Back in 2017, Microsoft’s CEO Satya Nadella called insurance “the most fertile ground” for bots – not because it was lagging in tech, but because it was overflowing with complexity. Fast forward to today, and LLM-powered chatbots for insurance are quietly transforming how carriers engage with customers, manage policies, and handle claims. They do it with more speed, consistency, and scale than traditional workflows allow.

In fact, these intelligent conversational tools have already become standard practice. According to a Conning survey, 77% of carriers are actively implementing AI across their value chain. Another 67% are piloting large language models for use in underwriting, claims handling, and sales.

Thus, insurance chatbots aren’t just supporting from the sidelines. They’re being woven into the core of operations. To prove that, we will examine how insurers like Geico, Zurich, and SWICA are deploying bots and what’s actually delivering results. Stick around to get answers to the questions your stakeholders and team are already asking.

Table of Contents

What Is an Insurance Chatbot?

This virtual assistant is powered by artificial intelligence that helps automate interactions between providers and their clients. These bots can be deployed on websites, mobile apps, or messaging platforms to handle a wide range of tasks – from answering policy questions and generating quotes to processing claims and collecting customer data.

Unlike static FAQ pages or long phone queues, a chatbot for insurance delivers instant, consistent, and accessible support 24/7. They use natural language processing (NLP) to understand user queries and respond with relevant information in real time.

For insurers, bots reduce the workload on human agents and improve operational efficiency. For customers, they simplify complex processes and make services more convenient and less intimidating. In short, AI chatbot solution for the insurance sector enables faster help, fewer manual errors, and higher satisfaction – all while cutting costs.

How are AI Chatbots Changing the Insurance Industry?

Health Insurance

In healthcare, AI for claims processing reduces friction in high-volume service areas. It assists with policy coverage questions, claims tracking, and appointment scheduling — all in real time. By automating these tasks, insurers can reduce call center costs and improve accessibility, especially during peak times.

Boosting Patient Engagement & Conversions: Discover How AI Chatbots Can Empower Your Healthcare Practice

Life Insurance Chatbot

Digital assistants guide people through the policy selection and application process. They answer queries about term lengths, premiums, and coverage benefits, and pre-qualify users by collecting essential personal information. This not only shortens decision cycles but also improves lead quality for human staff.

Insurance Agents

Chatbots act as virtual helpers for workers. They handle repetitive client requests like document updates, policy changes, and payment reminders. Without the need to manage FAQs across all touchpoints, staff dedicates more time to complex cases and relationship-building. The combination of AI insurance agent tools and automation boosts client satisfaction and sales performance.

Reinsurers

For such companies, bots enhance operational efficiency by analyzing loss data, identifying claim anomalies, and generating summary reports. They also assist in data collection from multiple insurers, improving modeling accuracy and risk assessment. This level of automation supports faster decision-making while maintaining compliance.

What Are the Pain Points of Insurance AI Chatbots?

Securing Integrations

Implementing an insurance chatbot in core systems like CRMs, policy admin platforms, and claims processing tools isn’t always straightforward. Without secure, real-time connections, bots can’t access or update customer data effectively – limiting their functionality and value.

Misunderstanding Technical Requirements

Many insurers underestimate what it takes to create and maintain an effective AI assistant. Off-the-shelf tools rarely allow deep integration with proprietary or legacy software, have a hard time with specialized language, and offer limited customization. Custom solutions, meanwhile, demand clear architecture, robust APIs for real-time data access, and ongoing model tuning to keep pace with new products and regulatory updates.

Data Privacy & Compliance

Providers handle sensitive personal details. Chatbots must comply with industry regulations like GDPR, HIPAA, or state-level laws. A failure to protect client information, or even to explain how data is used and stored, might lead to reputational and legal risks.

Handling Complex Queries

Digital tools excel at routine tasks but sometimes struggle with edge cases. Complicated claims, disputes, or policy exceptions often require human judgment. Without a smart fallback or escalation system, customer frustration quickly builds or misinformation gets spread.

Maintaining Human Touch

A fully automated experience risks feeling impersonal, especially in sensitive situations. However, well-crafted conversation design makes chatbots feel natural and empathetic: from using plain, reassuring language to mirroring human dialogue patterns and adapting tone based on context. When designed this way, bots don’t just provide answers; they create interactions that feel personal, approachable, and trustworthy.

Insurance Chatbot Benefits

Many calls and messages agents receive might be simple policy changes or queries. The chatbot for insurance helps reduce those simple inquiries by answering customers directly. This gives agents more time to focus on difficult cases or get new clients.

You can integrate bots across a variety of platforms to best suit your audience. So let’s take a closer look at the main benefits for businesses and clients.

Customer Onboarding Assistance

For example, a potential client contacts a company via Messenger. A bot asks them for relevant information, including their name and contact information. It also inquires about what they are wanting to buy insurance for, the value of the goods they are wanting to secure, and basic health information.

From there an agent is able to review the information, ask more questions if needed, draft up a plan, and get it signed. Bots help make the process more efficient and free up time for agents to do other tasks.

The virtual assistant asks for contact information and details about the business. It also inquires about when they would like their coverage to start. It could be general questions, including any claims in the past five years.

Help with Fraudulent Claims

False requests remain one of the toughest challenges for insurers. Chatbots and AI-powered tools analyze claim data at scale, uncovering patterns and anomalies that often go unnoticed by humans. By flagging suspicious activity early, they help insurers reduce losses, improve efficiency, and maintain greater trust with their customers.

70 percent of our customers are buying insurance on their phones.

The Ease of Access of Information Provided

Companies can install backend chatbots to give information to agents quickly. A broker is able to ask a bot a question. The bot then searches the insurer’s knowledge base for an answer and returns with a response. This is more efficient than the majority of website searches.

Quick and Easy Acquisition of Information

Many consumers prefer to communicate via messaging as opposed to on the phone or via email. They are able to receive the information they need, when they need it, in their preferred medium. While insurance might be intimidating, especially for young consumers, virtual assistants help make the entire experience more user friendly.

AI bots will power 95% of all customer service interactions by the year 2025

Cost & Time Reduction

Insurance chatbots save companies money and time in a number of ways. They automate many of the tasks that are currently performed by human customer support. These tasks include answering questions and processing claims. For instance, bot helps to file a claim in minutes, instead of having to wait on hold.

Increase Customer Engagement

Through NLP and AI, assistants have the ability to ask the right questions and make sense of the information they receive.

AI chatbots in insurance are able to take clients through a custom conversational path to receive the needed insights. This can be done without waiting or needing to talk to a person. It gives bots a valued advantage over a website or an email campaign.

Simply put, chatbots are disrupting the insurance industry. Month over month, more consumers are interfacing with companies via different channels. There are a variety of reasons bots do well in the business:

- they are personal,

- they are replacing apps,

- they’re easy to deploy,

- they have been shown to increase customer engagement,

- and they automate the claims process.

24/7 Assistance

Traveling and losing your glasses? No problem – use the messenger application on your phone to get the information you need ASAP. Bots inform clients of their insurance coverage and how to redeem said coverage. Providing round-the-clock help, this AI chatbot feature saves clients’ time and reduce frustration.

Multilingual

75% of consumers opt to communicate in their native language when they have questions or wish to engage with your business. Multilingual chatbots can connect with customers in their preferred language, which makes interactions more comfortable and effective. It allows companies to cater to a diverse client base.

Collect Data

All companies want to improve their products or services, making them more attractive to potential customers.

They use bots to collect data on user preferences, such as their favorite features of deliverables. They also gather information on their pain points and what they would like to see improved.

Insurance chatbot is good at feedback collection. It can survey clients about their experience with the company. Companies might use this feedback to identify areas where they could improve their customer service.

Insurance Chatbot Use Cases

Employing artificial intelligence can revolutionize operations within the industry. There exist many compelling AI use cases in insurance that might convince you to integrate virtual assistants into your company.

Help to Choose Insurance Plan

The organizations can streamline and improve customer journey with assistant support. Your company is able to stand out in a crowded market by integrating chatbots into your insurance business to automate search and purchase processes.

The interactive bot greets people and gives them information about claims, coverage, and industry rules. Furthermore, it collects important details about clients. These details include their age, job, travel habits, and potential risks.

For instance, Geico virtual assistant welcomes clients and provides help with insurance-related questions. Users either type their queries or choose from a list of options.

The bot uses your questions to give relevant information. It also improves its interaction knowledge, learning more as you engage with it.

GEICO’s virtual assistant helps you with a variety of tasks, including:

- Answering your questions about policies, coverage, and claims.

- Helping you to file a claim.

- Processing your payments.

- Generating quotes for new policies.

- Finding the right policy for your needs.

- To locate important documents, such as ID cards or other documents.

You can access it through the mobile app on both iOS and Android devices, which offers 24/7 assistance.

Help with Insurance Plans

A chatbot is a practical tool that explains your strategies in simple terms. It can ask the right questions, understand customer needs, and then provide tailored recommendations that align with their requirements.

For example, SWICA, a health insurance provider, has developed the IQ virtual assistant for user support. The bot responds to FAQs and helps with insurance plans seamlessly within the chat window. It eliminates the need to redirect people to external pages.

Users are able to change franchises, update addresses, and request ID cards through the chat interface. They can add accident coverage and register new family members within the same platform.

Automatically Process Insurance Claims

A chatbot can collect information, help consumers file claims, and guide them through the whole journey. Automating these processes speeds up the claims procedure. Nearly half (44%) of customers find digital tools to be a good way to handle claims. It saves time and effort for both clients and insurers.

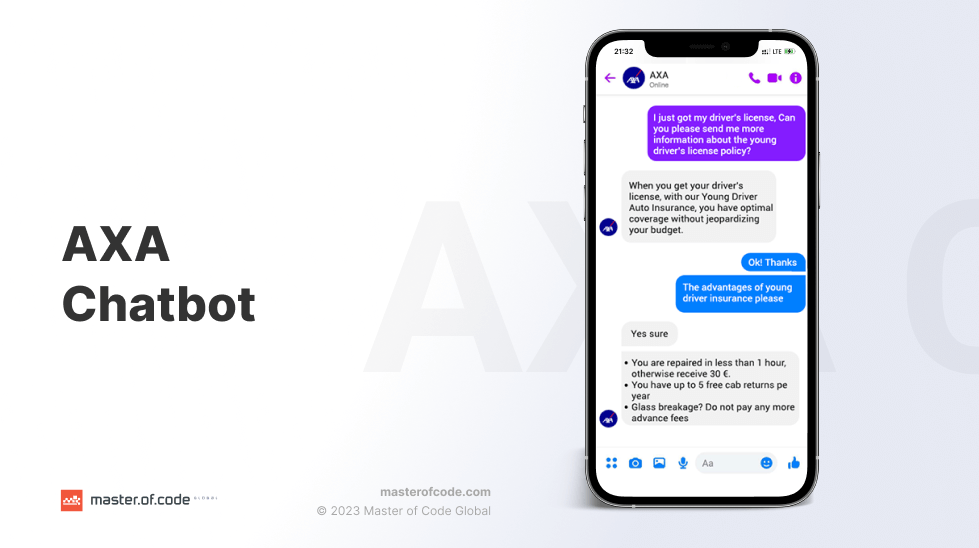

AXA Chatbot excellently demonstrates how bot automated processes. The bot responds to questions from clients and provides them with the correct answers. Thanks to advances in machine learning, the digital tool answers not only simple questions but also more complex ones. For example, if a client needs to replace their insurance card, bot can help them enter the necessary information. It can then start the replacement process.

Policy Comparisons

One of the most practical use cases for insurance chatbots is helping customers manage policy-related tasks quickly. Instead of forcing people to scroll through lengthy product pages or wait on hold, digital tools can walk them through a personalized comparison based on their needs, such as coverage type, risk level, budget, or life stage.

The bot can also break down the differences between options (e.g., deductible amounts, term lengths, or optional riders) and recommend the most suitable plan. This makes it easier for users to make informed decisions, even if they’re new to insurance.

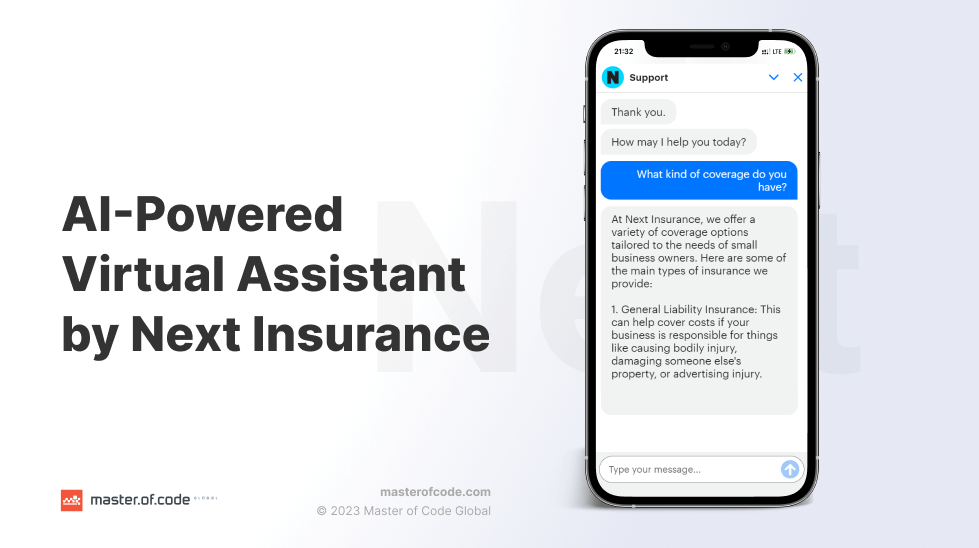

Beyond comparisons, bots also optimize transactions. For instance, Next Insurance’s digital assistant allows people to manage certificates, billing, claims, and policy changes directly through chat – a prime example of AI chatbot platforms designed for insurance providers improving usability.

Assist Customers with Payments

Most companies now let their clients pay for their plans online. This option has become popular due to its ease and accessibility. In a normal office, a receptionist usually manages this and answers calls from clients. By introducing a chatbot, agencies can save time and focus on important tasks.

Besides, a digital tool can help consumers check for missed payments or report errors. In situations where the bot is unable to resolve the issue, it can offer to escalate the customer’s request. Alternatively, it can promptly connect them with a live agent for further assistance.

Instant Policy Guidance

Insurance chatbots can lead users to the right policy by asking a few targeted questions. Moreover, AI in insurance communications confusion and help customers analyze coverage options. Real-time assistance enables people to compare features, costs, and limitations without manual searching, making the choice faster and improving conversion rates across digital channels.

Efficient Claims Processing

Virtual assistants simplify the claims journey by collecting necessary information, verifying data, and initiating the claim process automatically. Clients avoid long wait times and paperwork while insurers reduce human handling. Bots can also update users on status in real time, demonstrating how Conversational AI in insurance improves transparency and constantly keeps consumers engaged.

Lead Generation and Qualification

AI tools can identify approved leads by asking relevant questions and segmenting clients based on their responses. They capture essential data points like age, insurance needs, and risk tolerance – helping sales teams focus on prospects with high conversion potential. This automation accelerates pipeline growth and enhances ROI on traffic and campaign investments.

Automated Renewals and Reminders

Missed prolongations often lead to lost revenue and coverage gaps. Insurance chatbots can automatically remind clients of upcoming renewals, confirm continuation, and process payments. This reduces churn, keeps users compliant, and removes friction from the policy lifecycle – all while minimizing manual follow-up for agents and assistance teams.

24/7 Customer Support

AI chatbots for insurance deliver consistent, accurate help around the clock, answering FAQs, resolving basic queries, and routing complex issues to human agents. This guarantees coverage for all time zones, lowers operational costs, and boosts customer delight – especially during urgent situations or outside of normal business hours.

Personalized Cross-Selling and Upselling

Based on user profiles, behavior, and past interactions, AI tools can recommend relevant add-ons or upgraded policies. For instance, they might suggest travel package to a frequent flyer or renters coverage to a homeowner. This kind of personalization shows the growing maturity of AI agents pre-trained in insurance-specific terminology, which confirms recommendations remain accurate and compliant.

Fraud Detection Support

Insurance chatbots facilitate scam prevention by flagging suspicious claim patterns, inconsistent answers, or mismatched data inputs. While not replacing full fraud systems, bots can trigger alerts early in the process and prompt further verification steps, improving accuracy and saving insurers significant costs associated with fraudulent activity.

Seamless Onboarding Experience

From the moment a customer engages, bots guide them through onboarding by collecting details, verifying identity, and helping them understand their policy. Automated welcome messages, tutorials, and document checklists reduce confusion, speed up setup, and offer a smooth start to the client relationship, especially useful for first-time policyholders.

Efficient Support During Peak Periods

During high-demand periods like open enrollment or post-disaster surges, bots absorb large volumes of inquiries without sacrificing response time. They deflect repetitive questions, triage issues, and escalate only when necessary. This reduces backlog, keeps users informed, and protects assistance teams from burnout.

Dynamic Risk Assessment Tools

Advanced chatbots equipped with AI risk modeling can collect and assess user data in real time to support underwriting decisions. They can flag missing information, estimate coverage tiers, and even suggest risk mitigation strategies. By integrating directly with actuarial models and policy databases, these algorithms make profiling faster, more accurate, and less dependent on manual review.

Interactive Education

For most clients, field terminology is complex, but chatbots in insurance industry can simplify them. Through interactive questions, plain-language answers, and visual aids, bots help customers understand policy terms, exclusions, and coverage limits. This builds trust, reduces help calls, and empowers people to make more informed decisions without overwhelming them with dense content.

Agent Support Assistants

Internal-facing insurance chatbots act as digital aides for employees, helping them retrieve policy details, generate quotes, or prepare for client meetings. This boosts productivity, shortens lookup time, and makes sure agents always have up-to-date information. It’s especially useful for hybrid or remote sales teams handling multiple product lines.

Regulatory Compliance Updates

Bots can automatically notify users about changes in policy terms or regulatory shifts that affect their coverage. They ensure transparency and required disclosures, all while simplifying the acceptance of updated terms. This lowers compliance risk for insurers and keeps clients notified without legal jargon.

Localized and Multilingual Support

Insurance chatbots with voice assistance can engage people in their preferred language or format. This improves inclusivity, accessibility, and trust – particularly in diverse or global markets. Voice-enabled bots can also assist consumers with disabilities or those less comfortable typing, expanding the reach of digital services.

Assistance with Complex Forms

Instead of presenting customers with long, static forms, an AI-powered chatbot for insurance sector can guide users step-by-step through data collection. They explain fields in plain language, validate inputs, and pre-fill known information. This reduces form abandonment, minimizes input errors, and guarantees more complete submissions for quotes, claims, or onboarding.

Chatbot Examples in Insurance

Exploring successful AI cases can provide valuable insights into the potential applications and benefits of this technology. Master of Code Global has also delivered several advanced projects, demonstrating the power of agentic AI in insurance – from an embeddable voice assistant framework to a GenAI FAQ bot establishing compliance.

A Pocket-Sized AI Pharmacy for Canadian Insurance Giant

To support patient-centric care, Master of Code Global built an AI-driven virtual medicine kit for a leading Canadian insurer. This mobile solution helps users manage prescriptions, monitor intake, and access reliable drug information. The platform processed over 1 million medication records without a single data breach and achieved a 320% drug database expansion through digital content aggregation, setting a new standard for online health engagement.

GenAI FAQ Bot for Reimagined Insurance Support

Built on the LivePerson platform, this AI assistant delivers instant, compliant responses to a wide range of questions. Master of Code Global engineered the bot to handle vague queries without promoting unlicensed products, providing regulatory compliance and user trust. The result: reduced legal risk, smoother claims processing, and improved conversion through intelligent cross-sell and upsell opportunities across conversations.

Embeddable Voice Assistant Case Study

Master of Code Global developed a flexible voice assistant framework that drastically accelerates time-to-market for voice-enabled applications. This lightweight, customizable setup supports rapid prototyping and native app compatibility, allowing insurers to launch innovative features faster. With built-in speech recognition and wide industry adaptability, it empowers teams to transform apps into voice-activated tools that boost interaction and future-proof their digital strategy.

Zurich Claims Bot

Zurich Insurance now has chatbot on their claims guidance pages. The Zurich Claims Bot engages users with a series of pertinent questions. It helps them find the right pages or easily connects them with an agent.

Now Zurich is trying out ChatGPT: the company is testing how Generative AI in insurance can be used in areas like claims and modeling.

Zurich is looking into how the technology can be used. They want to extract data from claims descriptions and other documents. To improve its underwriting process, it analyzes the past six years of claims data to pinpoint the exact cause of losses in different claims.

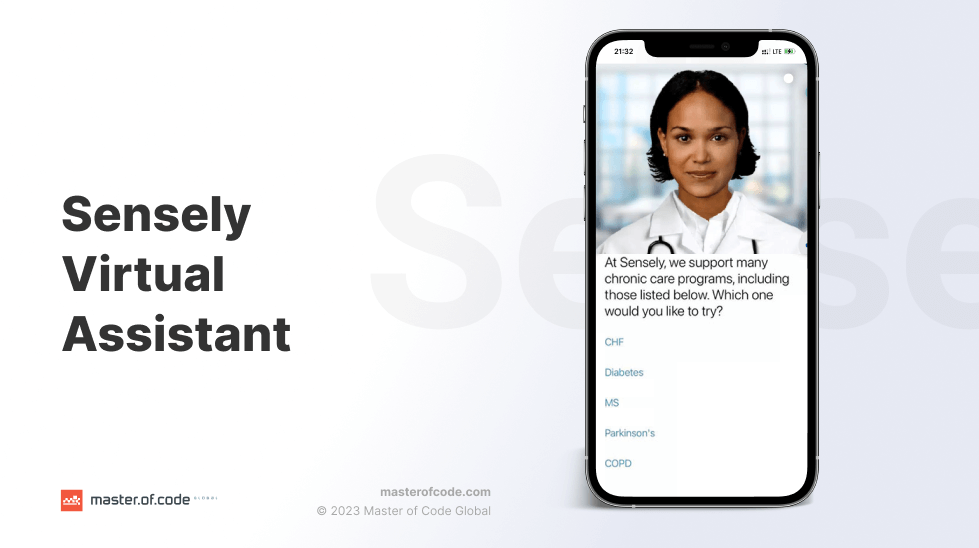

Sensely Virtual Assistant

This intelligent solution helps insurance plan members and patients by making it easier to access health insurance services and healthcare resources. Over time, Sensely’s virtual healthcare assistant has expanded its capabilities, now supporting everything from symptom checking and guidance to the management of patient care programs.

Molly, the Virtual Assistant at Sensely

Designed for health and insurance navigation, Molly helps users check symptoms, explore coverage options, and connect with care providers. The avatar-based interface combines voice, text, and visual cues to deliver a smooth, accessible experience, making it easier for members to manage their health plans and receive timely support.

IEC Insurance

Travelers looking for straightforward guidance can rely on IEC Insurance’s Lyro chatbot to simplify the process. The assistant explains coverage options (12, 18, or 24-month plans), excess amounts, and pre-existing conditions. It also highlights covered and excluded activities, provides claims instructions through Cover-More, and shares emergency contact details. In addition, the bot supplies IEC visa applicants with quotes, policy requirements, and general FAQs, offering fast, accurate answers without demanding manual agent involvement.

Varma

Serving Finland’s pension insurance market, Varma’s chatbot answers common queries and walks users through application steps in both Finnish and Swedish. It offers fast, accurate assistance across demographics, improving service accessibility without requiring live assistance for every interaction.

SWICA

IQ, SWICA’s digital assistant, helps customers make plan adjustments, update details, and request documents, all within a single chat session. There’s no need to navigate portals or call support. This self-help functionality improves experience while encouraging adoption of the insurer’s online tools.

How to Implement an Insurance Chatbot in 5 Steps

Creating such an application isn’t about dragging and dropping templates. This industry is too complex, too regulated, and too demanding for that. The most effective path is either a hybrid solution (mixing existing platforms with custom layers) or a fully customized tool that can handle compliance, integrations, and domain-specific workflows.

Choose the Right Partner

The first step is finding a development partner with proven expertise in insurance AI. Take Master of Code Global, for example: we’re not vendor-locked and have hands-on experience building both hybrid and fully bespoke solutions – some of which you’ll see in the examples above. We know the unique challenges insurers face, and we’re equipped to solve them. So if you already have a plan in mind, let’s discuss how to bring it to life.

Define Objectives and Success Metrics

Clear goals shape everything that follows. Decide whether your insurance chatbot should focus on lead generation, policy guidance, claims automation, or all of the above. At the same time, specify measurable results, such as reduced call center volume, faster claim resolution, or higher CSAT, to guide priorities and track ROI.

Design, Build, and Integrate

This stage combines conversation design, engineering, and system integration. The process starts with mapping conversational flows and training the bot on real queries to guarantee natural, accurate responses. From there, the assistant must be integrated with the needed systems to provide data access and minimize manual work for agents.

Deploy and Continuously Improve

Once live, monitor performance against your KPIs. Use analytics to identify where users drop off, which intents need refining, and how the bot impacts business outcomes. Ongoing updates, retraining, and feature enhancements ensure the solution evolves with new products, regulations, and customer expectations.

Future of Chatbots in Insurance

In the insurance chatbot market, multi-access customers have been growing the fastest in recent years. Every second client now falls into this category. This means that more and more people are interacting with their insurers through multiple channels which include online, mobile, and phone communication.

Chatbots increase sales and can help companies automate user conversations. This shift aligns with a broader trend – McKinsey reports that the COVID-19 pandemic drove a sharp rise in digital channel usage across all industries. Companies can keep these new clients by elevating their digital experiences and investing in assistants. Additionally, they can focus on placing customer trust at the center of everything they do. Also, the insurance AI chatbots market is growing rapidly, and it is expected to reach $4.5 billion by 2032.

Conclusion

Chatbots deliver a better experience for both customers and teams. They streamline processes, improve efficiency, and make it easier for agents and clients to quickly access the information they need – ultimately enhancing overall service quality. Virtual assistants have already proven their value in the insurance sector, so the real question is: what can chatbot be used for in your business?

At Master of Code Global, we provide professional chatbot development services that seamlessly integrate AI into your insurance operations. By automating repetitive tasks, we help your team save valuable time and resources while ensuring clients receive fast, accurate support. Our experts design bots tailored to your company’s specific needs, giving you a solution that enhances both customer satisfaction and operational efficiency.

FAQ

Q: How to use AI assistants for insurance?

Chatbot for insurance companies automates customer help, guides people through claims, answers policy questions, generates quotes, and assists with onboarding. These bots improve response times, reduce call volumes, and deliver consistent service across channels like web, mobile, and messaging apps.

Q: How many insurance companies use chatbots?

Adoption is growing rapidly, with more and more businesses integrating bots into different areas of user interaction – from underwriting support to claims automation. Both established carriers and digital-first providers are expanding their use of these solutions to streamline processes and enhance client experiences.

Q: How can bots help with policy renewals automatically?

Insurance AI chatbots send proactive reminders, confirm renewal intent, and process payments directly in the chat interface. They decrease missed renewals, enrich the customer experience, and facilitate cross-sell opportunities by suggesting policy upgrades at the right time.