Here’s a number that should catch the attention of any finance leader: custom AI voice agents for banking can help achieve a 79% first-call resolution rate and, as a result, cut call center volume by 26%. These aren’t just mystery numbers but a real success story of our client.

How does this translate to your bank? In fact, this is all about winning or losing a customer in a single, critical moment.

Picture Natalie. It’s 10 PM on Sunday, and she spots a transaction on her account she doesn’t recognize. A knot of anxiety forms. She opens her banking app, looking for a quick answer. Instead, she hits a wall. The contact center is closed. The generic chatbot offers a list of irrelevant FAQs. Her simple question goes unanswered, and her anxiety turns into frustration.

This isn’t just a minor inconvenience. For Natalie, it’s a genuinely bad experience. According to Zendesk, three in four consumers say an interaction like this can ruin their entire day, and over 50% feel stressed and exhausted when dealing with support teams.

This was Natalie’s first truly bad experience with your bank. Research from Coveo shows it only takes two negative experiences for a customer to abandon a brand forever. Are you willing to risk her having a second?

This is where conversational banking steps in as an intelligent solution to everyday business problems. It is the loyalty engine designed to win such critical moments. It’s a strategy that transforms customer friction into lasting trust, turning a moment of panic into proof that you have their back.

So, how does this engine work, and how can you build it before your competitors do? Read to the end to uncover all the hidden pitfalls, get proven strategies and win your clients’ hearts.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Table of Contents

What is Conversational Banking, Really?

At its core, the concept is simple: it’s when your customers can talk or text with your bank in plain, everyday language to get things done.

Think of it this way. Your current mobile app and website are like a detailed city map. They have all the information, but the client has to do the work of finding their own route. Conversational banking is like giving them a personal driver. They just say where they want to go, and the driver navigates all the complexity for them, taking them directly to their destination.

This isn’t just another chatbot from five years ago. It’s powered by smart technology (AI) that’s trained to understand what people mean, not just the keywords they type. Crucially, it remembers the context of the conversation, so customers never have to repeat themselves.

The results are tangible. After implementing Conversational AI, Federal Bank reported a staggering 98% response accuracy and saw satisfaction jump by 25%. They handled 133% more issues while projecting a 50% reduction in support costs. It’s a clear win-win.

10 Core Banking AI Use Cases for Your New Operational Blueprint

This isn’t a distant future trend; it’s happening now. Our partner, Infobip, conducted an analysis of over 530 billion interactions in 2024. It shows a massive surge in customers messaging financial institutions – up 70% in North America, 77% in the Middle East, and 28% in Europe. Your clients are already trying to have these conversations. Here’s how you can start answering them: learn from 10 Conversational AI use cases in banking we selected for your business.

1. 24/7 Customer Support & Self-Service

Your clients’ anxiety doesn’t clock out at 5 PM. A simple question about a card fee left unanswered overnight can erode trust. Instead of forcing people to wait for business hours, Conversational AI in banking provides instant, accurate answers to hundreds of common questions around the clock. The customer feels secure and in control, while the bank reduces its morning call queue, freeing up human agents for more complex work.

2. Seamless Transactional Assistance

Even simple actions like paying a bill or moving money can involve multiple taps and screens. Artificial intelligence turns these multi-step processes into a single command. Your user can simply say or type, “Pay my $75 credit card bill from my checking account,” and the system confirms the details and executes the transaction securely. Banking begins to feel as effortless as sending a text message.

3. Secure Customer Onboarding & Identity Verification (ID&V)

Lengthy sign-up forms are a primary reason potential clients abandon the process. Conversational banking transforms onboarding into a guided, interactive experience. It asks for information one piece at a time and can prompt the user to upload a photo of their ID directly in the chat. This drastically improves completion rates and makes a welcoming first impression.

4. Guided Loan & Product Applications

Applying for a mortgage or loan is intimidating. The forms are long, the terminology is confusing, and finance clients often stop if they hit a roadblock. AI acts as a personal guide, walking the user through the application step-by-step and answering questions like “What is an APR?” in real time. This reduces application abandonment and results in higher quality submissions.

5. Personalized Financial Advice & Guidance

By analyzing transaction history (with permission), conversational banking solutions are able to offer truly tailored insights. It can notice a customer is saving for a trip and suggest a travel-friendly credit card, or see they’re paying high interest on a loan and explain refinancing options. We all know that generic advice rarely resonates. This is critical, as 70% of people now expect this level of contextual understanding, transforming the bank from a service to a valued partner.

6. Real-Time Fraud Detection & Security

Discovering fraud hours or days after it happens is a nightmare. An AI-driven tool monitors for suspicious activity and sends an instant, interactive alert like, “We just saw a $300 charge in another country. Was this you?” A simple “No” from the customer can instantly freeze the card and initiate a fraud case. Modern smart systems achieve detection rates up to 94%, stopping crime before it escalates and proving to users you are proactively protecting them.

7. Empowering Agents with AI

When a client does need a human, Conversational AI in banking acts as a “copilot.” Before the call is even connected, it has authenticated the user and summarized their issue for the manager. This eliminates frustrating repetition for the client and allows the agent to solve the problem faster. It’s no surprise that support teams using these tools are 20% more likely to feel empowered in their roles.

8. Cross-Sell, Upsell & Retention

Traditional cross-selling often can feel like spam. This is where intelligent tools come to the rescue, identifying genuine needs from the individual’s context. If someone asks about international wire fees multiple times, the virtual assistant can gently suggest an account designed for global transactions. The offer is relevant and timely, coming across as good service, not a pushy sales tactic.

9. Championing Accessibility & Inclusion

Conversational banking with its digitalization can be a barrier for people with visual impairments, motor disabilities, or those who are less tech-savvy. Voice-first interaction allows these users to bank simply by speaking. Furthermore, multilingual capabilities mean the organisation can serve diverse communities without needing to staff a specialized, 24/7 contact center for each language. In fact, voice AI in banking is a powerful solution for a great number of inclusivity and accessibility challenges organizations face daily.

10. Data-Driven Business Intelligence

AI turns every interaction into a valuable data point. This is incredibly relevant for customer feedback, which is often hidden in surveys or siloed call logs. By analyzing thousands of chats, the financial institution can spot trends in real-time. If hundreds of people suddenly start asking about a specific fee, it signals a confusing policy that needs to be fixed. This data becomes a goldmine for making smarter strategic decisions.

Read also: How to Future-Proof Your Communication Strategy with Сonversational AI in Debt Collection

15 Real-World Conversational Banking Examples

Seeing is believing. The true power of conversational banking comes to life when you see how financial institutions are using it to solve real-world problems. From global giants to nimble fintechs. Let’s explore the most showcasing examples and learn how the versatility and impact of technology help reach different business goals.

1. Microsoft-Native AI FAQ Chatbot

What It Is: An intelligent AI-powered knowledge assistant developed by Master of Code Global for a leading member-owned banking institution. Integrated into Microsoft Teams, this solution allows staff to access important policy information and answer regulatory inquiries through natural, conversational dialogue, streamlining workflows and enhancing internal efficiency.

Takeaway: This solution combines seamless AI integration with Microsoft’s existing collaboration platform, allowing the bank to improve both staff productivity and internal service quality. It’s an efficient internal tool that automates common queries, making the process faster, easier, and more reliable.

The Results:

- 85% reduction in time spent searching for policy information

- 42% decrease in internal support tickets related to procedure questions

- 93% of AI responses rated as accurate and helpful

2. Voice AI Agent for Financial Services

What It Is: A sophisticated Voice AI solution, built by Master of Code Global, that automates credit account inquiries for financial institutions. This intelligent agent handles everything from transaction processing and account updates to authentication, all through natural voice interactions. Designed to integrate seamlessly with core banking systems, it provides a secure and efficient service for both customers and financial institutions.

Takeaway: This innovative solution empowers institutions to manage over 156,000 calls per month, cutting costs and enhancing customer satisfaction. By automating routine inquiries, it improves security and reduces the need for human intervention, streamlining operations without compromising quality.

The Results:

- $7.7M annual savings in operational expenses

- 94% first-call resolution rate for routine inquiries

- 88% customer satisfaction rating for Voice AI interactions

3. Bank of America – Erica

What It Is: A sophisticated AI virtual assistant that provides 24/7 personalized service for transactions, budgeting, and financial advice to millions of consumers.

Takeaway: Erica demonstrates a powerful dual-value strategy, serving as an external, customer-facing tool while also functioning as an internal “Erica for Employees” platform – a real AI copilot for banking executives.

The Results:

- Over 1 billion user interactions since launch.

- 50% reduction in IT service desk calls thanks to the internal version.

- Now used by over 90% of the bank’s employees.

4. bunq – Finn

What It Is: An AI conversational banking agent launched by the challenger bank bunq to automate customer service and personal finance tasks.

Takeaways: Finn is a critical lesson in what not to do. The product was pulled after significant user backlash due to a poor, frustrating experience, proving that raw AI intelligence is useless without thoughtful, client-centric design.

The Result: A valuable industry case study on the importance of prioritizing usability and clarity above all else in a user-facing AI.

5. Cleo

What It Is: A chatbot-led fintech that uses a distinctive, humorous personality to deliver spending advice and budgeting help.

Takeaways: Cleo proves that brand voice is a powerful tool for engagement. By making finance more approachable and fun, they have successfully captured the attention of millions of younger users (Millennials and Gen Z) who might be turned off by traditional strategies.

The Result: High, ongoing user engagement and a loyal community built around a unique, personality-driven conversational banking brand.

6. N26

What It Is: A global digital bank that uses multilingual Conversational AI to provide efficient customer service.

Takeaways: N26 offers a clear blueprint for sustainable international growth. By using AI to handle support in multiple languages, they can scale their user base across new regions without a proportional increase in human staffing costs.

The Result: A scalable and cost-effective model that supports rapid global expansion.

7. HSBC

What It Is: An implementation of conversational banking that goes beyond simple FAQs to address complex, high-value financial tasks.

Takeaways: HSBC demonstrates the maturity of AI technology. It can be trusted to assist with sophisticated queries, provide investment information, and manage fraud alerts, elevating the digital channel into a hub for substantive financial guidance.

The Result: Expanded digital service capabilities and documented operational efficiencies in high-value business areas.

8. FirstBank

What It Is: A strategy that leverages simple, accessible SMS-based chat services to keep customers informed.

Takeaways: This approach proves that conversational banking doesn’t always require a flashy app. Given that SMS accounts for over 70% of all bank-to-client messaging, FirstBank’s strategy ensures that critical, real-time updates reach the widest possible audience reliably.

The Result: High-accessibility engagement and informed people, using a channel that is nearly universal.

9. Belfius (Belgium)

What It Is: A chatbot designed to digitize and automate the insurance claims process.

Takeaways: Belfius provides a crystal-clear return on investment (ROI) story. By targeting a specific, high-friction business process, they were able to use AI to make it significantly faster and more efficient for both the customer and the bank.

The Result: Hundreds of staff hours saved and a significant improvement in conversion rates for insurance claims.

10. Argenta Group

What It Is: A customer service banking chatbot rolled out to handle common questions and simplify support interactions.

Takeaways: This example shows a direct and positive link between implementing Conversational AI and improving client happiness. By providing instant answers and reducing friction, Argenta made a measurable impact on how the audience perceives the bank.

The Result: A significant boost in user satisfaction and Net Promoter Scores (NPS) after the chatbot was deployed.

11. Nets (Europe)

What It Is: A Conversational AI in banking system used for real-time payment verification and fraud prevention across a massive network.

Takeaways: Nets showcases the critical role of innovative tech in security. Using instant, interactive messaging to confirm suspicious transactions allows them to stop fraud before it happens, building a deep sense of trust and safety with users.

The Result: A documented reduction in fraud incidents and improved trust, powered by real-time communication.

12. Nationwide (UK)

What It Is: A proactive messaging strategy that uses conversational banking to engage with members during periods of economic volatility.

Takeaways: Nationwide proves that communication is a key tool for building loyalty. By keeping people informed and supported during uncertain times, they strengthen the customer relationship when it matters most.

The Result: Higher engagement and enhanced brand trust, confirmed by feedback studies.

13. Commonwealth Bank of Australia – Ceba

What It Is: A powerful virtual assistant capable of driving over 200 distinct banking tasks for both service consumers and employees.

Takeaways: The sheer scale of Ceba is a testament to the power of deep automation. It illustrates how a virtual assistant can become a core part of a bank’s operations, handling hundreds of thousands of conversations daily.

The Result: A large-scale, highly integrated AI that delivers efficiency across the entire organization.

14. Galileo – Cyberbank Konecta

What It Is: A conversational banking platform that integrates chat data directly into the company’s CRM system.

Takeaways: This example highlights that a conversation shouldn’t be a dead end. By feeding interaction data back into the CRM, Galileo gives its staff a richer, more complete picture of each individual, turning every chat into valuable business intelligence.

The Result: Improved staff awareness and more personalized service, driven by data captured from conversations.

15. Lendesk – Spotlight AI Assistant

What It Is: An AI assistant designed specifically for mortgage brokers to help them with document checks and client communication.

Takeaways: Lendesk demonstrates that conversational banking is a powerful tool for specialists, not just consumers. This B2B use case shows how the tech can streamline complex professional workflows, reduce tedious paperwork, and make experts faster and more effective at their jobs.

The Result: Optimized workflow speed and accuracy for mortgage professionals.

What Tangible Business Benefits to Expect in Banking

Theory is one thing, but tangible results are what truly matter. While many articles quote generic, third-party industry reports, we believe in showing, not just telling. The following benefits are grounded in the real-world success stories of the fintech leaders and financial institutions we’ve worked with. These are the actual numbers our clients have achieved, offering a clear, honest look at the practical, ground-level impact conversational banking can have on your operations, your consumer relationships, and your bottom line.

1. A Better Customer Experience

When people get what they need instantly, without navigating confusing menus or waiting on hold, they feel genuinely seen and valued. This shift from transactional service to a supportive partnership is the foundation of modern loyalty, creating an experience that people actively appreciate rather than simply tolerate.

2. Lower Operational Costs

Every simple, repetitive question that is expertly handled by AI copilots for banking is one less call your support center has to manage. This frees your highly-trained staff from routine work, allowing them to focus their expertise on complex, high-value problems where a human touch is essential. It’s a strategic reallocation of your most valuable resource: your people.

3. More Revenue & Higher Customer Value

Intelligent conversations naturally uncover user needs in a way that feels organic, not invasive. This allows you to offer the right product at precisely the right time, making the suggestion feel like helpful advice rather than a sales pitch. As a result, you witness higher trust and dramatically improved effectiveness of your marketing efforts.

4. Stronger Security and Compliance

In a highly regulated industry, Conversational AI in banking ensures clear and timely communication, which is non-negotiable. Automating identity checks and sending critical notifications through a reliable, trackable channel creates a secure and auditable trail. This not only protects the user but also simplifies regulatory reporting and mitigates compliance risk.

5. The Ability to Scale and Innovate

What happens when there’s a sudden surge in financial consumer questions during a market shift or a service update? With conversational banking in place, you can handle the spike in volume instantly without the cost and delay of hiring and training temporary staff. This builds operational agility and creates a flexible foundation for future growth and innovation.

6. A Shift to Proactive Support

The best service solves a problem before the client is even aware one exists. A conversational banking agent can spot potential issues – like a low balance before a large payment is due – and send a timely, helpful nudge. This changes the entire dynamic of the customer relationship from reactive problem-solving to proactive partnership.

Proof from Master of Code Global: This approach doesn’t only prevent problems, but resolves them at unprecedented speed. The mentioned above company saw this firsthand, achieving a 300% faster average issue resolution time with their new RCS tool.

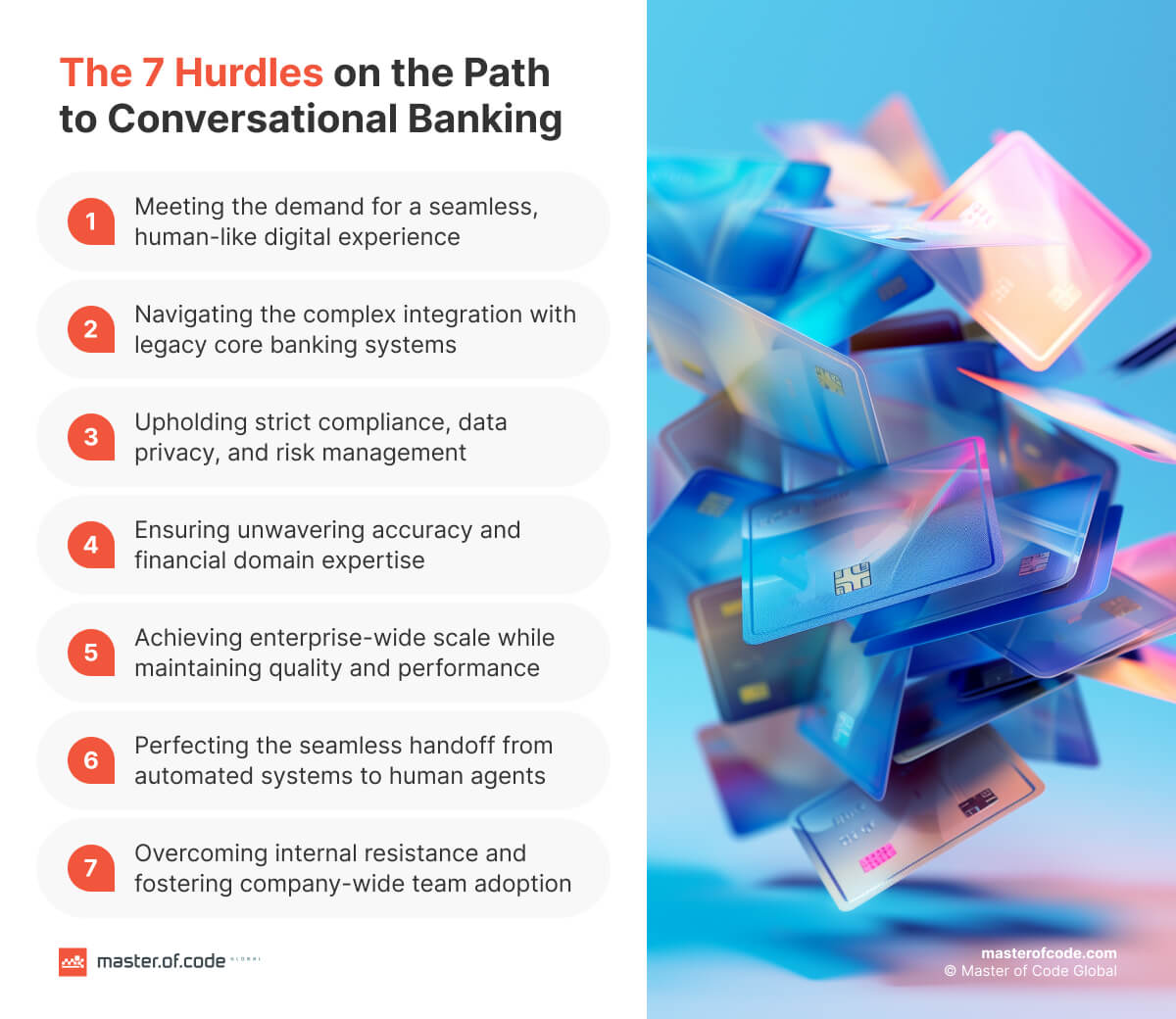

7 Challenges You Should Be Prepared For

The destination is clear: a bank that feels like a helpful, intelligent partner. But getting there isn’t magic. It’s a serious project with real hurdles that can trip up even the most ambitious teams. Without expert banking AI consultants it’s easy to take the wrong step. Acknowledging pitfalls upfront isn’t a sign of weakness. It’s the foundation of a successful strategy. Here are the seven challenges you need to anticipate and solve.

1. Rising Customer Expectations

Today’s users have already interacted with sophisticated language models. They definitely know what a good digital conversation feels like. The bar is set incredibly high. They will not tolerate a clunky, robotic system that misunderstands them, which means a bad experience can be more damaging to your brand’s credibility than having no digital option at all.

2. Legacy Systems & Technical Integration

Making a nimble, modern intelligent system talk to a complex, decades-old core banking platform is a major technical undertaking. It requires deep expertise in APIs, middleware, and real-time data synchronization. Without this, your AI-driven conversational banking remains superficial, unable to connect to the live financial data that makes it truly useful for the person on the other end.

3. Compliance, Risk & Data Privacy

A mistake in banking isn’t just bad PR – it can be a multi-million dollar compliance failure with lasting legal consequences. The system must be engineered from the ground up with security and privacy as its central pillars. It cannot give incorrect financial advice or expose sensitive information, demanding a “Privacy by Design” philosophy where every interaction is securely logged for a clear, auditable trail.

4. AI Training & Accuracy

An intelligent system that misunderstands a dinner reservation is a minor inconvenience. A system that misinterprets a payment instruction is a serious liability. The difference between “transfer $100.00” and “transfer $10,000” is just two zeros, but the consequence is enormous. This demands that any conversational banking model be rigorously trained on finance-specific language and complex user intents, followed by constant refinement and quality control.

5. Scaling Without Complexity

There is a vast difference between launching a pilot bot that answers 50 common questions and deploying an enterprise-grade system. An architecture that can’t handle tens of thousands of chats daily, across multiple languages and product lines, will buckle under its own success. The platform must be built for scale from day one to avoid slow responses and a degraded user experience as adoption grows.

6. The Human-AI Handoff

Forcing a client to repeat their problem is the cardinal sin of support. When the automated conversational banking system reaches its limit, the escalation to a human assistant must be absolutely seamless. The receiving agent needs a full summary of the dialog: who the user is, what they want, and what they’ve already tried. This way, they can pick up the thread instantly without missing a beat.

7. Internal Resistance & Team Adoption

Your own staff will have one burning question: “Is this going to replace my job?” If the team sees this new technology as a threat, they will resist it, undermining the entire project. Overcoming this requires a cultural shift, not just an IT rollout. The solution must be framed as a “copilot” that removes tedious work, freeing your people to focus on strategic thinking and building human relationships. Simply put, the work they are uniquely qualified to do.

5 Predictions for the Future of Conversational Banking

Solving today’s challenges is only half the battle. The true leaders will be those who are already preparing for what comes next. This investment isn’t just about catching up; it’s about building a foundation for the future of finance. Here’s a glimpse of where the industry is heading.

1. Assistants Will Become Emotionally Aware

The next frontier isn’t just understanding what a person says, but how they say it. Future systems will be able to detect frustration, urgency, or delight in a user’s tone and language. Conversational AI in banking that recognizes a client is stressed can immediately change its approach. For example, it may offer more empathetic language, or know that it’s the right moment to escalate to a human agent who can provide a reassuring voice.

2. Banking Will Be Proactive, Not Reactive

Today’s systems largely wait for a command. Tomorrow’s will anticipate needs. Imagine an assistant that sees you’ve received a large bonus and proactively suggests options for investing it based on your stated goals. Or one that warns you that your current spending trajectory means you’ll have a low balance five days before a big mortgage payment is due. This shifts the entire relationship from transactional to advisory.

3. AI Copilots for Banking Professionals Will Be Standard

The most powerful use of this technology may not be replacing human agents, but augmenting them. Every support manager will have an intelligent assistant on their screen, acting as their personal research team. It will listen to the conversation, find answers to complex questions in real-time, summarize client history, and automate routine tasks. A conversational banking agent frees specialists to focus entirely on strategic problem-solving and building rapport.

4. Conversations Will Happen Everywhere

The bank will no longer live only inside its app or website. Your financial life will be accessible wherever you are. You’ll be able to ask your smart speaker to confirm if a check has cleared, tell your car’s dashboard to pay for parking, or message your bank on WhatsApp to open a new savings account. Conversational banking will become a seamless, embedded part of your daily digital ecosystem.

5. Hyper-Personalization Will Be the Norm

Generative AI in banking will move personalization beyond simple product recommendations. By understanding a person’s complete financial history, their goals, and their habits, the system will be able to create truly unique advice. Instead of a generic budget, it might generate a customized spending plan for an upcoming vacation, packed with savings targets and tailored tips. The main goal here is to make every interaction feel like it was crafted just for that individual.

How to Implement Conversational AI in Banking with Master of Code Global

So, how do you get from here to there? A project this transformative can look complex and risky from the outside. We totally get it. That’s why our entire approach is designed to remove the uncertainty and deliver real value from day one, turning a massive undertaking into a series of clear, manageable wins.

Step 1: Strategic Discovery & Proof of Concept (POC)

It all starts with a conversation. Before we write a single line of code, we sit down with you to understand one thing: what is your biggest, most urgent headache right now? We then map out a clear, focused plan to solve that one problem first. As a core part of this initial service, we prepare a working Proof of Concept in just a few weeks. This isn’t a theoretical slideshow; it’s a tangible, working version of your conversational banking solution that can be shown to your team, proving the value. Test the waters before committing to anything bigger.

Step 2: Secure Integration & Scalable Build

Now for the part that often keeps IT leaders up at night: connecting new technology to your existing core systems. Think of our Conversational AI development company as the expert navigators for this complex terrain. Our team handles the hardest part: secure integrations, data synchronization and compliance checks. So, you can focus on the results, not the plumbing. We build for today’s needs on an architecture designed for tomorrow’s growth.

Step 3: Intelligent Deployment & Optimization

Launch day isn’t the finish line; for us, it’s the starting pistol. An intelligent assistant is a living system that gets smarter over time. After it goes live, we obsess over the details, analyzing how real people are interacting with it. This constant feedback loop allows us to teach and refine the system every single week, making it more accurate, more helpful, and more valuable to your organization as it learns.

Step 4: Long-Term Innovation Partnership

The digital world doesn’t stand still, and neither do we. Master of Code Global stays with you for the long haul, acting as your dedicated innovation team to help you add new features, expand to new channels, and stay ahead of the trends we’ve talked about. Your success is the only metric we care about. Our goal isn’t just to complete one more conversational banking project; it’s to build a lasting partnership.

Summing Up…

In the end, it all comes back to that single moment of friction. The late-night question, the confusing charge, the search for a simple answer. In today’s world, the difference between keeping a loyal client and losing them to a competitor is decided right there.

Conversational banking is the single most powerful tool for winning such moments. It’s how you replace frustration with relief, anxiety with trust, and a transactional relationship with genuine loyalty. It’s how you ensure that when your clients need you most, you’re there with the right answer, instantly.

The most important conversation about your bank’s future is the one we can have today.

Contact us to schedule a strategic discovery session.