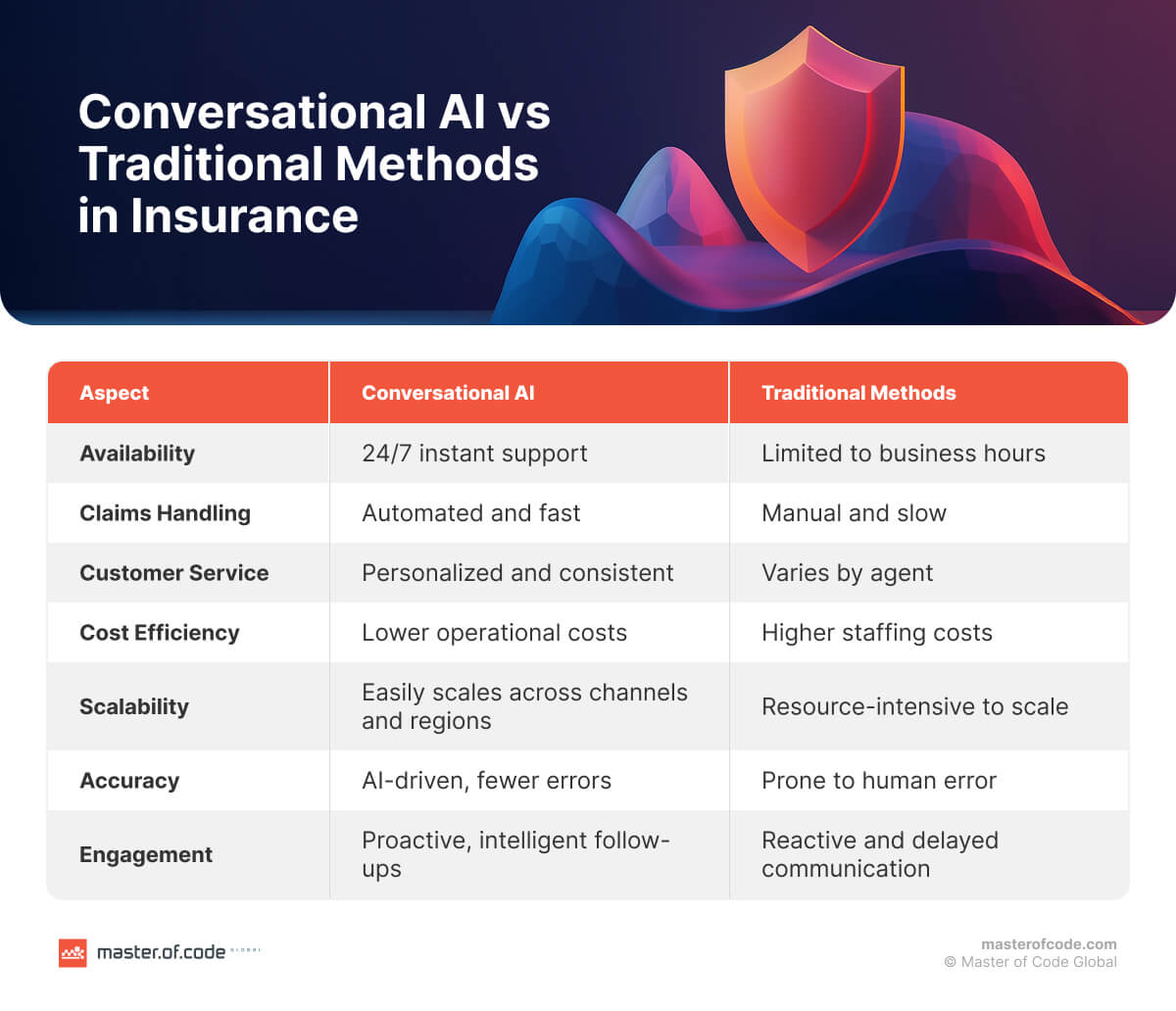

Insurance may be built on trust, but it’s bottlenecked by inefficiency. Long wait times, confusing policy documents, and inconsistent customer support have eroded the patience of today’s digital-first policyholders. And for companies? Rising costs, shrinking margins, and pressure to personalize at scale are pushing traditional systems to their limits. In the life coverage space, bereavement claims – arguably the most sensitive cases – can take up to four months to process, with certain policy types spanning 53 to 122 days.

This is where Conversational AI in insurance enters the conversation – literally.

Chatbots that walk users through claims and virtual agents handing out real-time quotes in an instant, making the whole process faster and more personal. AI empathizes, translates complexity into clarity, and delivers service that feels intuitive, not transactional. In fact, digital conversational solutions are making a significant impact by shaving query response times by up to 80%.

At Master of Code Global, we’ve seen firsthand how businesses are using this technology to reduce support volume, boost customer engagement, and accelerate sales cycles. After delivering almost 100 projects for insurance, we can give you practical advice and make your business really prosperous.

In this article, we’ll explore the top benefits, real-world use cases, and what the future holds for digital communication in the risk management sector. If you’re still relying on legacy systems and human-only help, trust us – you’re leaving revenue and loyalty on the table.

Now that we’ve set the stage, let’s break down the technology itself.

Table of Contents

What Is Conversational AI in Insurance?

At its core, Conversational AI refers to technologies that enable machines to simulate human-like dialogue across voice, chat, or text interfaces. But in the risk management industry, it’s more than just a digital assistant answering FAQs. It’s a strategic tool designed to simplify complexity, resolve claims faster, and create meaningful customer engagement at scale. For example, companies can save up to $7 billion over 18 months by implementing digital technologies, optimizing administrative processes.

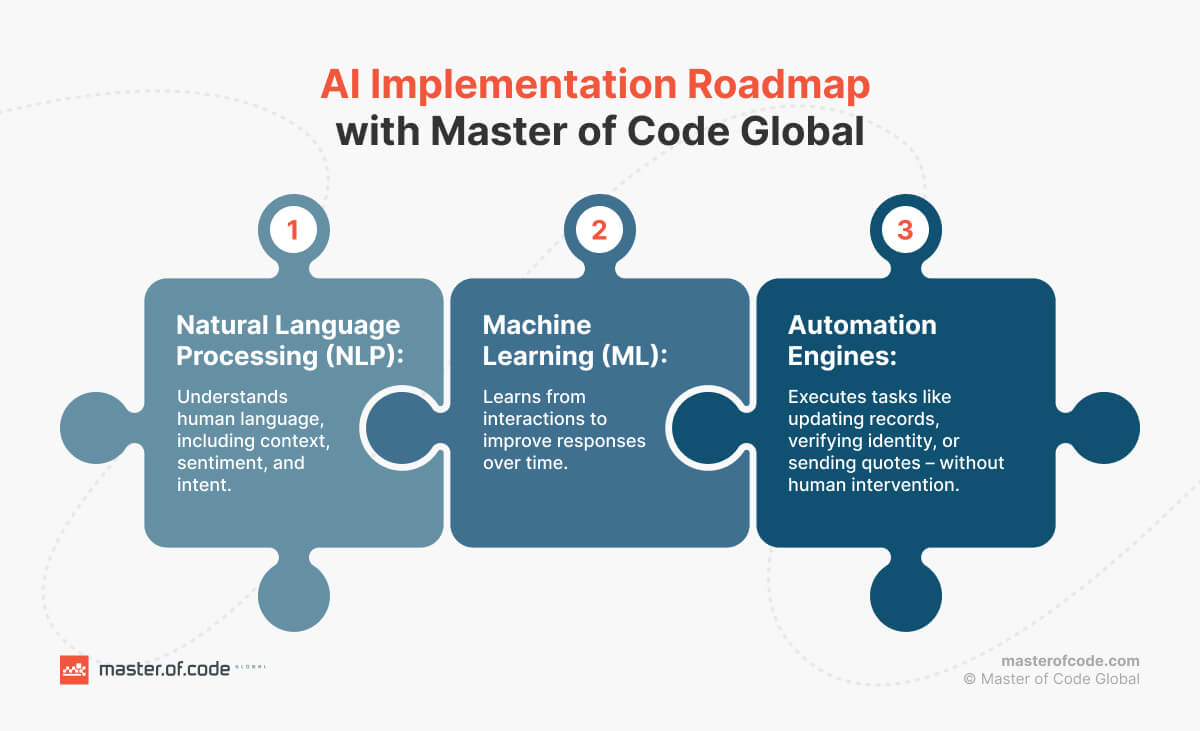

Unlike basic chatbots, which follow rigid scripts, Conversational AI leverages three key components:

- Natural Language Processing (NLP): Understands human language, including context, sentiment, and intent.

- Machine Learning (ML): Learns from interactions to improve responses over time.

- Automation Engines: Executes tasks like updating records, verifying identity, or sending quotes – without human intervention.

This trio turns simple interactions into intelligent workflows. Whether it’s guiding a customer through policy selection or triaging claims based on urgency, Conversational AI for insurance adapts and evolves – something static rule-based bots simply can’t do.

Layer large language models on top, and you get even more powerful solutions that continuously learn, grow sharper over time, and step confidently into more sophisticated use cases.

At Master of Code, we go a step further than definitions—we put Conversational AI into practice with LOFT.

Our Edge: LOFT – Orchestrating Smarter Conversations

At Master of Code Global, we don’t just build bots, but whole ecosystems. Our LOFT (LLM-Orchestrator Open Source Framework) is what truly sets us apart. Instead of relying on a single large language model, LOFT orchestrates multiple LLMs based on your specific needs – fact-checking against real-time data, enforcing regulatory compliance, and optimizing for cost and performance.

This multi-LLM strategy ensures:

- Higher accuracy and fewer hallucinations

- Scalability across product lines and languages, ideal for enterprise needs

- Governance aligned with insurance regulations

With LOFT, we help insurance companies move beyond “just automation” toward trusted, compliant, and human-grade digital conversations at scale.

Once the tech foundation is clear, the next question is: why are insurers moving so quickly to embrace it?

Why Insurers Are Adopting Conversational AI

Risk management has never been just about policies, but about people navigating uncertainty. And in 2026, those people expect fast, personalized, and 24/7 service. Unfortunately, most traditional systems still struggle to deliver that without burning out staff or inflating costs. And customers notice: 63% say they’ve felt frustrated with their provider’s service in just the last year.

That’s the core driver behind the rise of Conversational AI in insurance.

Clients now expect seamless digital interactions, just like they get from banks, travel platforms, or eCommerce. Long hold times? Confusing paperwork? Generic responses? These are deal-breakers. Artificial intelligence bridges that gap by offering instant, intelligent, and human-like help – whether someone is reporting a fender bender or asking about coverage on a Sunday night.

On the operational side, the benefits are just as compelling. Conversational AI can reduce support volume, cut claims handling times, and drive significant cost savings by automating repetitive tasks. And the industry is responding. According to a recent survey, 77% of insurance companies are either deploying or actively scaling AI technologies to stay competitive.

Conversational AI has become an essential tool in customer experience, underwriting, and claims, moving beyond experimental technology to a must-have in today’s risk management sector. For organizations looking to meet rising expectations without escalating overhead, adoption is no longer optional, but strategic.

Let’s move from “why” to “what”—the concrete advantages insurers gain from using Conversational AI.

Key Benefits of Conversational AI in Insurance

Customer Satisfaction & 24/7 Support

Today’s policyholders don’t want to wait until Monday morning to get help. With Conversational AI solutions for customer service, insurers can deliver instant help, anytime – whether it’s a billing question at midnight or a roadside assistance inquiry on a holiday. Virtual agents offer consistent, accurate, and human-like responses across channels, building trust and reducing friction. This “always-on” availability plays a major role in boosting client satisfaction scores (CSAT) and reducing churn.

Operational Efficiency & Cost Savings

Behind every claim, policy update, or document request is a set of repeatable steps – steps that AI can handle faster, cheaper, and with fewer errors. Artificial intelligence reduces the burden on live agents by resolving routine queries and automating backend workflows. This means fewer escalations, shorter handling times, and leaner support teams without compromising service quality. For many insurers, that translates to millions saved annually.

Fraud Detection & Risk Reduction

Conversational AI always listens for patterns. With advanced NLP and ML models, virtual agents can flag suspicious behavior in real time. For instance, inconsistencies in claim narratives or repeated submissions can trigger alerts for human review. Such proactive monitoring helps companies detect fraud earlier, reduce false claims, and mitigate financial risk.

Scalability During Peak Demand

Storm season. Tax deadlines. Open enrollment. The insurance industry sees regular demand spikes – and traditional systems often crack under pressure. Conversational AI scales effortlessly, handling thousands of simultaneous conversations without delay or degradation in service. The elasticity makes sure you’re prepared for the surges without the cost of overstaffing during slower periods.

Continuous Learning & Personalization

The more conversations AI handles, the smarter it gets. Each interaction feeds into a feedback loop, improving accuracy, tone, and relevance over time. Integrated with CRM and policy data, artificial intelligence can also tailor responses based on user history, preferences, or coverage level. The result? Dialogues that feel tailored, not templated.

Of course, benefits only matter if they translate into real-world applications. Here’s how insurers are putting them to work.

Top Use Cases of Conversational AI in Insurance

Claims Processing Automation

Requests are often the most stressful part of the coverage journey. AI for claims processing can simplify this experience by guiding users through step-by-step submission, validating documents, and even offering real-time status updates. With integrations to backend systems, virtual agents can automate triage, flag inconsistencies, and accelerate first notice of loss (FNOL), cutting processing time from days to minutes.

Customer Service & Virtual Agents

Chatbots for insurance tackle everything from billing inquiries to coverage details, delivering quick and precise answers with ease. These AI-powered virtual agents are trained on policy data, FAQs, and claims logic, offering helpful explanations while escalating complex cases to human reps. The result? Faster resolutions, higher CSAT, and lower support costs.

Fraud Prevention

AI keeps a watchful eye on claims, optimizing every stage of the process. Conversational systems trained on historical claim data can detect patterns linked to fraudulent behavior, such as exaggerated losses or duplicate submissions. By flagging high-risk cases for further review, artificial intelligence helps reduce fraud losses and protect the insurer’s bottom line.

Underwriting Automation

Underwriting processes often involve repetitive data collection and rule validation. Digital agents gather applicant information, verify identity, and pre-screen risks based on pre-set parameters. It reduces the manual load on underwriters, speeds up policy issuance, and facilitates more consistent decisions.

Personalized Product Recommendations & Upselling

AI agents can analyze clients’ profiles and interaction history to suggest the right products at the right time. For instance, a renter purchasing auto insurance may receive a bundled offer for home coverage. This real-time upselling feels consultative, not pushy – boosting conversions while adding value.

Policy Management & Renewals

Forget the paperwork. Conversational AI for insurance helps customers update personal details, add vehicles, or renew policies – all via chat or voice. Notifications about expiring coverage can be automated, with the digital agent walking users through available renewal options in minutes.

Agent Productivity & Internal Support

Conversational AI can also act as a virtual teammate for agents, enhancing their workflow alongside serving clients. Digital tools can surface relevant documents, answer internal queries, or assist in compliance workflows, saving time and improving accuracy across the board.

How does it all come together in practice? Let’s take a look at brands already using Conversational AI successfully.

Real-World Examples of Conversational AI in Action

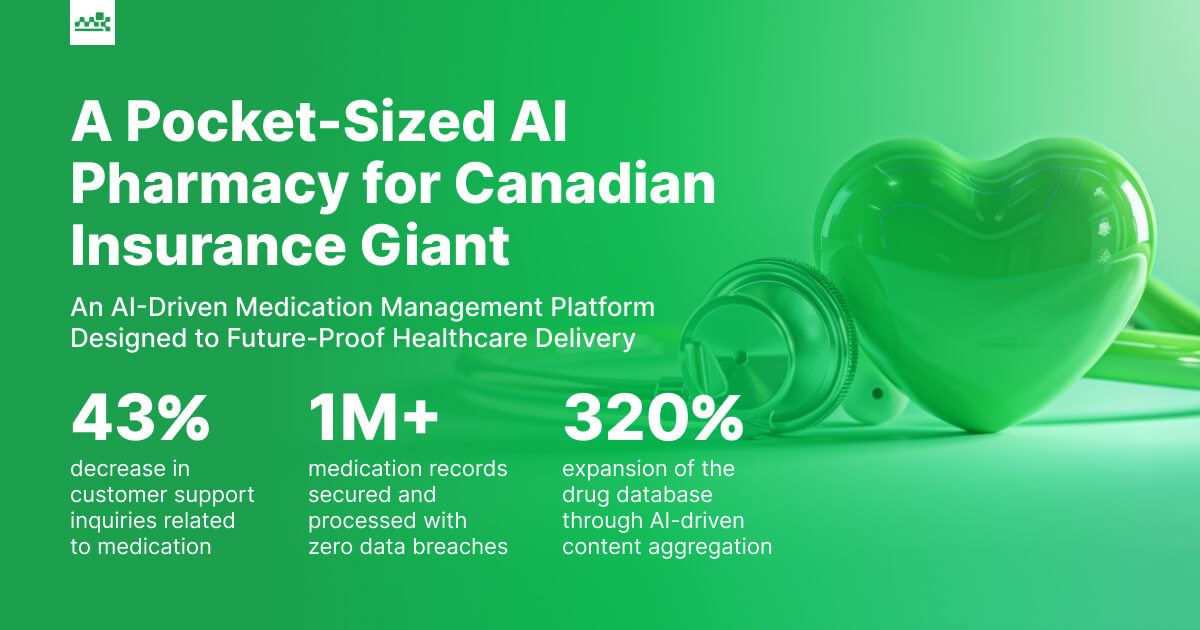

AI Pharmacy for Canadian Insurance Giant

Master of Code Global developed a virtual AI-powered medicine cabinet to help users manage prescriptions, refills, and health insights in real time. More than a reminder app, it became a trusted digital health companion. The platform processed 1M+ medication records with zero data breaches, setting a new standard in secure, patient-centric journey.

GenAI FAQ Bot for Insurance Providers

Built on the LivePerson platform, this GenAI-powered assistant delivers instant, compliant answers to complex queries. It interprets vague questions without breaching regulatory limits, offering legal safety while improving customer experience. The result: reduced compliance risk, faster claims processing, and new cross-sell opportunities.

Embeddable Voice Assistant

To accelerate voice-first innovation, Master of Code Global built a native, embeddable voice assistant framework compatible with iOS, Android, and cross-platform apps. Designed for speed and flexibility, it supports rapid prototyping, custom voice UX, and seamless integration into existing interfaces. This solution enables brands to launch smarter, faster, and completely hands-free, with voice-guided shopping and healthcare tools that prioritize patients.

Geico – AI Assistant for Insurance Questions

This virtual tool is built into its mobile app, providing instant answers to FAQs. The assistant simplifies tasks like checking ID cards and updating policies, letting call centers focus on more urgent needs while improving service delivery.

Allstate (ABIe) – Virtual Assistant for Customer Service

ABIe helps users navigate policy details, billing issues, and product options. It’s a strong example of how artificial intelligence can elevate the consumer journey without losing the human touch.

Lemonade (Maya) – AI-Powered Claims Companion

Maya leads the charge in digital coverage experiences. It guides users through quote generation, policy setup, and claims filing – all in a friendly, intuitive flow. Its speed and clarity exemplify how AI can drive both delight and operational efficiency.

Implementation Best Practices

Adopting Conversational AI in insurance goes beyond picking the right tech – it’s about making sure it’s ready to thrive in the real world. Here’s how to implement it effectively from day one.

Set Clear, Measurable Goals

Before building anything, define what success looks like. Are you aiming to reduce support tickets by 40%? Automate 60% of claims processing? Improve quote conversion rates? Setting specific, measurable KPIs makes sure your strategy stays focused and proves its value fast.

Choose the Right Custom Provider & Integrator

Off-the-shelf bots rarely deliver in a regulated, data-heavy space. You need a partner who understands compliance, data integration, multilingual NLP, and user privacy. At Master of Code Global, our insurance AI consultants specialize in custom Conversational AI built for industry workflows – whether it’s claims triage, policy management, or broker enablement. Scalability and security are built in from the start.

Design Smart Flows & Human Handoffs

Even the best tools can’t solve every problem. Well-crafted conversation design ensures intuitive paths with clear fallbacks to human agents. We help map out user journeys, edge cases, and escalation logic to reduce frustration. The goal isn’t to replace people, but to empower them.

Monitor KPIs & Optimize Continuously

Launch is just the beginning. Then goes analytics to track performance: containment rates, resolution times, customer sentiment, etc. Update scripts, retrain your models, and adapt to changing client behavior. Continuous learning isn’t limited to AI; it’s a growth opportunity for your ops team as well.

Master of Code Tip: POC as a Zero Sprint

As Olga Hrom, Head of Delivery at Master of Code Global, puts it:

An AI Proof of Concept should never be a standalone — treat it as a Zero Sprint to map out integrations, compliance checks, and claims workflows before scaling.

Learn more about our POC development approach

Challenges in Deploying Conversational AI for Insurance

While the benefits of artificial intelligence are compelling, implementation in the insurance sector isn’t without its hurdles. Understanding these early can mean the difference between a scalable success and a stalled pilot.

Data Privacy & Compliance

Handling sensitive customer information – claims, payments, health records – means navigating a minefield of regulations. Any conversational solution must be designed to comply with GDPR, HIPAA, PCI DSS, and local data residency laws. That includes encryption, consent, and audit trails. Failing to align from day one can lead to legal exposure and reputational risk.

Integration with Legacy Systems

Many organizations still rely on legacy policy administration and claims platforms – some decades old. Plugging Conversational AI into these systems isn’t always straightforward. Without proper middleware or custom APIs, response times lag, workflows break, and the entire experience suffers. A scalable deployment requires thoughtful integration architecture, not just chatbot UX.

Customer Trust & AI Empathy Concerns

Digital assistants must walk a fine line: efficient, but not robotic; informative, but not impersonal. In a high-stakes industry like insurance, clients expect empathy, especially during claims or disputes. Poorly designed bots that sound cold or dismissive can damage trust faster than slow service. This makes tone, escalation paths, and conversation design mission-critical.

Measuring ROI Correctly

Many companies go live without fully accounting for the hidden costs of insurance Conversational AI. These include training high-quality datasets, running compliance reviews, fine-tuning agent handoffs, and maintaining knowledge bases over time. Without these line items planned, ROI tracking becomes skewed, leading to underinvestment or unrealistic performance expectations.

To maximize Conversational AI ROI, organizations must align KPIs with business impact from the start and treat artificial intelligence not as a “one-and-done” tech drop, but as a living, evolving part of the CX and claims ecosystem.

Once you’ve addressed the roadblocks, here’s what the next wave of innovation will bring.

The Future of Conversational AI in Insurance

Generative AI’s Expanding Role

Large language models like GPT-4 and Claude are changing the game. Unlike scripted bots, Generative AI can craft contextual, dynamic responses across complex customer journeys. In conversational insurance, this means fewer dead ends, richer guidance, and interactions that feel truly human. Moving forward, Generative AI use cases in insurance will power everything from real-time documentation to automated claims narratives, dramatically reducing manual workloads.

Voice AI Growth

Typing isn’t always convenient, especially in moments of stress. Voice AI is gaining traction as businesses look to offer hands-free, natural interactions across mobile apps, contact centers, and even smart home devices. According to PwC, 89% of customers say they prefer brands that offer digital voice support.

With advances in speech recognition and multilingual NLP, expect to see conversational coverage go beyond the screen and into voice-first, omni-accessible experiences.

Embedded Insurance & Omnichannel Expansion

As integrated security becomes mainstream – think travel coverage at checkout or device protection bundled with eCommerce – Conversational AI for insurance will need to work across touchpoints outside the domain. Support that’s smooth and consistent across every channel, brand, and context – like WhatsApp or connected car dashboards – will be your secret weapon in staying ahead of the competition.

Continuous Innovation & Agent Augmentation

Artificial intelligence won’t replace agents, but it will absolutely amplify them. Forward-thinking companies are exploring Agentic AI for insurance, not just for clients, but for internal teams. These tools elevate agent productivity by automating routine tasks, surfacing relevant data, and providing real-time help, allowing staff to focus on high-value activities.

Forecast: Insurance AI Copilots

Picture a claims adjuster with an LLM-powered assistant that surfaces previous cases, suggests the next best action, or checks for regulatory red flags in real time. Underwriters could compare policies, pull insights, and draft reports instantly. At Master of Code Global, we build these kinds of agent-assist copilots—custom solutions that go beyond productivity boosts to refine decision-making, elevate consistency, and reduce human error.

In the near future, expect companies to combine customer-facing AI with these internal copilots, creating a dual-layer strategy that scales both experience and expertise.

Our Unique Angle: Master of Code Global Perspective

We help our clients move beyond basic automation to intelligent, scalable, and secure conversational ecosystems. We already mentioned LOFT, which allows companies to orchestrate multiple large language models for accuracy, regulatory compliance, and cost-efficiency.

But we don’t stop at frameworks – we deliver real-world results across industries, backed by our comprehensive Conversational AI services. Whether it’s enhancing customer experience, streamlining claims, or supporting internal workflows, our solutions are designed to solve complex challenges and drive measurable business outcomes.

Here are some case studies that showcase our expertise and the tangible impact we’ve made for our clients:

- For Burberry, we built a Conversational AI concierge on Facebook Messenger that let users shop runway looks, watch live fashion shows, and receive personalized product suggestions, all while deepening emotional brand connection. The solution boosted online sales, improved loyalty, and unlocked rich customer insights.

- With Tom Ford, we launched an AI-powered Messenger bot for the Beauty Gift Finder campaign, just in time for the holiday rush. The assistant offered tailored gift recommendations using website data and past behavior, driving 2,000+ product clicks and high-quality traffic to their eCommerce store.

- For CanadaRX, our team conducted a full digital transformation of their prescription referral ecosystem, modernizing front-end UX, back-end systems, and automated workflows. This blueprint now supports over 100,000 historical orders, improves stakeholder visibility, and ensures compliance in a highly regulated space.

If you’re set to make the most of Conversational AI solutions for insurance, we’re here to bring your ideas to life. Together, we’ll ensure the system fits perfectly into your existing setup while upholding top-tier security standards. Let’s build a solution that redefines efficiency and sets a new standard for customer experience.