Every business investing in artificial intelligence eventually runs into the same question: Is this actually paying off? Not in theory. In real operational and financial terms.

This article is an AI ROI analysis built as a meta-review of 16 recent research reports from global leaders like IBM, Deloitte, and McKinsey, combined with 18 real-world success stories across industries. Instead of repeating vendor claims or isolated case studies, it focuses on what consistently shows up in the data: the payoffs companies are actually achieving, how long it takes to materialize, how executives measure it, and why proving value remains so difficult.

The piece is also informed by hands-on AI strategy consulting work with enterprises, where initiatives are evaluated not as isolated experiments but against measurable business outcomes and long-term operational impact.

So if you’re responsible for investment decisions, or advising those who are, and looking for the real side of AI ROI, you’re in the right place. Let’s get into it.

Table of Contents

Key Takeaways

- At scale, only about 5% of companies achieve substantial AI ROI, while 35% report partial returns. Average payoff reaches ~1.7×, with 26–31% cost savings registered in functions like supply chain, finance, and client operations.

- Initial returns usually appear within 6–18 months as efficiency gains. More meaningful financial impact tends to emerge over 18–36 months, while enterprise-level ROI and competitive effects typically require 3–5 years.

- Businesses calculate hard returns such as cost avoidance, productivity increase, faster cycle times, and error reduction. They also count soft returns like improved decision quality, higher adoption, better customer experience, and organizational agility to explain compounding value.

- Positive ROI obstacles include pilot-to-production failure, unclear ownership, weak governance, and difficulty translating internal efficiency gains into visible financial results.

- Returns are strongest when artificial intelligence is applied to core workflows, paired with process redesign, backed by executive support, and scaled deliberately rather than scattered across experiments.

- Are companies actually seeing ROI from AI? Yes. Mastercard, HSBC, Shell, BP, Walmart, Zipify, and others have reported measurable outcomes, including higher detection accuracy, lower downtime, operating cost reductions, and faster resolution times.

Why AI ROI Confuses Even Experienced Executives

When leaders talk about artificial intelligence return on investment, they’re often referring to different dimensions of value. Some emphasize cost savings. Others focus on productivity gains, risk mitigation, or revenue protection. For many, the real payoff lies in long-term competitive positioning.

The ambiguity isn’t about misunderstanding; it’s about what qualifies as “return”. It’s also one reason more than 1/2 of finance executives cannot clearly demonstrate ROI from their AI/GenAI initiatives. And why 42% of companies abandoned most of their intelligentization projects in 2025.

Why is AI ROI different from traditional tech ROI?

Traditional enterprise technology follows a predictable pattern. You implement a system, digitize processes, and efficiency gains appear within 7 to 12 months — the standard payback period for most IT investments. The returns are linear, measurable, and relatively easy to isolate.

AI doesn’t work that way.

Most organizations achieve satisfactory returns within 2 to 4 years. It’s three to four times longer than conventional tech deployments. Only 6% see payoff in under a year. Even among the most successful implementations, just 13% deliver payback within 12 months.

Why the delay? Intelligent systems learn, adapt, and depend heavily on data quality, organizational adoption, and operational context. Value compounds over time rather than appearing all at once. Early initiatives typically deliver modest efficiency improvements first. Larger financial impact emerges only after workflows, decision rights, and governance models evolve around them.

This is why applying classic IT ROI frameworks leads to false conclusions — either declaring failure prematurely or overestimating value before it materializes.

How Enterprises Are Measuring ROI of AI in Operations

There’s no single standard for calculating the impact, and what works for one company often fails at another. Most businesses use a mix of frameworks, balancing hard financial metrics with softer operational indicators. The best performers track both and know which to prioritize at different stages.

Common ROI Measurements

To understand how to estimate ROI of AI workflow automation, leading organizations rely on several core approaches:

- Financial metrics: revenue growth, cost reduction and avoidance, Earnings Before Interest and Taxes (EBIT) or Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) impact, and return on invested capital.

- Operational metrics: productivity gains measured in hours saved or throughput increases, cycle time reductions across key processes, error and defect rate improvements, and time-to-market acceleration for new products or features.

- Client-facing metrics: Net Promoter Score changes, conversion rate lifts, customer satisfaction boost, and resolution time decrease.

- Deployment metrics: percentage of workflows deployed or scaled, time from pilot to measurable value, adoption rates among employees, and the ratio of production use cases to pilots.

Defining these is only the first step. The harder problem is translating them into evidence that survives budget reviews, board scrutiny, and long-term investment decisions.

Why Most Organizations Still Struggle to Prove ROI

Several factors drive this measurement gap:

- Difficulty separating AI impact from overall business growth.

- Inability to move from proof-of-concept to production scale.

- Lack of clear ownership and accountability.

- Challenges mapping internal efficiency gains to cost impact.

The gap between doing AI and proving its value remains one of the biggest obstacles to sustained investment. The issue becomes even sharper in financial services, where 11% of executives identify unclear ROI as the primary barrier to scaling AI, according to our proprietary report, “The State of AI in Financial Services.” Eventually, organizations that crack the measurement problem tend to be the same ones pulling ahead in overall intelligence maturity.

Time to Value: How Long AI ROI Really Takes

The returns don’t arrive as a single event. They accumulate in phases, with different types of value appearing at different stages.

Short-term wins typically surface within 6 to 18 months:

- Productivity rise through task automation.

- Time savings in repetitive processes.

- Error reduction in data-intensive workflows.

- Faster decision cycles for routine choices.

Medium-term returns emerge over 18 to 36 months:

- Process redesign that leverages AI capabilities.

- Cost reductions from eliminating manual work or external vendors.

- Quality improvements that reduce rework or waste.

- Customer experience enhancements that protect revenue.

Long-term enterprise ROI shows up after 3 to 5 years:

- Revenue growth from AI-enabled products or services.

- Market share gains from competitive advantages.

- New business models made possible by emerging capabilities.

- Compounding returns as systems improve over time.

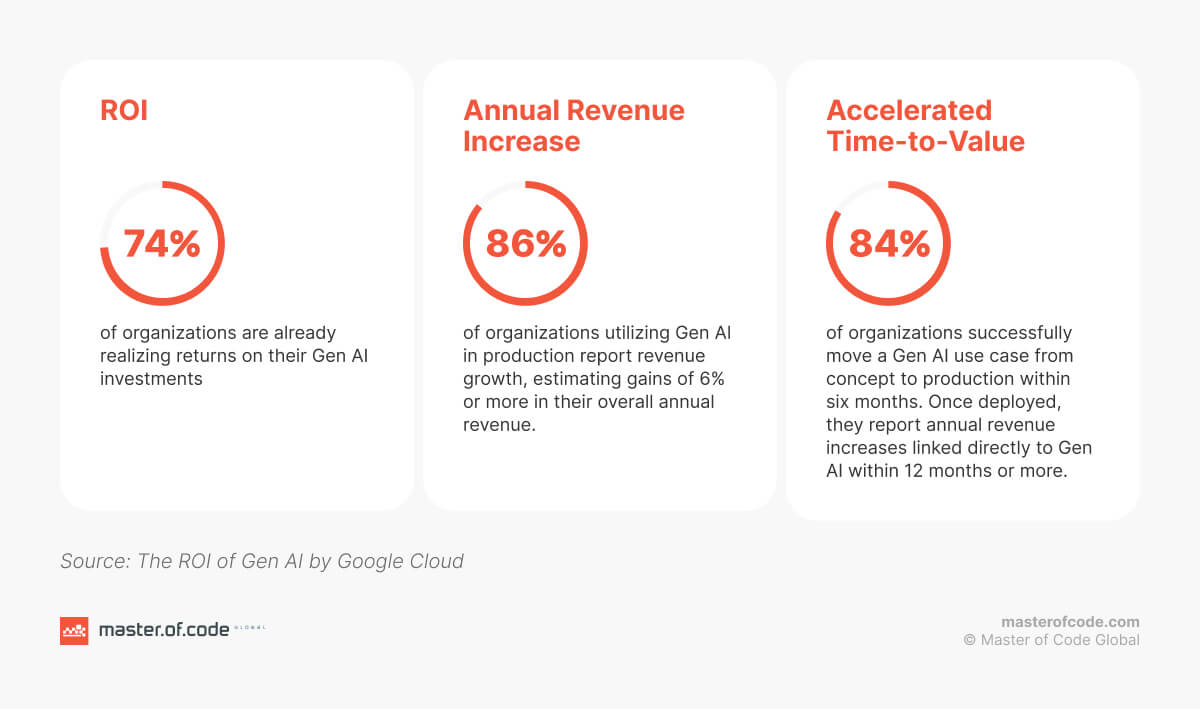

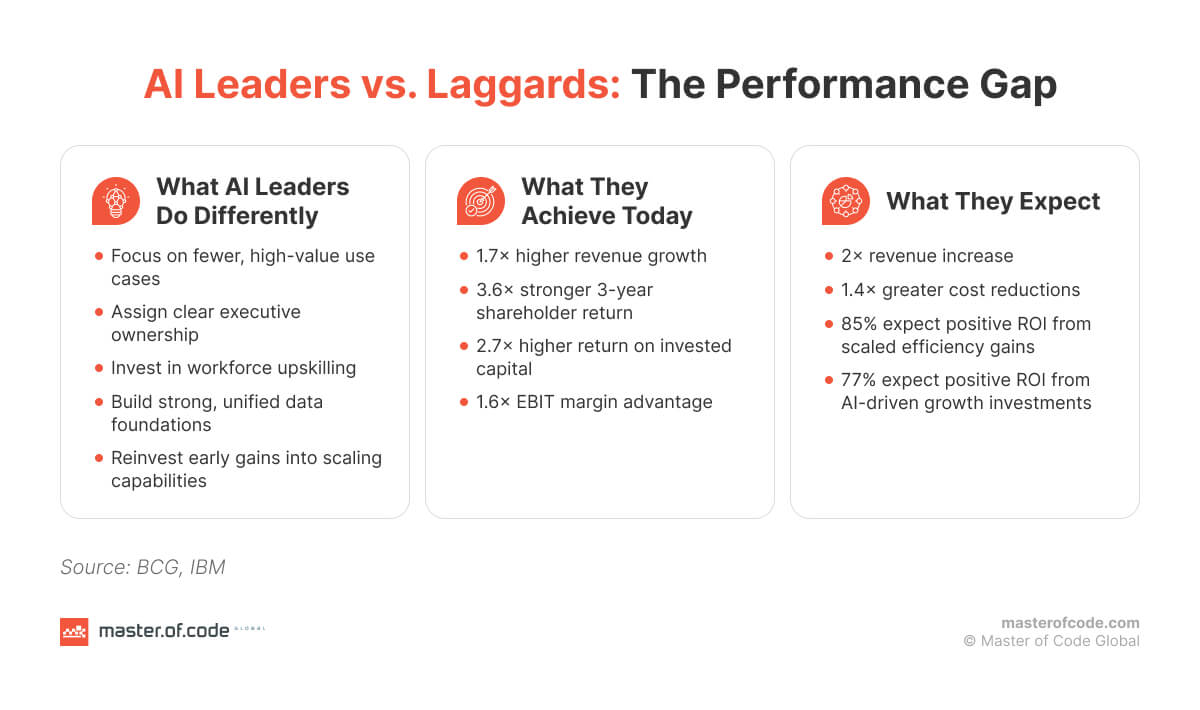

BCG’s research shows this pattern clearly. Future-ready companies — the top 5% achieving substantial value — expect twice the revenue increase and 40% greater cost reductions than laggards by 2028. The gap widens over time because leaders reinvest early artificial intelligence returns into stronger capabilities, creating a compounding effect.

Organizations that understand this sequencing plan accordingly. They pursue near-term efficiency wins to fund longer-term transformation, rather than expecting all value types simultaneously.

How Many Companies Actually Generate AI ROI?

The gap between investment and measurable payoffs has become one of the most scrutinized metrics in enterprise technology. Multiple independent studies from 2025-2026 reveal consistent patterns in who’s achieving value, how much they’re getting, and where returns materialize first.

Here’s what the cross-study data demonstrates.

ROI Realization Rates

BCG (1,250 companies globally):

- 5% achieve substantial value from AI at scale.

- 35% are scaling this tech and beginning to generate yields.

- 60% report minimal revenue and cost gains despite investment.

- Visionary players show 1.7x revenue growth, 3.6x three-year Total Shareholder Return (TSR), 2.7x return on invested capital, and 1.6x EBIT margin vs. laggards.

IBM (2,000 CEOs globally):

- 25% of AI initiatives delivered expected ROI.

- 16% of them scaled enterprise-wide.

- 65% CEOs now prioritize use cases based on payoff (up from scattered approaches).

- 68% report clear metrics to measure innovation outcome effectively.

Capgemini (1607 organizations):

- Average ROI of 1.7x for firms moving technology from pilots to production-scale processes.

- Cost savings of 26-31% reported across supply chain & procurement, finance & accounting, and customer & people operations.

- 40% expect positive yields within 1-3 years; 35% within 3-5 years.

McKinsey (1,993 participants in 105 nations):

- 39% track enterprise-wide EBIT impact from artificial intelligence.

- 64% say it is enabling innovation at the large-scale level.

- Use-case level benefits are registered more commonly than enterprise P&L results.

- 62% at least experimenting with agentic AI; 23% scaling it in at least one function.

The pattern is consistent: a small cohort achieves strong returns, a larger middle group is progressing, and the rest struggles to demonstrate measurable value.

Read also: Quantitative Breakdown of Voice AI ROI for Modern Enterprises

CEO and Executive Perspectives on AI Returns

C-suite sentiment reveals both commitment and caution:

Investment momentum remains strong:

- 85% of organizations grew AI allocations in the past 12 months, 91% plan to increase them again this year.

- 71% of CEOs call artificial intelligence a top priority.

- 69% allocate 10-20% of their budgets to intelligentization.

- 62% increased GenAI spending in 2025, with 36% assigning dedicated capital.

ROI timeline expectations:

Eventually, leaders invest despite uncertain near-term returns because they view this technology as strategically necessary.

What Distinguishes High-ROI AI Implementations

The performance gap between intelligentization leaders and the rest isn’t about access to better models. Research across multiple studies reveals the following reasons:

Strategic alignment over scattered experimentation

- 76% higher match between where AI is deployed and where it delivers actual impact.

- 62% of value comes from core business functions: R&D/innovation (15%), digital marketing, sales, manufacturing, and supply chain.

- Future-built companies deploy 62% of initiatives to production vs. 12% for laggards.

- They achieve faster time-to-impact: 9-12 months instead of 12-18 months.

- 5x more apt to have intelligent workflows already deployed or scaled.

- 65% of high-ROI organizations prioritize use cases explicitly based on outcome projections vs. scattered experimentation.

Focused prioritization with adequate funding

- Agile businesses plan to spend 26% more on IT and dedicate up to 64% more of their budget to artificial intelligence.

- As a result, they expect 2x the revenue increase and 1.4x greater cost reductions than laggards.

- 2.5x more likely to have governance and value-measuring setups in place.

- Firms infusing $10M+ across units report 71% likelihood of significant productivity gains vs. 52% for those investing less.

- Average organization scraps 46% of AI POCs before production; high performers flip this ratio through ruthless prioritization.

Process redesign, not AI layering

- Nearly 90% of future-built and scaling companies expect most value to come from reshaping and inventing business processes, not automating existing ones.

- Agentic tech accounts for 17% of total payoff in 2025, expected to reach 29% by 2028.

- Forward-thinking companies allocate 15% of AI budgets to agents; 33% already use them vs. 12% of scalers.

- 21% of organizations using GenAI have redesigned workflows from the ground up.

- 64% of technology executives plan to deploy agents over the next 24 months.

Budgeting is increasingly ROI-driven. AI is measured against questions like: will it reduce costs, improve conversion, or raise satisfaction? Too many businesses still expect consumer-style plug-and-play systems, underestimating the training, tuning, and integration required. Successful programs are treated like hiring a new employee: requiring structured onboarding, ongoing coaching, and performance tracking. Partnerships also matter: even strong platforms fail if delivery partners can’t execute.

Executive ownership and co-governance

- Nearly 100% of trailblazers report deeply engaged C-suites vs. only 8% of laggards.

- Three-quarters of CEOs are their company’s chief decision maker on artificial intelligence.

- Innovation-driven companies are 3x more predisposed to appoint a chief AI officer and 2x to designate a chief data officer.

- 1.5x more inclined to have business and IT share ownership of transformation with clear decision rights.

- Over 40% explicitly embed shared accountability into governance vs. 19% of stagnating firms.

- More than 60% of progressive firms rigorously track AI value vs. only 17% of underperformers.

- Digital vanguard achieves 71% success rate on initiatives vs. 48% average, distinguished by co-ownership between CIOs and CxOs.

Data foundations and platform infrastructure

- Organizations with AI-ready data report 26% improvement in business outcomes.

- Single enterprise-wide data model: 50% of future-built vs. 4% of stagnating companies.

- Central data policies defined and monitored: 3x more likely among outperformers.

- Tech-forward businesses are 4.6x more apt to have fit-for-purpose guardrails in place.

Workforce transformation and reinvestment

- Pioneering companies upskill 50%+ of employees vs. only 20% at laggards.

- 6x more apt to carve out time for structured learning.

- 2x more prone to involve employees in shaping and adopting artificial intelligence.

- 5x more expected to engage in strategic workforce planning for AI.

- Effective talent strategies unlock up to 40% additional productivity gains.

- 96% of businesses investing in AI observe efficiency increase, with 57% witnessing a significant one.

- Among those seeing positive ROI, 56% report that it translated into measurable improvements in overall financial performance.

- Only 17% use productivity gains for headcount reduction; the majority reinvest in AI capabilities, cybersecurity, R&D, and upskilling.

Governance as enabler, not blocker

- 58% say responsible inttelligentization initiatives improve returns and organizational efficiency.

- Growth-focused companies are 2.6x more likely to have rigorous tracking of AI value across the organization.

- 68% report clear metrics to measure innovation ROI effectively.

- 21% have a mature model for agent governance vs. the majority still building these capabilities.

What Blocks AI Automation ROI the Most

Despite record investment and widespread adoption, most organizations struggle to translate AI initiatives into measurable returns. Research across multiple studies reveals consistent barriers that prevent value realization.

People, Organization, and Process Blockers (Primary Constraints)

These dominate agentic and Conversational AI ROI failure and account for the largest share of roadblocks.

- Lack of expertise to manage unstructured data.

- Low adoption: people struggling to use AI in their daily work.

- Shortage of artificial intelligence talent.

- Organizational silos limiting cross-functional collaboration.

- Difficulty aligning initiatives with firmwide strategy.

- Social resistance and labor concerns limiting scaling.

- No leadership support or commitment.

- Missing clear metrics and ROI measurement.

Technology and Data Blockers (Secondary, but Still Material)

These limit AI performance and scalability, indirectly suppressing ROI.

- Challenges with compliance and responsible AI business implementation.

- Lack of access to high-quality data.

- Potential hallucinations and lack of explainability.

- Insufficient model accuracy and reliability.

- AI-driven security risk management.

- High and hard-to-control scaling of AI development costs.

- Difficulty in system integration with legacy tools and APIs.

Use Cases that Drive High AI ROI: Examples Across Industries

The most important question for executives is whether meaningful returns are actually being achieved in reality. The following success stories show how organizations across sectors are translating intelligentization into tangible business outcomes.

Finance & Insurance

- Applied advanced models to real-time transaction monitoring and fraud detection.

- Outcome: Increased detection accuracy while lowering false positives by up to 200%, protecting revenue without adding customer friction.

One of the UK’s leading providers of insurance

- Launched a GenAI–powered FAQ assistant to deliver instant, compliant answers to complex insurance queries and reduce pressure on customer support teams.

- Outcome: Lower agent escalation and handling times, higher containment rates, and improved policyholder engagement.

- Implemented AI to aid in identifying financial crime and monitoring transactions.

- Outcome: Achieved 2–4× improvement in detection rates and significantly fewer false alerts by 60%, improving compliance efficiency.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Energy & Utilities

- Used AI-based predictive analytics to monitor equipment health across upstream and downstream assets.

- Outcome: Lowered unplanned downtime by up to 20%, delivering cost savings of about $2 billion each year.

US-based independent energy and carbon management company

- Integrated an agentic conversational data analysis tool to give non-technical teams instant access to complex energy and carbon data.

- Outcome: Quicker decisions through self-service analytics and improved operational efficiency.

- Used AI and advanced analytics to optimize drill planning, access historical data instantly, and support faster, safer decision-making for wells engineers.

- Outcome: Between 2022 and 2024, increased operating production by ~4% and prevented around 10% more shutdowns.

Healthcare & Life Sciences

- Applied artificial intelligence to transcribe and summarize patient visits to care quality.

- Outcome: 500 lives saved annually by AI-based alerts.

American academic medical center

- Rolled out a conversational assistant to automate internal HR and benefits support.

- Outcome: Lower call center workload, faster access to accurate policy information for employees, and enhanced operational efficiency.

- Uses GenAI and machine learning to continuously learn from lab and clinical data, predict drug targets and molecules, and rapidly test and refine them in experiments.

- Outcome: Accelerates drug discovery, improves prediction accuracy across programs, and increases the likelihood of developing more effective therapies faster.

Logistics & Transportation

- Deployed an AI-powered, multi-channel parts sourcing assistant to automate aircraft component requests, order tracking, and FAQs for airline customers.

- Outcome: Lower inbound call volume, faster handling of urgent part requests, and improved support team efficiency.

- Testing LLM-supported pricing to dynamically adjust domestic airfare based on market conditions, demand patterns, and competitive signals.

- Outcome: Delivered strong enough revenue performance in testing to justify expanding its use from 3% to a planned 20% of the network.

Telecom & Media

- Building a GenAI platform that enables engineers to rapidly develop, deploy, and monitor AI-powered RAN applications.

- Outcome: expected to cut RAN app development and launch times by 60–70%, while reducing costs and improving network reliability and energy savings.

- Used intelligent personalization to optimize content recommendations and retention strategies.

- Outcome: Estimated to save Netflix more than $1 billion annually by lowering churn and increasing engagement.

Retail & Consumer Goods

- Built an internal assistant and analytics dashboard to support customer service teams with faster responses, knowledge automation, and performance insights.

- Outcome: faster response times by up to 65%, ticket resolution completed twice as fast, and operating costs lowered by roughly 30% while improving customer satisfaction by 24%.

- Used AI-driven demand forecasting and inventory optimization across its supply chain and 4,700 stores.

- Outcome: Lower inventory imbalances and fewer stockouts, contributing to margin stability at enterprise scale.

- Rolled out its own smart algorithm to optimize packaging and cut waste.

- Outcome: Package Decision Engine saves at least 500,000 tons of packaging a year.

- Introduced its proprietary tool to deliver culturally relevant, personalized content, using exclusive in-house data.

- Outcome: Drove 30% repeat usage among operators, and tripled average engagement time to 13 minutes.

Wrapping Up

AI ROI doesn’t fail because the technology underperforms. It fails when organizations expect value to appear without changing how work gets done, how decisions are made, or who owns outcomes. A rigorous ROI analysis is less about proving success after the fact and more about forcing clarity upfront: what problem matters, where value should show up first, and how it will compound over time.

The companies seeing durable returns treat artificial intelligence as an operating capability, not a collection of experiments. They invest early in workflow redesign, measurement discipline, and governance that links AI outputs to real business action. That’s where ROI stops being debated and starts being repeatable.

If you’re investing in AI and need to move from experimentation to defensible results, our role as an AI ROI consultant is to help you structure that transition — from selecting the right use cases to embedding measurement and accountability into execution. Book a consultation to discuss your case.

FAQ

How Do Companies Measure the ROI of AI Initiatives?

It’s done by combining financial outcomes with operational indicators. Early-stage projects focus on productivity gains, cost avoidance, and error reduction, while more mature programs track margin impact, revenue protection, and scalability. A clear view of AI infrastructure ROI also matters, especially when shared platforms and data foundations support multiple use cases.

How Should Enterprises Evaluate ROI in an AI Strategy?

They link investments directly to business workflows, ownership, and trackable results. Instead of assessing isolated pilots, leaders look at how initiatives scale, compound, and reinforce each other across functions. Well-designed AI integration solutions help ensure that ROI is built into execution rather than measured after deployment.

What Industries are Seeing the Most ROI from AI?

Verticals with high-volume processes and complex decision-making tend to see the fastest returns. Financial services, retail, healthcare, manufacturing, logistics, energy, and telecom consistently report measurable gains from AI adoption. In these sectors, strong change management plays a critical role in turning automation and analytics into sustained business value.

![Why a Managed Dedicated Team Is the Best Model for AI Solutions [Interview with the Director of Delivery]](https://masterofcode.com/wp-content/uploads/2026/02/cover-640x400.jpg)