Is your department a chaotic whirlwind of paper invoices, frantic phone calls, and looming payment deadlines? Do you feel like you’re constantly playing catch-up, struggling to maintain accuracy and avoid late penalties? The solution might be closer than you think. Enter the world of Generative AI, where cutting-edge technology is transforming the very fabric of financial operations.

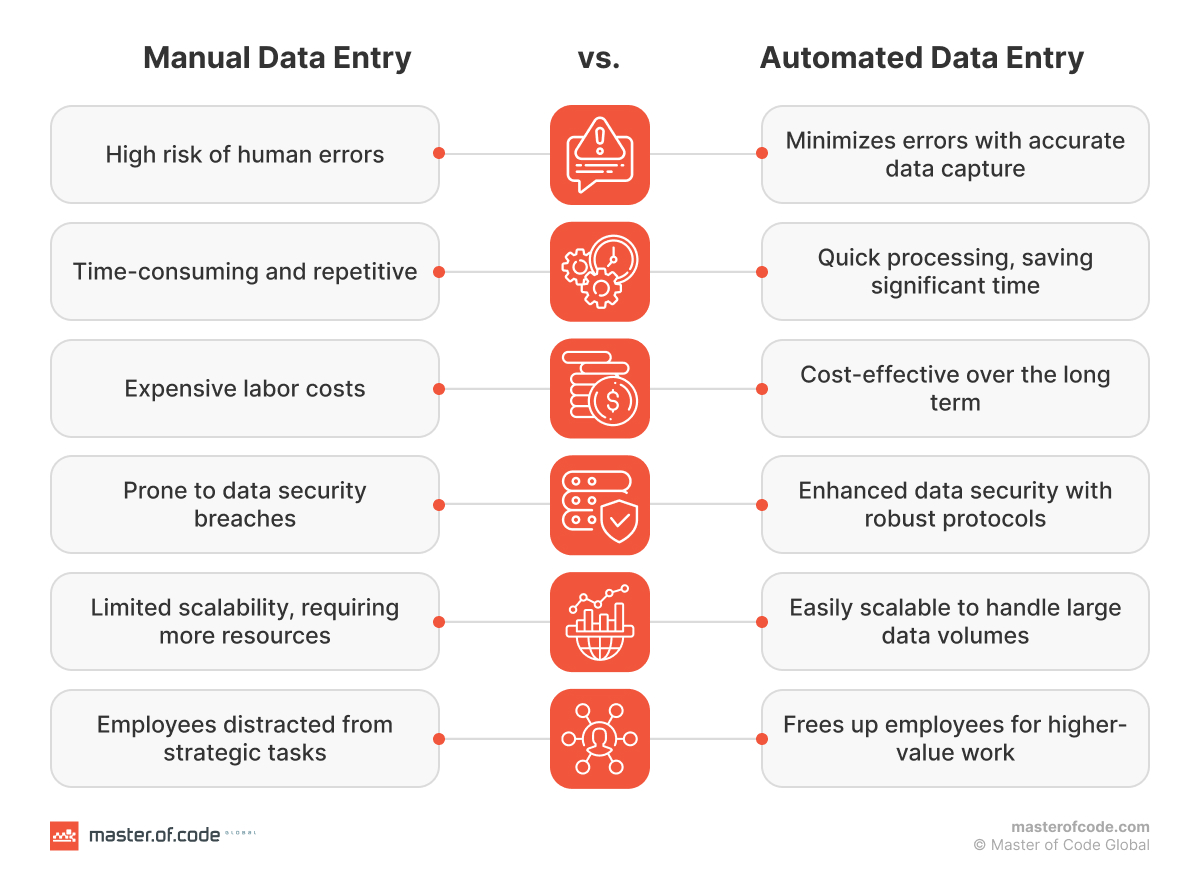

It’s closer than it seems: a world where manual data entry becomes a relic of the past, where invoices are processed with lightning speed and pinpoint accuracy, and where your team is freed from tedious tasks to focus on strategic initiatives. This is the promise of Generative AI in Accounts Payable. It’s not just about automation; it’s about empowering your company with effective tools that learn, adapt, and optimize your entire payment journey. DocuClipper states that automated data entry boasts an accuracy rate of 99.99%, unlike the human approach.

In this article, we’ll delve into the exciting possibilities of artificial intelligence, exploring its diverse use cases, uncovering its transformative benefits, and demonstrating how it can propel your business into a new era of financial efficiency and control. Get ready to say goodbye to the headaches of yesterday and embrace a future where technology takes the lead.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Table of Contents

5 Key Pain Points of Traditional AP

Let’s face it, traditional Accounts Payable departments are often bogged down in a quicksand of manual processes, outdated systems, and a never-ending influx of invoices. 1/3 of accountants admit they make at least a few financial errors every week due to capacity constraints. It’s a constant struggle to keep up, and the consequences of falling behind can be significant. Here’s a closer look at the key pain points that plague teams:

- The Data Entry Black Hole: Imagine a scene straight out of the 1950s: mountains of paper invoices piled high on desks, staff hunched over keyboards, their fingers flying as they painstakingly enter data into archaic systems. It’s a mind-numbing, time-consuming task that feels like it belongs in a bygone era. This tedious, repetitive work not only consumes valuable time but also opens the door to a cascade of errors. What a relief that automation has cut down manual recording processes by 80% (Tech Report)!

- The Error Avalanche: In the world of AP, even a small mistake can have a big impact. One misplaced digit, one overlooked detail, and suddenly you’re facing a domino effect of problems: duplicate payments, incorrect vendor information, or even fraudulent invoices slipping through the cracks. These errors can damage your company’s reputation, strain supplier relations, and directly impact your bottom line.

- The Visibility Vacuum: Trying to track down a specific invoice in a traditional department can feel like searching for a needle in a haystack. Where is that critical receipt? When is it due? Has it been approved? This lack of visibility into invoice processing and payment cycles can lead to missed deadlines, penalties, and a constant struggle to maintain adequate cash flow.

- The Supplier Relationship Struggle: Building and maintaining strong connections with clients is essential for any business. But in the traditional AP world, juggling a multitude of vendors, each with their own terms and communication preferences, can be a logistical nightmare. Missed payments, delayed responses, and communication breakdowns can strain these vital relationships and hinder your company’s ability to operate smoothly.

- The Strategic Stagnation: With so much time and energy devoted to manual tasks and firefighting, departments often find themselves trapped in a reactive cycle. They struggle to find the capacity for strategic analysis and process optimization. Valuable historical data remains locked away in invoices, preventing companies from gaining insights that could drive better decision-making and improve financial performance. It’s like having a treasure chest of information but lacking the key to unlock its potential.

Generative AI as the AP Game Changer

Tired of the Accounts Payable grind? Ready for a solution that’s as intelligent as it is efficient? Enter the technology that’s poised to revolutionize the way you handle invoices and manage supplier relations. Explore the transformative potential of Generative AI in finance and discover how it can streamline your entire monetary operation.

But what exactly is this technology? Think of it as a supercharged form of artificial intelligence that goes beyond simple automation. It’s not just about following pre-programmed rules; it’s about learning, adapting, and even predicting. The algorithms can analyze vast amounts of data, identify patterns, and make intelligent decisions, all without human intervention.

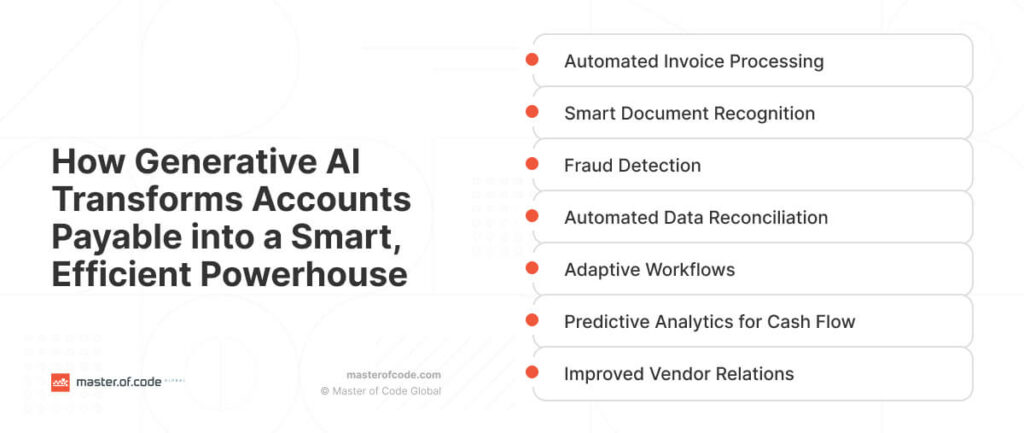

In the context of AP, this translates to a whole new level of efficiency and control over your payable process. Let’s explore some of the key ways Generative AI is changing the game.

Use Cases and Examples

- Automated Invoice Processing: Say goodbye to manual data entry! Generative AI, powered by Intelligent Document Processing (IDP), can extract information from receipts – even those unstructured, messy ones that make your team cringe. Algorithms then automatically match this data with purchase orders and code it accurately, ensuring a smooth and error-free process. This is what is called touchless invoice processing, where human intervention is minimized for optimal efficiency.

- Timely Anomaly Detection: Machine intelligence acts as a vigilant guardian, constantly learning your company’s spending patterns and flagging any suspicious invoices or activities. This proactive approach to fraud prevention helps protect your business from financial losses and reputational damage. By performing advanced data extraction, digital tools can identify subtle anomalies that might indicate malicious activity. For more robust security measures, consider implementing specialized Generative AI for fraud detection solutions that can further enhance your financial protection.

- Automated Invoice Matching and Approval Workflows: No more chasing down consents! Intelligent systems can automate the entire invoice approval process, routing documents to the right people at the right time, ensuring timely payments and eliminating bottlenecks. There is a stark contrast between traditional methods and AI-driven tools, revealing an extraordinary 99% accuracy in capturing invoice header data through automation.

- Predictive Analytics for Cash Flow: Gain a crystal-clear view of your future payables. By analyzing data and current trends, technology can accurately forecast cash flow, optimize schedules, and even help you negotiate better terms with suppliers. This goes beyond basic forecasting and delves into horizon scanning to anticipate future financial challenges and opportunities. With the advancements in Generative AI for payments, businesses can achieve greater financial efficiency.

- Personalized Vendor Interaction: Building strong supplier relationships is crucial, and artificial intelligence can help you tailor your messages. It can generate customized messages, reminders, and updates for different vendors, fostering trust and streamlining interactions. Imagine effortlessly managing multi-language invoices and communications, breaking down barriers and enhancing collaboration with international suppliers.

Benefits Beyond Efficiency

Even though Generative AI reduces expenses up to 80%, its impact in AP extends far beyond simple cost savings. The technology unlocks a range of strategic advantages that can transform your entire finance operation:

- Improved Accuracy and Reduced Errors: By automating data entry and invoice processing, AI minimizes the risk of human inaccuracies, ensuring greater correctness and reducing costly mistakes.

- Enhanced Compliance and Reduced Risk: Smart tech helps you stay on top of regulatory requirements and adherence standards, mitigating danger and protecting your business from penalties.

- Data-Driven Insights for Better Decision-Making: Unlock the treasure trove of data hidden within your invoices. Generative AI can analyze this info to provide valuable insights into spending patterns, vendor performance, and potential areas for improvement. This includes using sentiment analysis to gauge supplier enjoyment and identify potential relationship issues proactively.

- Freed-Up AP Staff to Focus on Higher-Value Tasks: By automating tedious and repetitive work, artificial intelligence lets your team focus on more strategic initiatives, such as financial planning, analysis, and payable process optimization.

- Increased Employee Satisfaction: Let’s face it, nobody enjoys spending hours on end doing manual data entry. AI eliminates these mundane tasks, boosting employee morale and allowing your team to focus on more engaging and fulfilling aims.

Conclusion: The Future of AP is Intelligent

It’s time to rethink traditional processes and embrace cutting-edge solutions. The writing’s on the wall: the future of Accounts Payable is smart, efficient, and powered by Generative AI. This isn’t just a passing trend; it’s a fundamental shift in how businesses manage their financial operations. By automating tasks like data extraction, invoice processing, and payment approvals, AI frees up valuable time and resources, allowing professionals to focus on strategic initiatives and contribute to the overall success of the company.

Ready to escape the chaos and embrace a new era of control and efficiency? Choosing the right Gen AI integration solutions provider is crucial. Look for a company with a proven track record in machine intelligence and a deep understanding of the unique challenges of AP automation. At Master of Code Global, we specialize in helping finance businesses achieve their goals and reap the maximum benefits of digital transformation.

Don’t let your business get left behind. Take the leap and transform your department with the power of digital tools. Contact us today to explore how we can help you unlock the full potential of intelligent AP and propel your company forward.

Ready to build your own Conversational AI solution? Let’s chat!