Debt collection is changing with AI-driven systems that have proven their positive impact on repayment rates. In fact, the average financial burden per household in the US has reached $104,215 across mortgages, auto & student loans, and credit cards. With more than one in four Americans having at least one liability in collections, the demand for effective arrears retrieval services is evident.

The question now: How can debt retrieval firms leverage Conversational AI for customer service while addressing challenges like trust, empathy, and data security?

In a recent experiment, algorithmic calling decisions led to 23.4% higher repayment rates compared to humans. But the results aren’t always so clear-cut. A 2024 study showed that automated callers collected 11% less in repayments than humans, even after a year.

Despite these mixed results, investment in artificial intelligence in this sector is growing. TransUnion reported a rise from 11% of U.S. debt-collection companies investing in AI in 2023 to 18% in 2024, with the main applications being account segmentation and predicting payment outcomes.

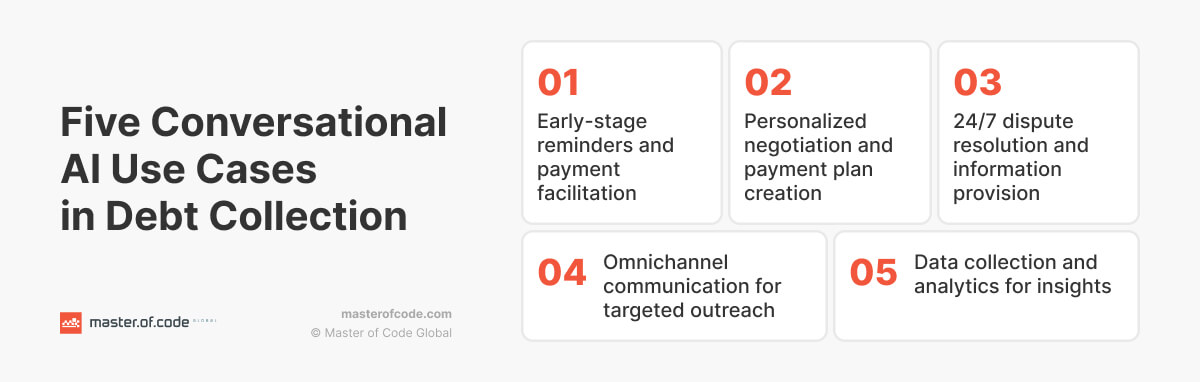

Of course, navigating the field can be daunting, so we’ve crafted this article to shed light on the role of Conversational AI in debt collection. We’ve pinpointed five key use cases where it delivers significant value. We also share expert tips from Olga Bayeva, Olga Hrom, and Daria Vynohradina, seasoned project managers, for fine-tuning your AI communication strategy. Ready to explore the possibilities?

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Table of Contents

Understanding Debt Collection

Imagine you’re an industry professional managing hundreds of accounts, each with its own history and unique challenges. Traditionally, this meant relying on human intuition, making calls, and following up manually. But what if you could use a system that not only handles those tasks but also predicts which accounts are most likely to pay?

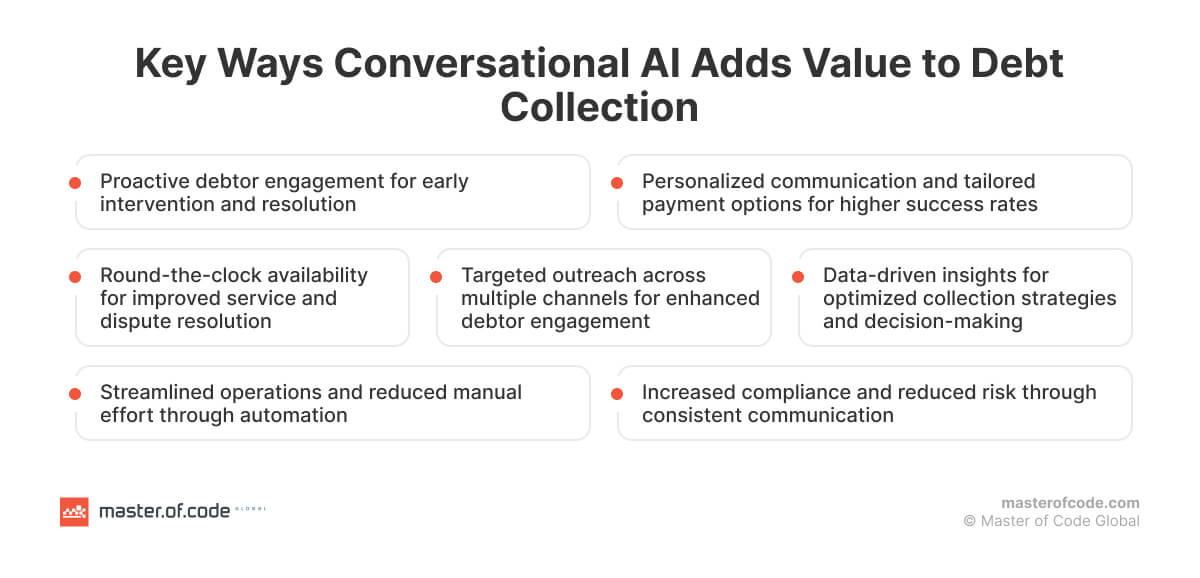

Debt collection AI systems are helping agencies of all sizes transform their operations by using predictive models to analyze debtor behavior. Think of it as having a digital assistant that lets you predict behaviors, identifying the accounts that need attention first, based on real data, not just gut feeling.

Instead of relying on guesswork, artificial intelligence uses data-driven insights for debt collection optimization. This enables such agencies to make informed decisions, prioritize accounts more effectively, and adjust strategies in real-time. By centralizing debt management, AI offers a unified view of every debtor, making it easier to personalize communication.

Intelligent solutions automate routine tasks like sending reminders and offers, leaving more complex, sensitive negotiations to human agents. This partnership frees up agents to focus on cases that truly require human touch, improving efficiency and recovery rates.

Why AI Matters in Debt Collection

52% of debt-collection companies have seen increased account volumes, which has driven many to invest in automated systems to handle the growing workload and improve recovery outcomes. AI’s ability to predict future behavior of debtors is one of its most valuable features. Forecasting models analyze vast amounts of data to determine which accounts are most likely to repay, helping agencies focus on the right ones first. This data-driven approach improves decision-making and reduces guesswork.

One more benefit to mention is that AI as a digital teammate boosts human agents’ ability to manage complex interactions while automating repetitive tasks. This combination of technology and human intelligence is improving the efficiency and effectiveness of debt retrieval.

72% of collections professionals say AI influences manual workload, allowing agents to focus on more complex cases. Thus, the market for AI-powered debt collection is expanding rapidly. It’s projected to grow by USD 2.8 billion with a CAGR of 15% between 2024 and 2029, signaling that technology will continue to reshape the industry. So, let’s explore the areas where technology has the biggest impact.

Key Applications of AI in Debt Collection

Predictive Analytics & Scoring

AI’s ability to analyze vast amounts of data and predict person’s behavior is changing how retrieval of goods is actually managed. Now, a predictive model can identify high-risk accounts and prioritize them for collection efforts. For example, Corewell Health, a large Michigan healthcare system, used predictive analytics to identify high-risk patients and prevent 200 unnecessary hospital readmissions, saving $5 million in the process. Similarly, in debt collection, such models can predict the likelihood of repayment, allowing companies to focus on the most promising accounts.

Automated Communication

Advanced intelligent tools, such as chatbots and AI-driven phone systems, are streamlining debt collection processes. They can handle reminders, payment arrangements, and follow-ups, reducing the need for human intervention in routine tasks. This not only improves efficiency but also increases customer satisfaction by providing timely and consistent communication.

Personalized Payment Plans

By analyzing payment history, income levels, and spending habits, AI can recommend realistic payment schedules, increasing the likelihood of successful repayment. Personalization helps build trust and reduces the chances of accounts becoming overdue again, leading to more favorable outcomes for both people and collectors.

Sentiment Analysis

In debt collection and finance, understanding the emotional state of a debtor can improve communication. AI-driven sentiment analysis tools can analyze the tone and content of a client’s messages or voice to detect frustration, confusion, or willingness to pay. This allows collectors to adjust their approach accordingly, shifting from a more assertive strategy to a compassionate one when needed, improving engagement.

Real-time Compliance Monitoring

Aligning with regulations like the Fair Debt Collection Practices Act (FDCPA) is critical in this industry. GAI can automate real-time compliance monitoring, ensuring that collection efforts adhere to legal standards. By flagging potential violations during interactions, AI helps agencies reduce the risk of legal issues and guarantee that collection practices remain in line with regulations, protecting both businesses and consumers.

Fraud Detection

This is a major concern in nearly any business, and debt retrieval isn’t an exception. The good news is that artificial intelligence excels in this area. By analyzing payment patterns and identifying unusual activities, AI can spot signs of fraudulent behavior, such as multiple accounts linked to the same individual or irregular payment amounts. Proactively flagging these activities helps companies minimize financial losses and focus on legitimate accounts.

AI in Debt Retrieval Use Cases

#1. Early-Stage Reminders and Payment Facilitation

The power of Conversational AI shines on the initial steps of debt management after finding widespread adoption in the financial sector. In 2022 alone, over 98 million Americans engaged with bank chatbots, a figure projected to reach 110.9 million by 2026. This highlights the growing comfort and acceptance of AI-assisted financial interactions. Notably, 53% of collection companies employ AI for virtual negotiations, demonstrating its capacity to optimize debt recovery.

To capitalize on this potential, AI-driven tools can be applied to:

- Send automated notifications about upcoming payments, minimum due amounts, and grace periods.

- Guide people through available payment methods and assist with setting up online or recurring transactions.

- Offer basic financial education and resources to help clients manage their finances and avoid future debt.

Such an approach yields significant benefits for businesses, including:

- Proactive outreach to people before accounts become delinquent, potentially preventing escalation.

- Frictionless operations through automation of reminders, freeing up staff for complex cases.

- Elevated customer experience with personalized and convenient communication channels tailored to individual preferences.

#2. Personalized Negotiation and Payment Plan Creation

Generic communication often leads to frustration and missed opportunities for both debtors and agencies. Conversational AI is changing this dynamic by enabling bespoke negotiation and payment plan creation. With 56% of companies already employing AI for customer segmentation, the ability to tailor offers to personal circumstances is becoming the norm.

The shift towards personalized solutions empowers debtors to take control of their financial situation. It also allows for more efficient use of collector’s time, as they can focus on more complex cases that require human intervention.

AI use cases in finance include:

- Engagement in interactive dialogues to estimate individual possibilities and preferences.

- Analysis of client data to dynamically generate tailored programs with flexible terms and options.

- Various payment scenarios to help customers understand the impact of different choices on their overall repayment.

The key advantages of these applications include:

- Increased engagement and cooperation through a more empathetic and understanding approach.

- Improved debt recovery rates by offering realistic and manageable plans that clients are more likely to adhere to.

- Advanced compliance by ensuring all interactions and agreements observe regulatory requirements.

#3. 24/7 Dispute Resolution and Information Provision

Debt recovery doesn’t adhere to a 9-to-5 schedule. Debtors may have questions or need to resolve disputes at any time, day or night. To meet this demand, AI systems offer 24/7 availability through both chatbots and voice Conversational AI. In fact, 36% of companies already utilize automated self-service capabilities, and 29% plan to add bots or digital assistants in the next two years. Additionally, 28% of businesses employ Interactive Voice Response (IVR) to elevate communication effectiveness and facilitate smoother operations.

To ensure round-the-clock assistance, organizations can integrate conversational interfaces to:

- Address common queries regarding balances, payment history, and due dates.

- Guide clients through settlement mechanisms, including submitting supporting documentation and tracking case progress.

- Provide real-time updates on account status and transaction processing.

- Suggest self-service options for procedures like updating contact info or requesting extensions.

Such an uninterrupted access to services brings significant benefits like:

- Improved customer satisfaction through prompt and accessible support.

- Faster dispute resolution and reduced case backlog.

- Increased operational efficiency through automation of routine inquiries and tasks.

- Heightened reliability by ensuring consistent and accurate data dissemination.

- Greater transparency and trust in the debt retrieval process.

#4. Omnichannel Communication for Targeted Outreach

The modern debtor prefers digital communication channels, and statistics reflect this trend. Online outreach boasts a 20-30% higher success rate compared to traditional means. Yet, many collection agencies struggle to personalize interactions and navigate the various media efficiently. This is where artificial intelligence steps in.

It bridges the gap between user preferences and successful outreach through personalized conversational customer engagement. With 47% of businesses already using AI to recommend communication methods and 37% leveraging it to help customers find the right channels, the industry is clearly recognizing the value of this technology. However, there’s still room for improvement, as 57% of companies express concern about effectively connecting with consumers.

To implement omnichannel tactics firms can integrate virtual agents to:

- Decipher individual communication behavior and habits to pinpoint the optimal medium for establishing rapport.

- Segment clients based on demographics, debt type, and history to deliver tailored messages.

- Automate message delivery across multiple channels, ensuring consistent and timely involvement.

- Track and analyze responses to refine future outreach approaches.

The advantages of these applications are also numerous:

- Improved response rates by reaching debtors through their preferred touch points.

- Higher debt recovery metrics due to more effective communication strategies.

- Optimized resource allocation by focusing efforts on the most promising channels.

- Enhanced brand image by demonstrating a commitment to customer-centric interaction.

#5. Data Collection and Analytics for Insights

In the realm of debt recovery, knowledge is power. The more data you have about debtors, the better equipped you are to formulate effective collection strategies. A survey of lenders revealed that ML significantly improves data analytics for 86% of respondents and boosts productivity for 77%. In the receivables management landscape, a significant portion of companies are already utilizing AI to predict payment outcomes (58%), analyze account lifecycles (47%), and anticipate consumer behavior (46%).

To extract actionable insights from collected datasets, digital agents are employed to:

- Record and transcribe conversations to capture info about client’s sentiments, communication styles, and financial challenges.

- Examine conversation transcripts to identify patterns, trends, and common objections.

- Track responses and engagement metrics to measure the effectiveness of different strategies.

- Integrate data from multiple sources to create an exhaustive picture of each debtor.

Such applications of artificial intelligence result in:

- Improved forecasting of customer behavior and payment likelihood.

- Enhanced segmentation and targeting for personalized outreach.

- Optimized workflows and increased operational efficiency.

- Proactive identification of compliance risks and potential issues.

- Ongoing refining of tactics based on real-time performance data.

#6. Conversational AI Debt Collection

The integration of conversational intelligence transforms operations into agile, customer-centric ecosystems. By combining behavioral data, predictive analytics, and dynamic dialogue, companies can recover debts faster, reduce manual workload, and maintain positive client relationships – a crucial differentiator in a competitive market. According to market research by Technavio, the global AI-for-debt-collection sector is projected to grow with a 15% CAGR through 2029.

#7. Conversation Intelligence for Collections Companies

Analyzing debtor-agent interactions is crucial for improving recovery rates and fostering better communication. AI in collections assesses both voice and text conversations between agents and debtors, identifying patterns in language, sentiment, and overall engagement.

These systems enable businesses to gain valuable insights into each dialogue, helping to improve future interactions. By identifying moments when a person is more likely to engage or showing when agents are missing key opportunities, conversation analytics services can directly improve outcomes and strategies.

When using AI, agencies can expect:

- Improved performance: AI analyzes chat data to provide real-time feedback to agents, helping them make more informed decisions and adjust their approach.

- Enhanced debtor relationships: By identifying emotional cues, the technology enables agents to engage with people in a more empathetic and personalized manner.

- Data-driven insights: Conversation intelligence helps companies identify patterns, trends, and areas for improvement, driving more effective debt recovery strategies.

- Increased compliance: AI helps ensure that all communications adhere to legal and regulatory standards, reducing the risk of violations.

#8. Generative AI Debt Collection Operations

Imagine an agent handling thousands of cases each month, each debtor presenting unique challenges. Some may be eager to negotiate, while others may be defensive or uncertain. GAI can automate communication while keeping it personalized and relevant.

Debt collection AI uses advanced language models to craft tailored messages, whether via email, text, or voice conversations. By analyzing past interactions, payment history, and communication preferences, a model generates responses that mimic human tone and style, making every interaction feel more authentic.

For instance, Vodafone uses AI in debt collection operations to automate customer outreach and payment reminders. Their system crafts messages that vary in tone depending on the engagement history, which has helped improve client satisfaction and streamline the retrieval process.

#9. Omnichannel Debt Collection at Scale

People expect flexibility and convenience when it comes to managing their payments. Debt collection with AI and predictive models allows companies to reach financial consumers through various platforms, whether via text, email, phone calls, or even social media, ensuring they are met where they are most active.

With omnichannel debt collection at scale, companies can:

- Increase debtor engagement: Consistent messaging across various platforms ensures no touchpoint is missed, leading to improved immersion and response rates.

- Scale outreach without added headcount: Automating communication across different channels allows teams to reach more debtors without increasing staff or workload.

- Provide better experience: By offering users the option to move between platforms without losing context, companies create a more cohesive experience that fosters trust and reduces friction.

#10. Handling Debtor Negotiations via Text and Email

AI-driven systems can craft tailored messages, suggest payment terms, and even simulate back-and-forth negotiations, all while maintaining compliance and empathy.

A 2025 report by TransUnion showed that 57% of U.S. debt-collection companies already use AI to predict payment outcomes and send personalized messages to people via text and email. This automation allows agencies to engage with consumers around the clock, improving repayment rates while reducing agent workload.

#11. Automatic Documentation of All Debtor Communication Attempts

Instead of treating documentation as a passive archive, AI transforms it into a source of strategic intelligence. By analyzing logged interactions, agencies can identify which outreach methods yield faster responses, which phrases encourage cooperation, and which timeframes maximize success rates. These insights empower managers to fine-tune scripts, optimize channel mix, and predict the best follow-up moment.

#12. Analyzing Debtor Responses to Optimize Collection Strategies

Improving engagement in debt recovery begins with understanding how people react to different communication styles and timing. Modern AI tools go beyond sentiment: they analyze behavioral cues such as response speed, preferred channels, message open rates, and engagement frequency. This helps organizations identify patterns that predict willingness to pay or risk of disengagement.

For example, if analysis shows that friendly reminders via messaging apps perform better with younger demographics, the system can automatically prioritize that channel. Likewise, when delayed responses indicate potential financial stress, recovery specialists can adapt with more flexible repayment options or personalized outreach.

#13. Conversation Analytics for Debt Recovery Teams

While behavioral analytics optimize outreach strategies, conversation intelligence focuses on improving performance inside the organization. These tools automatically record and assess every interaction between a person and a recovery representative, measuring factors like empathy, tone consistency, and compliance with regulatory requirements.

Supervisors can then review these insights to coach agents, refine training materials, and ensure all conversations meet ethical and legal standards. At scale, this transforms individual interactions into organization-wide learning: consistent messaging, reduced compliance risks, and higher-quality engagement that protects both the company’s reputation and the person’s experience.

Benefits of AI in Debt Collection

Higher Recovery Rates

For years, teams relied on instinct, deciding which accounts to chase first, hoping intuition aligned with outcome. Today, AI in debt recovery strategies replaces that guesswork with precision. By analyzing thousands of data points, from payment history and spending patterns to communication tone and timing, AI can pinpoint which accounts are most likely to pay and which need a different approach.

Imagine two clients with identical balances. One consistently opens messages within minutes; the other ignores them for weeks. AI detects those behavioral nuances instantly, alerting recovery specialists to focus where resolution is most likely and adjusting outreach tone for the disengaged. This intelligent triage shortens recovery cycles and ensures that every action contributes to measurable results.

Improved Daily Workflows

User-friendly AI interfaces in the debt collection sector are changing everyday operations by taking over routine, time-consuming tasks that once required constant manual effort. Instead of spending hours sending reminders, confirming payments, or updating account notes, teams can now rely on intelligent systems that handle these steps automatically and in real time.

For example, when a payment deadline passes, the solution instantly sends a personalized message through the person’s preferred channel, logs the interaction, and adjusts the case status, all before an agent even opens their dashboard. This kind of automation prevents delays and ensures every communication happens at the right moment, every time.

Enhanced Customer Experience

Picture this: a person juggling multiple bills late at night finally opens a message from their debt recovery service. Instead of a generic reminder, the message greets them by name, references their payment history, and offers a manageable plan. That’s an example of modern conversational systems understanding context, not merely generating identical messages.

By analyzing previous interactions, tone, and payment behavior, AI adapts its messaging style, offering reassurance when someone is anxious or clarity when confusion arises. This level of empathy at scale transforms what was once an uncomfortable experience into a collaborative dialogue.

Challenges of AI in Debt Collection

Trust and Empathy

Issue: People can feel uneasy when discussing finances with a machine, particularly when emotions are involved. Automated systems that sound too robotic or impersonal can damage trust and cooperation.

Data Security and Bias

Issue: Debt recovery involves handling large volumes of confidential financial data. Any misstep in storage or transfer could expose companies to legal penalties or reputational harm.

Integration Costs

Issue: For smaller or mid-sized agencies, AI deployment can seem intimidating, from budget limitations to legacy software that doesn’t integrate well.

ROI Measurement

Issue: Many agencies struggle to assess the real financial impact of AI. Gains in efficiency or satisfaction are clear, but linking them to direct revenue is harder.

AI Ethics in Debt Collection

Transparency

As artificial intelligence in debt collection becomes central to decision-making, transparency is essential. When algorithms decide who gets contacted, when, and how, people deserve to know why. Explainable AI models can reveal the factors that influenced a “high-risk” label or repayment offer, enabling organizations to maintain accountability and build public trust.

Fairness

AI systems can unintentionally mirror human bias embedded in historical data, leading to unfair treatment of specific groups. To prevent this, we establish continuous bias audits, diverse data sampling, and algorithmic fairness testing. Embedding human review checkpoints ensures that fairness remains a human responsibility.

Privacy

Ethical systems must collect only what’s necessary, anonymize personal identifiers during training, and clearly communicate how data is used. Beyond GDPR and CCPA compliance, this includes giving individuals more control, allowing them to view, dispute, or delete their data when appropriate.

Step-by-Step Plan for AI in Debt Collection

Step 1: Identify Your Pain Points

Before starting with implementation, work with financial services AI consulting experts to clearly define the issues in your processes. Are you struggling with long response times, missed opportunities for follow-up, or low recovery rates? For example, if your team spends too much time sending reminders or answering routine inquiries, chatbots could automate these tasks, freeing agents for more complex cases.

Step 2: Define Your Goals

Clearly outline what you hope to achieve with AI implementation. Whether it’s improving collection rates, reducing agent workload, or enhancing engagement, having specific, measurable goals ensures that smart solutions align with your business objectives. For example, you might aim to reduce response time by 50% or increase recovery rates by 20% within six months of incorporating AI.

Step 3: Evaluate AI Solutions

Once your goals are defined, research a tool for the debt collection industry that specifically addresses your pain points. Evaluate solutions based on their scalability, ease of integration with existing systems, and cost-effectiveness. Look for AI platforms with proven success in the industry and ensure they offer functionalities such as predictive analytics, automated communication, and personalized engagement.

Step 4: Start Small, Scale Fast

Instead of implementing AI across all aspects of your processes at once, begin with a pilot program. Start with a single application, such as automating payment reminders or implementing sentiment analysis to improve debtor interactions. Monitor the results and, once you’ve achieved success, expand the tools to other areas, gradually scaling the solution across your operations.

Step 5: Train Your Team

Even though using AI to optimize debt collection campaigns helps handle the workload, you still need your employees’ expertise. Ensure that your team is properly trained to work alongside AI systems. They should understand how to use these tools effectively, interpret AI-driven insights, and step in when a more personal approach is needed. Master of Code Global provides dedicated workshops to empower your staff with new capabilities and increase the acceptance level.

Future Trends of AI in Debt Collection

- Increased Personalization: Artificial intelligence will enable even more personalized communication strategies, adapting to a person’s preferences and financial situations to boost engagement and recovery rates. This shift toward hyper-personalization will be crucial in the future of the debt collection industry, as consumers increasingly expect tailored interactions.

- Predictive Analytics Expansion: AI will continue to influence this area, helping agencies not only identify high-risk accounts but also forecast payment behaviors with greater accuracy, leading to more proactive debt management.

- Integration with Voice and Chatbots: Speech-enabled virtual assistants will become more common, allowing debtors to interact through voice commands or texts, creating a frictionless experience across channels.

- Greater Compliance Automation: As regulations around debt retrieval tighten, AI will play a larger role in ensuring adherence by automatically adjusting strategies to stay in line with ever-evolving laws and guidelines.

- AI-Powered Fraud Detection: The technology will increasingly be used to detect fraudulent activity, spotting unusual patterns or discrepancies in client data to reduce financial risk and guarantee resources are directed towards legitimate accounts.

Your Roadmap to Successful Debt Management with AI

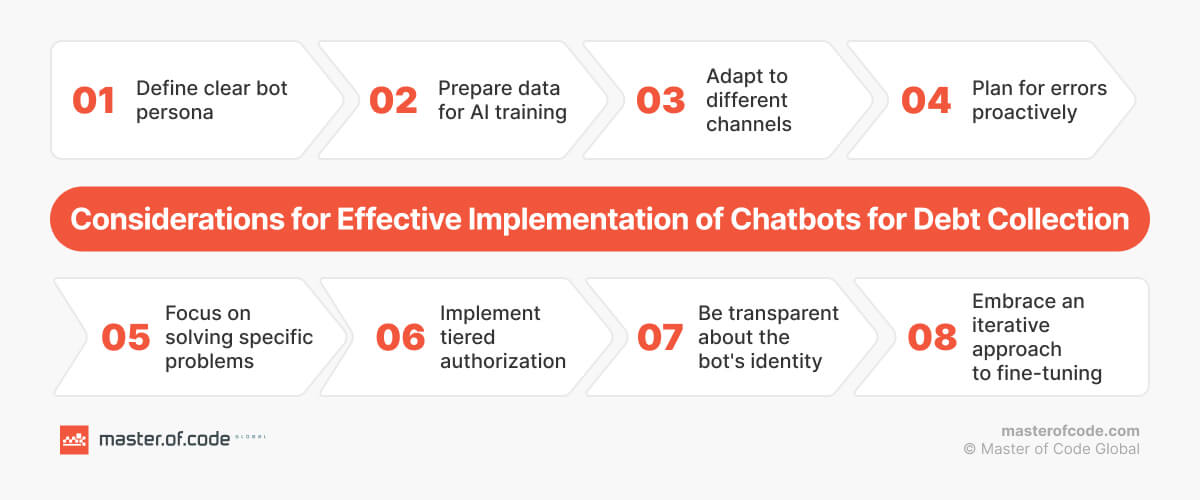

Realizing the full benefits of Conversational AI for debt collection requires careful planning and execution. As experts in digital solutions at Master of Code Global, we’ve gathered practical tips from our project managers to ensure successful chatbot integration.

Olga Bayeva, Olga Hrom, and Daria Vynohradina, with their extensive experience in Conversational AI services, recommend the following:

- Determine the chatbot’s communication style, tone, and personality to guarantee consistent and appropriate interactions with debtors.

- Tailor bot design and features for each channel (SMS, WhatsApp, etc.), considering platform-specific limitations and user preferences.

- Anticipate potential errors and incorporate solutions into the flow, including informative error messages and notifications.

- Establish different access levels for users based on their needs and permissions to protect sensitive information.

- Be upfront about the bot’s identity and capabilities to manage expectations and build trust.

- Invest in validating and refining the data used to train the AI model, ensuring correct and reliable answers.

- Budget for continuous oversight, retraining, and fine-tuning to keep the chatbot effective and up-to-date.

Transform your debt collection from reactive to proactive with the power of Conversational AI. Rely on personalization, optimized operations, and data-driven insights to improve recovery rates and enhance debtor engagement. Contact Master of Code Global to discover how our tailored conversational solutions can upgrade your business strategy and drive sustainable success.

FAQ

How can businesses leverage data analytics through Conversational AI to identify trends in overdue payments and improve collection strategies?

Debt collection agencies of all sizes can use it to track personal behaviors and identify patterns in missed payments. By analyzing conversation transcripts, payment history, and debtor engagement, models can highlight trends such as common objections or payment delays. This data enables businesses to adjust their strategies, offering more personalized payment plans or reminders, ultimately improving recovery rates.

What steps would need to be taken to implement Conversational AI as a collection debt service, particularly focusing on compliance evaluation?

To do this, businesses should start by selecting AI solutions that are compliant with data protection regulations like GDPR and CCPA. Steps include:

- Defining clear compliance rules for the AI to follow during interactions.

- Regular audits of the system to ensure it meets legal standards.

- Training agents to work alongside AI, especially for sensitive cases that require human intervention.

Does the acoustic model choice really affect average handle time when automating debt-collection calls?

Yes, the choice of acoustic model significantly impacts this metric. AI systems with better speech recognition and natural language understanding (NLU) models can process calls more efficiently, reducing the time spent on clarifications and improving conversation flow. Optimizing acoustic models leads to more accurate responses and faster resolution of debtor inquiries, ultimately reducing AHT in automated calls.

Why are AI agents better than chatbots in debt collection?

They are more advanced than basic bots because of machine learning and natural language processing (NLP) used to understand context, emotions, and intent during dialogues. Agents can handle complex scenarios, adapt their responses based on debtor interactions, and make personalized decisions – traits that chatbots typically lack. This allows an intelligent agent to offer more effective communication, better recovery rates, and handle difficult conversations without human escalation.

What’s the best way to train an AI collections assistant to verify identity, capture consent, and stay compliant on financial calls?

This can be implemented by integrating strict protocols, which include:

- Using secure authentication methods (e.g., multi-factor authentication or knowledge-based questions).

- Programming AI to ask for explicit consent at the start of the communication and document it.

- Training the model to follow compliance scripts based on relevant financial regulations (e.g., FDCPA) during every call.

- Regularly testing and auditing interactions to ensure they meet compliance standards.

How reliable are AI phone calls for handling debt collection conversations without human backup?

Automated phone calls can handle many tasks reliably, especially for routine activities like reminders, payment arrangements, and basic inquiries. However, their effectiveness diminishes when dealing with complex, emotionally charged, or non-standard situations. AI is best used for high-volume, low-complexity tasks, with human backup available for more nuanced conversations, staying compliant, and fostering better debtor relationships.

Let us help you connect your brand with customers where they communicate today. Chat or voice.