How It All Started

This was our second project with this organization. Last year, we developed AI-driven conversation simulators to enhance their customer service training. The credit union needed a scalable solution to improve service quality and reduce the time required to bring new staff up to proficiency.

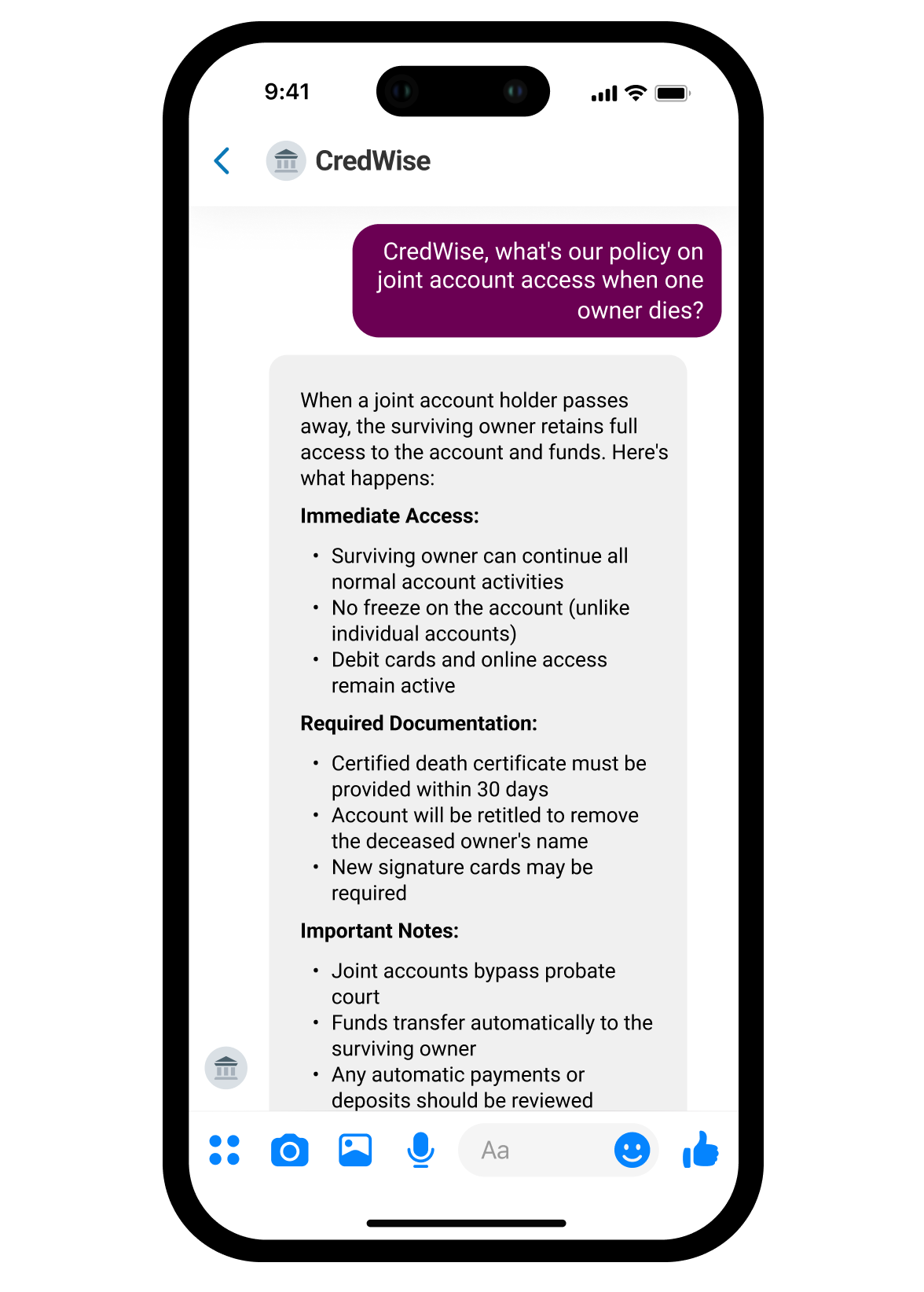

We created an interactive training platform using anonymized customer interaction data to simulate realistic conversation scenarios. Staff could practice handling various situations: from routine account queries to complex financial discussions and complaint resolutions. The system featured dynamic conversation flows, allowing employees to refine their skills in a controlled environment.

Over 1,500 employees completed the program. Customer support satisfaction scores increased by 17%, and average resolution time improved by 1.6 times. Building on this success, they approached us with their next operational challenge.