detection and market analysis. The technology is reshaping financial operations and aiding in strategic decision-making.

Transitioning from the impact of AI, it’s crucial to evaluate the ROI of projects like chatbots. The assessment implies calculating probable benefits against investment costs. Accurately gauging the returns is key to securing the economic success and tactic consistency of artificial intelligence initiatives.

In this context, the choice of a provider becomes pivotal. Selecting a partner involves more than assessing technical capability. It requires evaluating their alignment with your business’s strategic goals. The ideal one understands the specific challenges of the domain and is committed to ethical Gen AI development, ensuring a seamless and successful integration of the technology into your algorithmic trade model.

How will your company leverage Generative AI to redefine its future in FinTech? Contact us for expert guidance in harnessing AI’s potential to drive growth and innovation.

Don’t miss out on the opportunity to see how Generative AI can revolutionize your customer support and boost your ROI.