Generative artificial intelligence is rapidly gaining traction across industries. Thus, the question isn’t “to be or not to be”; rather, it’s about when you will start utilizing Generative AI in finance. Current statistics indicate that institutions in this sector are leading in workforce exposure to potential automation. Challenges like legacy technology and talent shortages might temporarily hinder the adoption of digital tools. Yet, these are merely short-term obstacles. The conceivable benefits are too significant to ignore.

For instance, imagine your financial advisors struggling to keep up with client demands, leading to errors and delays. Consumers become frustrated and may consider taking their business elsewhere. Now, think of implementing a chatbot. With access to your data and research, this assistant gives quick and accurate advice to your team, providing faster, more reliable support services. This boost in efficiency keeps customers happy and your firm competitive.

Are you still unsure about using digital tools, or maybe just testing it in smaller ways without a clear enterprise AI development services strategy behind it?? Join us as we explore this article. We’ll uncover how the top applications of Generative AI for finance can solve the industry’s ten biggest bottlenecks for optimal safety and ROI.

- Generative AI and finance are shifting from pilots to core operational workflows such as order-to-cash, FP&A, record-to-report, and procure-to-pay.

- The primary value of Gen AI lies in workflow-level automation and intelligence, not isolated tools or point solutions.

- Financial institutions are using digital tools to improve efficiency, reduce costs, and accelerate decision-making across finance operations.

- Advanced Gen AI finance use cases enable real-time insights, forecasting, and scenario modeling, strengthening planning and risk management.

- Personalization at scale is emerging as a key differentiator for customer experience and advisory services.

- Responsible adoption depends on data quality, governance, explainability, and regulatory alignment.

- In 2026, domain-specific models, multimodal AI, and enterprise-grade deployments will define mature artificial intelligence adoption in finance.

Table of Contents

What Is Generative AI in Financial Services?

Gen AI refers to a class of artificial intelligence models capable of creating new content, insights, and recommendations based on large volumes of structured and unstructured financial data. Unlike traditional rule-based or predictive systems, it generates outputs such as text, summaries, scenarios, forecasts, code, or conversational responses that closely resemble human reasoning.

Gen AI for finance is typically powered by large language models (LLMs) and advanced machine learning architectures trained on financial documents, transaction data, market reports, regulations, and customer interactions. These models can understand context, interpret complex financial language, and respond dynamically to new inputs.

What makes artificial intelligence particularly valuable for such institutions is its ability to work across functions. It can support analysts by summarizing research reports, assist advisors with unique recommendations, help compliance teams interpret regulatory changes, and enable conversational interfaces for both employees and clients. Importantly, Gen AI operates as an augmentation layer, elevating human expertise rather than replacing it.

When implemented responsibly, with strong governance and security controls, Generative AI in finance becomes a powerful tool for improving efficiency, accuracy, and decision-making across banking, insurance, asset management, and fintech operations. It transforms how financial organizations process information, interact with customers, and respond to market complexity at scale.

Adoption Trends of Generative AI in Finance

Wall Street is no stranger to disruption, but GAI is sparking a revolution unlike any before. Customer needs are shifting, executives are making bold bets, and the room for transformation has dollar signs attached. Here’s the proof in numbers:

- According to Marqeta’s Consumer Pulse Report, 36% of consumers are interested in using Gen AI for personal finance, with that number exceeding 50% for individuals under 50.

- Gartner revealed that 80% of CFOs surveyed in 2022 plan to scale up AI spending in the next two years. Moreover, 72% of CEOs in the domain cite this technology’s funding as their top priority.

- As per MIT Technology Review, Gen AI implementation could lead to up to $340 billion in annual cost savings across the finserv industry.

- Organizations leveraging artificial intelligence report an 18% boost in customer satisfaction, productivity, and market share. Such investments offer an average return of $3.50 for every $1 spent.

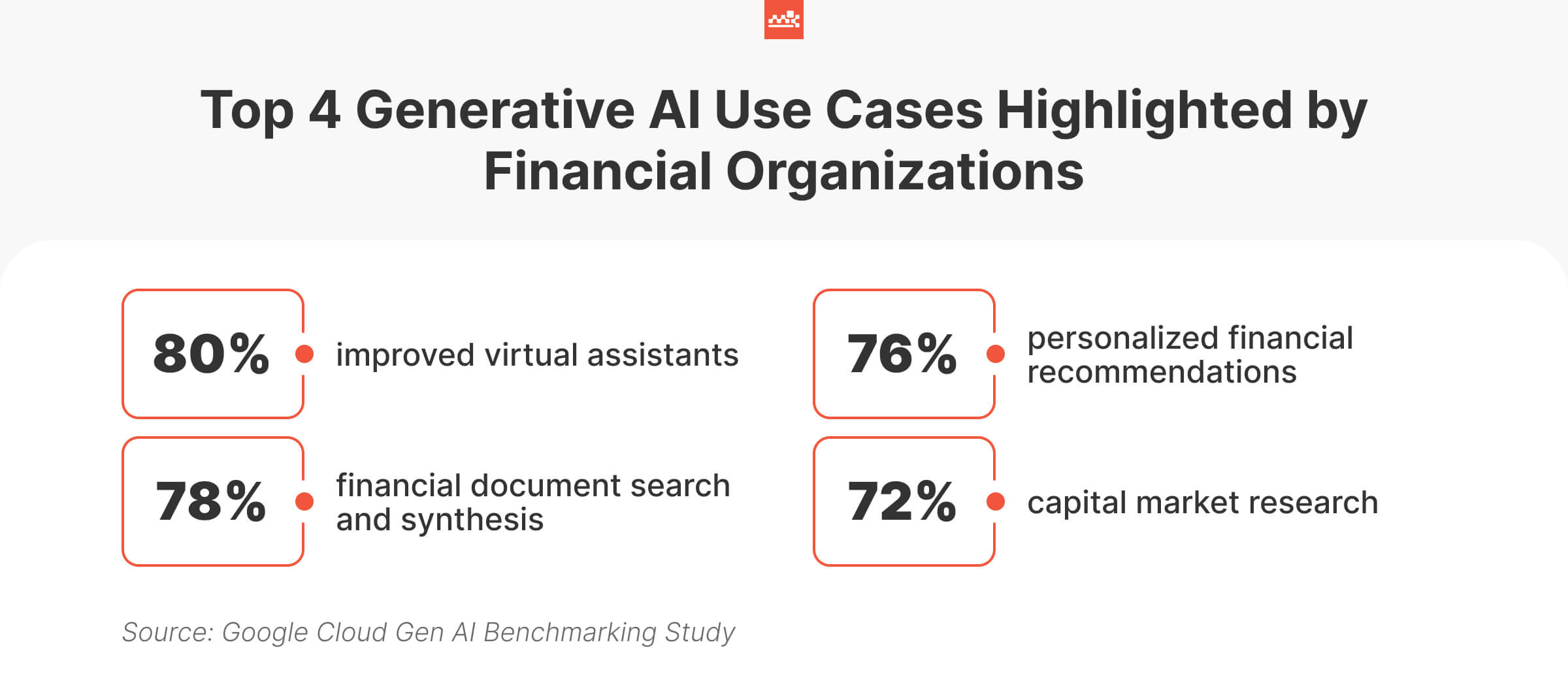

- Top GAI use cases in finance include improved virtual assistants (80%), financial document search (78%), personalized recommendations (76%), and capital market analysis (72%), along with the use of AI financial software to improve performance and decision-making.

These figures paint a clear picture: Generative AI across the financial landscape is poised to redefine the sector. It’s no longer a question of “if” but “how.” Let’s look into the forces accelerating this inevitable changeover.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

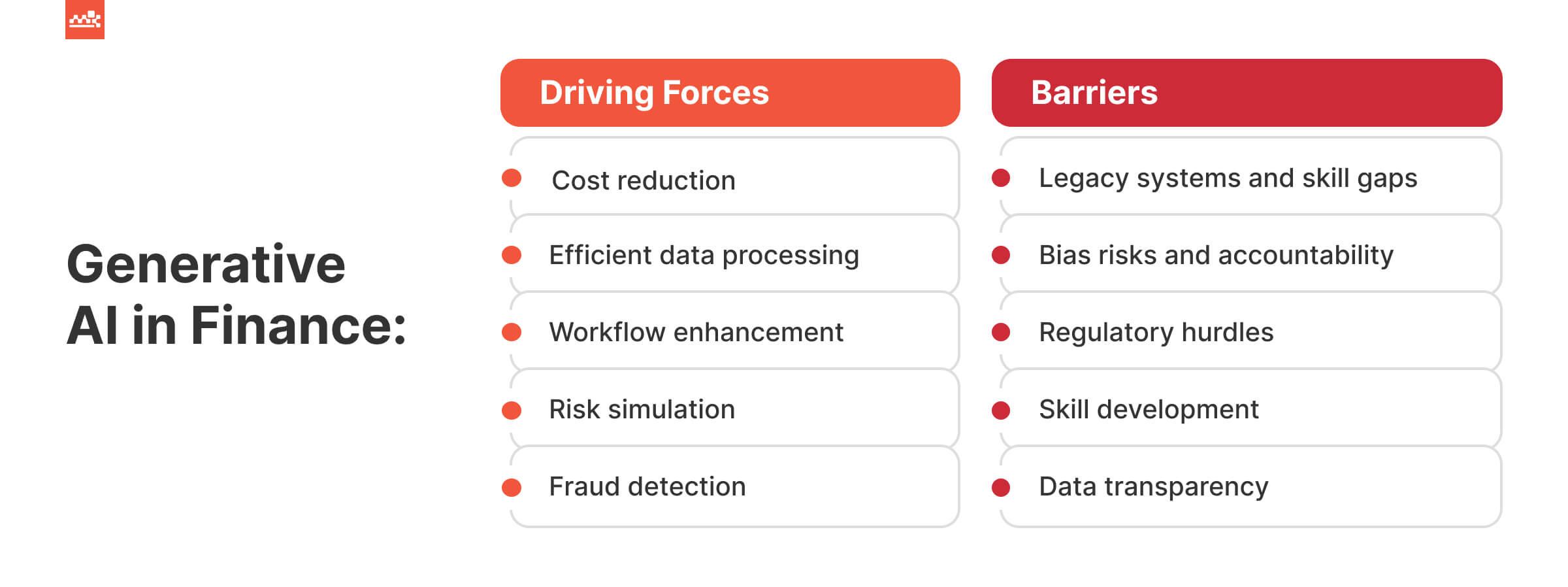

Factors Driving Adoption

Generative AI for financial services isn’t just another buzzword. Its incentives are tangible and far-reaching. Let’s analyze why this technology has already taken the sector by storm.

- Automating mundane tasks, freeing up valuable human resources, and slashing operational expenses.

- Extracting actionable tips from sophisticated data sources, unlocking new levels of analysis. Adding a layer of context and understanding to processes, optimizing operations.

- Significantly boosting productivity across the board through automation and insights.

- Enabling sophisticated “what-if” scenarios, empowering data-driven risk mitigation.

- Identifying anomalies and patterns invisible to the human eye, bolstering fraud prevention efforts.

- Meeting the growing demand for tailored financial services and elevating customer satisfaction.

The benefits of Gen AI are undeniable. Yet, as with any substantial force, there are obstacles along the path to widespread integration. Let’s delve into the facets that could slow down this momentum.

Potential Roadblocks

To maximize the ROI of Generative AI in finance, institutions must proactively address the following hurdles:

- Integrating with legacy technology and addressing the shortage of specialized talent.

- Offering the reliability and fairness of digital outputs, mitigating bias, and promoting ownership. Navigating regulatory complexities governing your solution deployment in critical finance functions.

- Overcoming skepticism and building trust in Gen AI among stakeholders.

- Adapting existing skill sets and developing new competencies for effective technology utilization. Avoiding overgeneralization based on limited data and balancing personalization with ethical considerations.

- Enforcing transparency and accountability throughout digital processes.

- Managing the limitations in training algorithms for nuanced financial analysis.

This is exactly where financial services AI consulting becomes essential — to align stakeholders, validate feasibility early, and make sure compliance and governance don’t slow down deployment.

Finance Workflows Impacted by Generative AI

Generative AI in finance is no longer limited to experimentation or isolated automation – AI agents in finance are increasingly embedded into end-to-end workflows. They are improving accuracy, speed, and decision-making across core operational processes. Below is how artificial intelligence reshapes the most critical workflows.

Generative AI for Order to Cash

Managing Sales Orders

Gen AI interprets unstructured inputs such as emails, contracts, and purchase orders to automatically validate, enrich, and create sales orders. It reduces manual data entry, flags inconsistencies, and provides alignment with pricing rules, contracts, and user terms.

Invoicing Customers

Generative models output accurate invoices by pulling data from orders, contracts, and delivery confirmations. They can adapt invoice formats to user-specific requirements, reduce billing errors, and explain details in natural language when customers or internal teams have questions.

Processing Accounts Receivable

AI assists in matching payments to invoices, resolving discrepancies, and explaining variances. By analyzing historical payment behavior, it can also prioritize follow-ups and predict late payments before they occur.

Managing and Processing Collections

Gen AI helps collections teams by crafting tailored outreach messages, summarizing account histories, and recommending optimal contact timing. This improves recovery rates while maintaining positive client relationships.

Managing and Processing Adjustments and Deductions

Revisions often involve complex reasoning across contracts, pricing, and delivery terms. Artificial intelligence can analyze supporting documents, propose root causes, and recommend resolution paths, significantly reducing cycle times.

Generative AI for Financial Planning and Analysis

Integrated Financial Planning

Gen AI models in finance connect financial, operational, and strategic data to create unified planning views. It helps align revenue, cost, and capacity assumptions across departments while explaining dependencies and trade-offs in plain language.

Planning and Budgeting

AI generates budget drafts, analyzes variances, and simulates alternative scenarios based on changing assumptions. This enables faster iterations and more informed decision-making during planning cycles.

Management and Performance Reporting

Gen AI technology for financial services automates narrative reporting by translating financial results into clear explanations for executives. It highlights drivers behind performance changes and surfaces risks or opportunities without manual analysis.

Forecasting and Modeling

By learning from historical trends and external signals, artificial intelligence improves forecast accuracy. It can continuously update models, generate “what-if” scenarios, and explain forecast changes as conditions evolve.

Generative AI for Record-to-Report

Processing Journal Entries

Gen AI assists in drafting accounting entries, validating classifications, and detecting anomalies. It can explain posting logic and support audit readiness by documenting assumptions and data sources.

Reconciling the General Ledger

AI accelerates alignments by matching transactions across systems, identifying exceptions, and suggesting corrective actions. This reduces close times and improves confidence in reported numbers.

Posting and Reconciling Intercompany Transactions

Generative AI systems in financial services help manage complex settlements by validating entries, resolving mismatches, and generating explanations for differences across entities and jurisdictions.

Performing Financial Reporting

Artificial intelligence sustains the preparation of financial statements by consolidating data, checking consistency, and generating narrative disclosures that align with regulatory and internal requirements.

Generative AI for Procure to Pay

Procuring Products and Services

Gen AI assists in drafting purchase requests, evaluating supplier proposals, and providing compliance with procurement policies. It can also summarize contracts and flag potential risks or unfavorable terms.

Processing Accounts Payable

Artificial intelligence automates invoice capture, validation, and matching against purchase orders and receipts. It resolves exceptions faster and gives clear explanations for discrepancies, reducing delays and manual effort.

Generative AI in Finance: Real Examples

Let’s now examine how Gen AI implementation in the financial industry helps companies across the globe gain a competitive advantage.

AI Architecture Audit for Asset Management

Master of Code Global was tasked with evaluating and improving the AI architecture of a leading asset management firm. We developed a tailored framework to analyze every component of their GenAI ecosystem, from data flow to security, making sure it could scale to meet future demands.

Our audit process included in-depth reviews, performance benchmarking, and stress testing, identifying 87% potential for performance improvement. Additionally, we uncovered 8 critical security vulnerabilities that were addressed before scaling. The result was a future-ready GenAI system with a projected capacity increase of 3x, making sure the architecture could handle growing demands while maintaining security and efficiency.

Microsoft AI FAQ Chatbot

Master of Code Global developed a Generative AI-powered knowledge assistant for a leading member-owned banking institution, utilizing Microsoft Power Automate’s AI capabilities. The tool connects to SharePoint libraries, document repositories, and knowledge bases, offering staff natural conversational access to critical information.

Trained in financial terminology, this assistant handles everything from policy lookups to complex regulatory inquiries, providing quick and accurate answers. Integrated within Teams, the institution’s existing collaboration platform, it offers seamless deployment without the need for additional tools or authentication systems. The result is a significant reduction in time spent searching for information, a decrease in internal support tickets, and a high user satisfaction rate with 93% of responses rated as accurate and helpful.

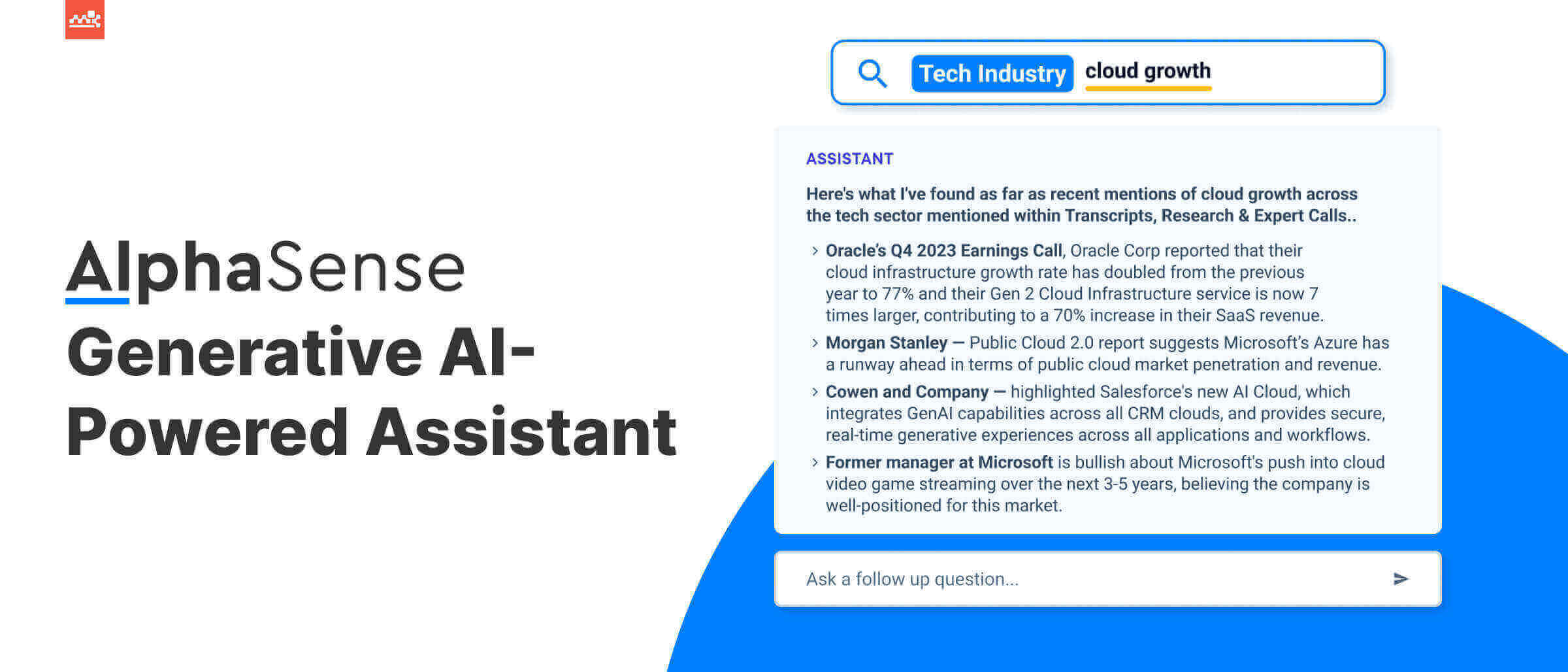

AlphaSense Assistant

AlphaSense platform recently unveiled its Assistant. This is a chat experience powered by Generative AI that aims to transform research for business and financial professionals. The tool taps into a vast library of documents to provide people with instant, accurate insights. Such capabilities significantly speed up the search for information.

The Assistant is built on AlphaSense’s own Large Language Model (ASLLM). It offers a conversational interface, simplifying the extraction of complex data. Users can explore investment opportunities or evaluate competitors, receiving precise, instantly verified answers. This development is a big step in AI for market intelligence promising more efficiency and accuracy in research.

TallierLT

Featurespace recently launched TallierLT, a groundbreaking innovation in the financial services industry. The tool represents the first Large Transaction Model (LTM) powered by Generative AI for payments. It aims to revamp how transactions are monitored, promising a significant leap in fraud detection. TallierLTM has proven to be remarkably effective, showing up to 71% improvement in identifying fraudulent activities over existing models.

It has been trained on a vast array of data across different markets. This aspect makes the model adept at spotting complex deceptive patterns previously undetectable. Thus, professionals get a powerful tool to fight against sophisticated financial crimes. By utilizing Gen AI, TallierLTM is set to make the systems safer and more secure for consumers worldwide.

AI @ Morgan Stanley Assistant

Morgan Stanley is setting a new standard on Wall Street with its digital assistant, developed in partnership with OpenAI. This instrument grants financial advisors quick access to a vast repository of around 100,000 research reports. Designed to interpret and respond to queries in complete sentences, it closely mirrors human interaction, thereby enriching the user experience.

Such capabilities not only simplify the retrieval of information but also significantly elevate client service efficiency. It is a testament to Morgan Stanley’s commitment to embracing Generative AI in banking. Furthermore, the company also positions itself as a leader in the industry’s technological evolution.

ZAML Platform

To expand credit accessibility, ZestFinance has launched its ZAML Platform. It targets a pivotal issue: underwriting for millennials and others lacking credit history. By integrating AI, this platform scrutinizes a broad spectrum of non-traditional data, from online behavior to how applicants interact with forms.

With the platform’s help, lenders can promise higher approval rates for these underserved groups. Thus, ZAML’s distinctive approach paves the way for more inclusive financial practices. At the same time, the solution aligns with regulatory standards through its transparent data modeling explanations.

10 Most Popular Gen AI Use Cases in Finance

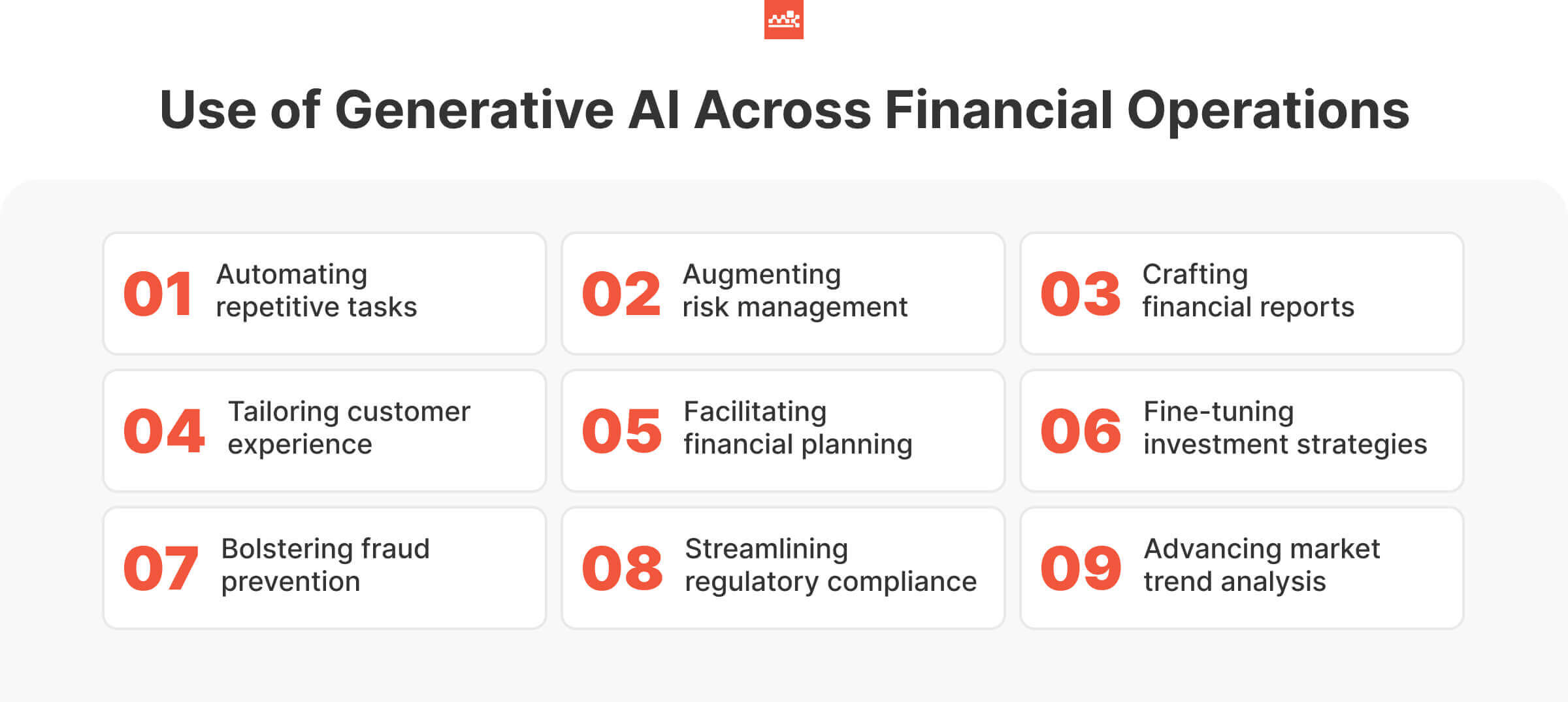

McKinsey’s research illuminates the broad capability of artificial intelligence, identifying 63 applications across multiple business functions. Let’s examine how this technology addresses the finance sector’s unique needs within 10 top Generative AI finance use cases.

Automating Repetitive Tasks and Improving Efficiency

Problem. The need to handle redundant and time-consuming duties, such as manually entering data, and summarizing lengthy papers. These tasks divert focus from higher-value activities.

Solution. The use of Gen AI in financial markets can refine workload by:

- Identifying relevant information from various formats and accurately populating databases or spreadsheets.

- Condensing financial papers, news articles, or regulatory documents into digestible summaries, highlighting key points and trends.

- Translating intricate industry-specific jargon into plain language, making knowledge more accessible to a wider audience.

Impact. AI frees up professionals to concentrate on more strategic initiatives that require critical thinking and analysis. It also leads to faster turnaround times, boosted performance across operations, and a profound understanding of complex financial details.

Enhancing Risk Management and Assessment

Problem. Vulnerability evaluation within the sector remains a complex, nuanced process. Traditional methods often rely on limited historical records or manual research, potentially leading to inaccurate predictions and missed red flags.

Solution. Generative AI solutions in financial services improve the procedure by:

- Synthesizing realistic data to augment training datasets for machine learning models.

- Simulating various scenarios to stress-test financial prototypes and identify probable vulnerabilities.

- Analyzing diverse resources to uncover hidden hazard factors and provide an exhaustive pitfall breakdown.

Impact. The use of technology leads to more informed decision-making, reducing possible losses for institutions. Timely identification of emerging risks enables proactive mitigation strategies.

Generating Financial Documentation and Analysis

Problem. Creating accurate and insightful financial reports is a labor-intensive, time-consuming process. Analysts must gather data from various sources, perform complex calculations, and craft digestible narratives, often under strict deadlines.

Solution. With generative technologies companies can:

- Assemble records from multiple datasets, automatically generating papers with tailored insights and visualizations.

- Conduct routine computations, reconciliations, and consolidations, delivering mathematical precision.

- Draft periodic management docs, both in numerical and narrative form, highlighting trends or anomalies.

Impact. Integrating GAI for report generation frees up expert’s time for strategic analysis, reduces errors for greater accuracy, and accelerates the identification of key recommendations for boosting agility.

Personalizing Customer Experiences and Services

Problem. Buyers increasingly demand tailored digital journeys and customized offers, posing a challenge for businesses with limited resources and traditional approaches.

Solution. With intelligent technologies, companies become capable of:

- Analyzing user data to generate unique suggestions for investment portfolios, financial products, and services.

- Powering finance AI chatbot that engages in natural language conversations, understands intricate queries, and provides context-aware, helpful responses to consumers 24/7.

- Assisting support agents by finding relevant information, summarizing escalated cases, and suggesting approaches, eventually optimizing problem resolution.

Impact. Such innovations significantly improve client journey through curated advice and proactive assistance. This leads to greater engagement and loyalty. Ultimately, financial settings gain a competitive edge by offering a superior CX.

Assisting in Financial Planning and Advisory Services

Problem. Every client has distinctive goals, risk profiles, and life circumstances. Traditional planning tools struggle to give truly tailored recommendations, potentially resulting in generic advice that fails to fully consider individual necessities.

Solution. GAI assists experts by:

- Analyzing extensive customer data to understand their unique profile, objectives, and preferences.

- Generating hyper-personalized suggestions for investment strategies, retirement plans, and tax optimization.

- Simulating scenarios and providing clear visualizations to illustrate possible outcomes of different decisions.

Impact. Gen AI-powered advising leads to greater consumer satisfaction, stronger advisor-client relationships, and increased confidence in suggested decision-making guides.

Enhancing Fraud Detection and Prevention

Problem. Fraudulent activities continually evolve, making it challenging for traditional monitoring systems to keep pace. This leaves financial service providers vulnerable to monetary losses and undermines customer trust.

Solution. GAI boosts fraud defense measures by:

- Creating mock data that mimics scheming patterns, fine-tuning the training and robustness of detection algorithms.

- Analyzing transactions in real-time to identify anomalies and suspicious movement, enabling swift labeling of potential scams.

- Automating the flagging of illegal activities, reducing the burden on involved employees, and refining the investigative process.

Impact. Fraud management powered by AI raises security standards, safeguards client assets, strengthens brand image, and reduces the operational strain on the investigation teams.

Optimizing Investment Strategies and Portfolio Management

Problem. Conventional investment techniques often rely on historical data, limiting their adaptability to rapidly changing market conditions and potentially hindering optimal returns.

Solution. When specialists integrate Gen AI into finance operations, it helps them to:

- Analyze vast amounts of market data, including alternative sources like news and social sentiment, to identify trends and trading signals unseen by traditional methods.

- Generate insights to inform tailored portfolio construction and asset allocation, constantly aligning with a client’s risk profile, goals, and evolving industry demands.

- Continuously adapt approaches in real-time based on market fluctuations, maximizing ROI.

Impact. GenAI in finance encourages more data-driven decision-making, future-proofing the business for global shifts, the discovery of untapped opportunities, and ultimately, greater profitability for both the financial institution and its clients.

Streamlining Compliance, Regulation and Reporting

Problem. The finance industry faces a complex and ever-evolving legislative environment. Old-school adherence methods are time-consuming, prone to error, and carry the threat of costly fines.

Solution. AI models assist with:

- Generating realistic synthetic data for robust testing of systems in controlled environments, minimizing real-world risks.

- Analyzing large volumes of information to proactively identify potential compliance issues and generate regulatory reports, reducing manual effort.

- Continuously monitoring transactions and flagging possible violations for swift corrective action.

Impact. Better accuracy, increased efficiency, and reduced risk of non-compliance penalties save financial institutions resources and protect their reputation.

Improving Market Trend Analysis and Predictions

Problem. Financial markets are in constant flux, and traditional appraisal methods lag behind, leaving investors vulnerable to missed possibilities.

Solution. Generative AI simulates market scenarios, stress-testing strategies, and uncovering potential risks and opportunities before they materialize.

Impact. GAI enables businesses to capitalize on industry shifts with agility, maximizing returns and outpacing competitors.

Code Generation and System Optimization

Problem. Financial institutions operate complex, often fragmented IT environments. Maintaining, optimizing, and modernizing legacy systems is time-consuming, costly, and heavily dependent on scarce engineering talent.

Solution. Generative AI assists engineering and IT teams by:

- Automatically generating and refactoring code for internal finance applications, integrations, and data pipelines.

- Assisting with system optimization by identifying performance bottlenecks, redundant logic, and inefficient queries.

- Translating business or compliance requirements into technical specifications and executable code snippets.

- Supporting legacy system modernization by explaining existing codebases and accelerating migration to newer architectures.

Impact. Gen AI-driven code generation accelerates development cycles, reduces technical debt, and improves system performance. As a result, financial institutions gain more resilient, scalable platforms while lowering maintenance costs and dependency on manual engineering effort.

Generative AI in Financial Services: Roadmap to Implementation

Now that we know what business value the technology proposes, it’s time to move on to discussing the strategies to manage the challenges we identified initially. At Master of Code Global, as one of the leaders in Generative AI development solutions, we have extensive expertise in deploying such projects.

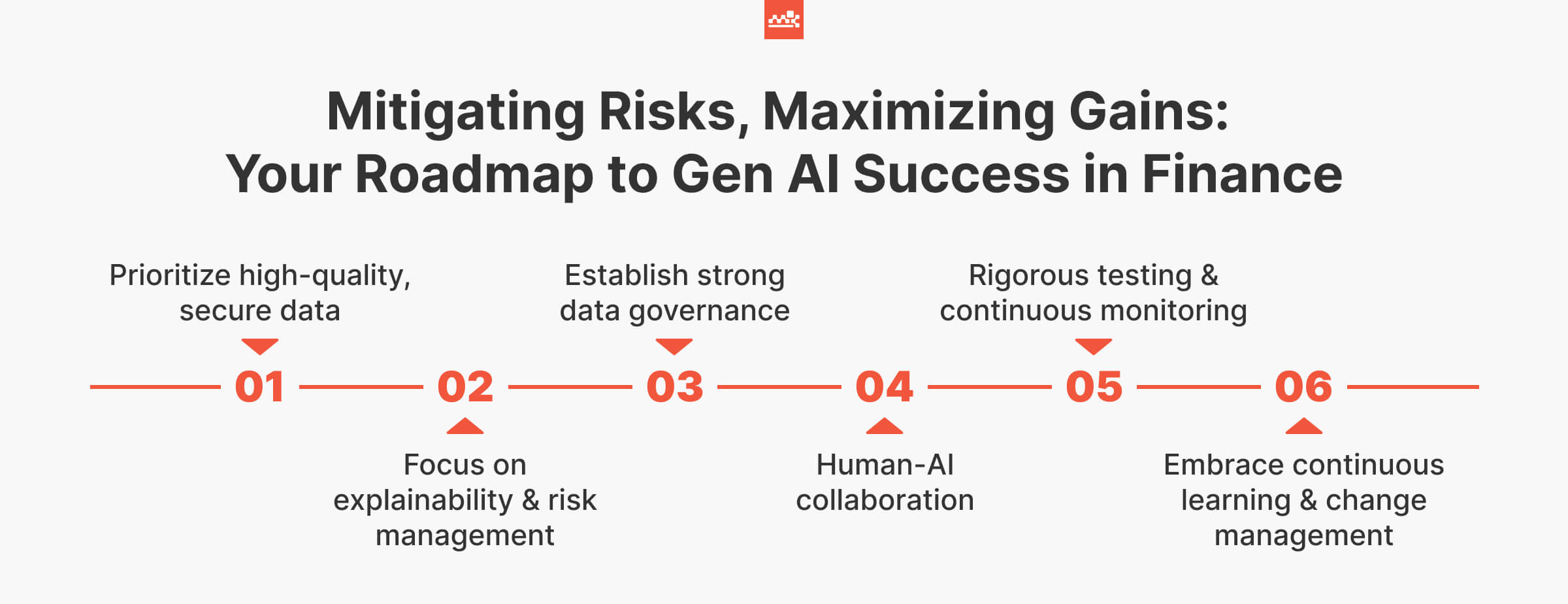

Based on our experience, we’ve curated a list of practical tips you can use to get the best out of generative AI for finance:

- Prioritize high-quality, secure data. Digital models are only as good as the data they are trained on. Invest in collecting and maintaining accurate, well-structured datasets. Furthermore, collaborate with reputable vendors to give the highest level of security for your financial information.

- Focus on explainability & risk management. Choose models that provide some insight into their decision-making processes and establish comprehensive threat control frameworks specifically designed for AI-powered applications. This will promote trust and help mitigate any potential negative consequences.

- Establish strong data governance. Develop clear policies for ethical AI use, responsible records handling, and compliance with the complex regulatory landscape of the financial sector. Robust oversight will offer data integrity and minimize the chance of misuse.

- Human-AI collaboration. Clearly outline the roles and responsibilities for both human expertise and automation, guaranteeing proper supervision and accountability. This is especially important in critical decision-making scenarios.

- Rigorous testing & continuous monitoring. Before deploying digital solutions, conduct thorough testing to identify potential biases or errors. Once in production, actively monitor performance to adapt models and address issues as they arise.

- Stakeholder engagement & feedback. Seek input from end-users and stakeholders throughout the development and implementation process. These insights foster trust, improve model accuracy, and make sure that the tool aligns with your strategic objectives.

- Embrace continuous learning & change management. The field of AI is constantly evolving. Foster a culture of innovation within your organization and provide adequate support and training for employees as workflows adapt to incorporate digital solutions.

Benefits of Generative AI in Finance

Better Operational Efficiency

Artificial intelligence automates repetitive, time-intensive tasks such as data entry, document processing, reconciliations, and reporting. By reducing manual effort and errors, finance teams can accelerate core processes, shorten cycle times, and focus on higher-value strategic activities.

Improved Customer Experience

Intelligent virtual assistants, tailored insights, and proactive support help financial institutions deliver consistent, high-quality service while reducing response times and friction. This way, Gen AI enables faster, more accurate responses across client touchpoints.

Cost Savings

Automation and smarter workflows lead to lower operational costs. AI reduces dependency on manual processing, minimizes rework caused by errors, and improves resource allocation across finance functions.

Improved Decision-Making

By synthesizing large volumes of financial and contextual data, Gen AI surfaces insights that might otherwise go unnoticed. This supports more informed, timely decisions across risk management, forecasting, and strategic planning.

Personalization at Scale

Digital tools allow financial institutions to tailor products, recommendations, and communications to individual customers without increasing operational complexity, driving engagement and long-term loyalty.

Gen AI Limitations in Financial Services

While powerful, Generative AI has important constraints that financial institutions must account for:

- Risk of inaccurate outputs when models rely on incomplete, biased, or outdated data

- Limited reasoning and contextual judgment, requiring human oversight for critical financial decisions

- Data privacy and security concerns, especially when processing sensitive or regulated information

- Regulatory and compliance challenges tied to transparency, explainability, and auditability

- Integration complexity when deploying Gen AI within legacy financial systems

Addressing these limitations through governance, validation, and human-in-the-loop controls is essential for safe and scalable adoption. With deep hands-on expertise, we help organizations implement these safeguards correctly, so AI delivers value without introducing any risks.

Challenges, Risks, and Opportunities of Gen AI in Finance

Data Integrity & Privacy

Gen AI systems rely on vast datasets, making data quality, governance, and privacy critical. Poor integrity can compromise outputs, while mishandled sensitive information increases regulatory and reputational risk. Strong controls also create an opportunity to build trusted, compliant foundations.

Systemic Risk & Opacity

Complex models might introduce constant threat if their behavior is not fully explainable. However, institutions that invest in transparency, monitoring, and human oversight can turn this into a competitive advantage through safer, more reliable AI adoption.

High Energy Costs

Training and running large models is often resource-intensive. Optimizing architectures and deployment strategies helps control costs while supporting sustainable, scalable AI use.

Future of Gen AI in Financial Services and Emerging 2026 Industry Trends

The evolution of Generative AI is accelerating from experimentation to enterprise-wide impact. In 2026, key trends shaping adoption include:

- Deeper integration into core finance systems, moving Gen AI beyond pilots into mission-critical workflows;

- Rise of domain-specific financial models trained on regulated, institution-grade data;

- Stronger emphasis on explainability, auditability, and governance to meet regulatory expectations;

- Growth of multimodal AI, combining text, numerical data, and voice for richer insights and interactions;

- Focus on energy-efficient and private deployments to address sustainability, cost, and security concerns.

Together, these trends mark a shift toward mature, scalable, and responsible Gen AI adoption in finance.

Overall, implementing Generative AI in financial services presents unique challenges, but the rewards are worth the effort. Our finance chatbot development company can partner with you to develop strategies that tackle any difficulties, enabling you to reap the transformative benefits of Gen AI.

Contact Master of Code Global today and let’s explore how our customized solutions can revolutionize your financial operations.