How much of your team’s potential is still tied up in tasks that AI could and should be handling?

In financial services, this is more than a productivity issue; it’s a strategic imperative. 32–39% of work across banking, insurance, and capital markets is fully automatable, while another 34–37% can be significantly augmented with artificial intelligence. That’s not just an efficiency gap—it’s a competitive opportunity.

In 2023, financial institutions invested $35 billion in intelligent systems. By 2027, that number is expected to reach $97 billion, making the field one of the most AI-invested industries globally. And the benefits aren’t limited to cost-cutting. 70% of executives believe technology will directly drive revenue growth in the coming years.

The shift is happening now. Leaders are turning automation into an engine for accuracy, speed, and scale.

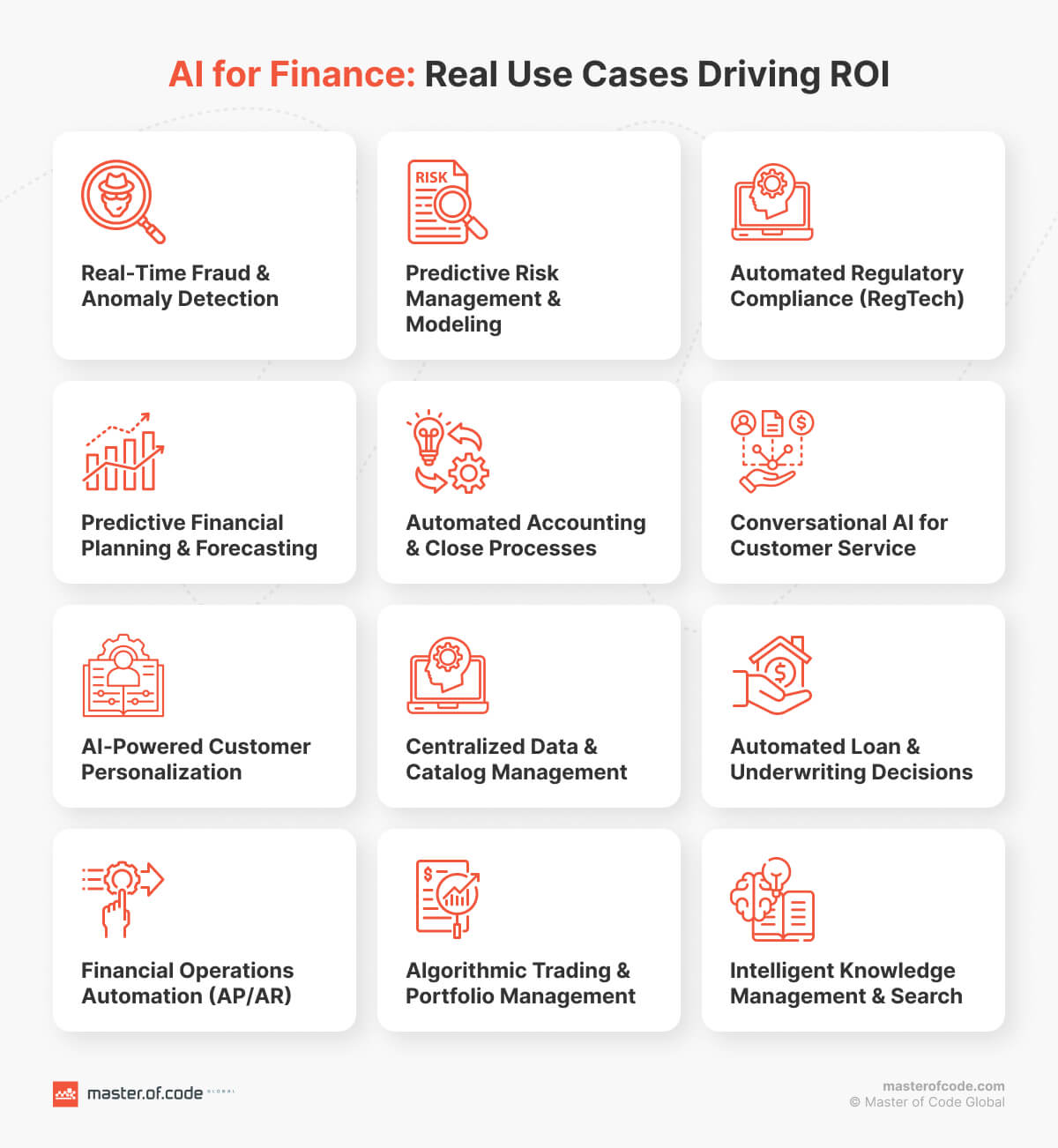

This article outlines 12 high-impact AI use cases in finance with real examples, clear advantages, and actionable takeaways for decision-makers ready to drive ROI.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Table of Contents

Core AI Use Cases in Finance

Lauren leads risk operations at a mid-sized bank. Her team works hard, digging through anomalies, sorting out false alarms, and staying ahead of constant compliance changes. But it’s a grind. New threats keep coming, margins keep tightening, and they’re always one step behind.

Now picture this: instead of chasing problems after they happen, Karen’s team gets real-time alerts, powered by artificial intelligence. The system spots patterns, flags fraud instantly, and keeps learning over time. No more delays. No more wasted hours. Just faster, smarter decisions.

Below are the most strategic use cases for AI in financial services that make that kind of transformation possible. Real solutions with real ROI, from risk assessment to forecasting and beyond.

Real-Time Fraud & Anomaly Detection

Advanced algorithms watch every transaction like a digital detective, recognize odd patterns, unusual behavior, and signs of fraud the moment they occur. No waits, no manual review queues. Just instant awareness. This kind of speed changes everything. Instead of sifting through alerts after the fact, finance teams can act instantly. The result? Lower losses, faster response times, and fewer false positives.

Mastercard’s AI has improved fraud detection accuracy by up to 300%, while HSBC now catches up to 4x more crime and has cut wrong alerts by 60%. With smart systems, fraudulent activities don’t slip through the cracks; they get stopped in their tracks.

Predictive Risk Management & Modeling

In finance, what you don’t see coming can hurt the most. Artificial Intelligence helps teams shift from reacting to anticipating, spotting early signs of credit risk, market volatility, or operational exposure before they escalate. Predictive models analyze thousands of variables in real time, giving leaders the foresight to adjust course before trouble lands. And the payoff is real: banks that embed AI across risk and decision-making functions could see a 20%+ increase in capital efficiency and a 30–50% reduction in losses.

That’s not just better analytics. It’s a smarter, faster way to protect profits in a world that rarely slows down.

Automated Regulatory Compliance (RegTech)

Compliance never sleeps, and your systems shouldn’t either. With thousands of changing rules and jurisdictions, manual tracking is a recipe for missed deadlines and costly errors. AI-powered platforms continuously scan for regulatory changes, run rule-based checks, and pinpoint inconsistencies automatically. That means fewer neglected filings, faster audit preparation, and lower risk of fines.

HSBC is a prime example. By deploying AI across its financial crime systems, it now detects 2-4× more suspicious activity while reducing alert volumes by 60%, cutting manual review time significantly.

For leaders, that’s the difference between firefighting and foresight. AI does the groundwork so teams can focus on strategy, not cleanup.

Predictive Financial Planning & Forecasting

Roadmapping shouldn’t feel like guesswork. AI gives finance teams a clearer picture of what’s coming by analyzing trends, market shifts, and real-time data to spot what’s likely to happen next. Need to forecast cash flow? Rework a budget mid-quarter? AI helps you do it faster and with more confidence. No more waiting for month-end reports to see where things went off track.

When finance leaders can see around corners, they make better moves: earlier, smarter, and backed by data that actually reflects reality.

If you’re curious how Generative AI is already shaping this shift, you can read more here.

Automated Accounting & Close Processes

Every month feels like a race to close the books: chasing numbers, fixing discrepancies, and racing against time. AI makes that chaos a thing of the past. By automating reconciliations, journal entries, and report generation, AI handles the heavy lifting so teams can concentrate on reviewing exceptions, not entering data. That adds up fast.

Automation can cut 30–40% of the time spent on these tasks, reduce errors by up to 90%, and speed up close cycles by as much as 85×.

What used to take days now takes hours or minutes. And more than that: your employees suddenly have the breathing room to shift from closing books to shaping business strategy.

Conversational AI for Customer Service

Your customers want answers now, not after a long wait on hold or a maze of menu options. AI-powered virtual assistants step in to deliver fast, accurate support around the clock.

To make it work at scale, partnering with the right finance chatbot development company ensures your assistant is built to meet both user expectations and business goals.

Whether it’s checking a balance, handling routine inquiries, or walking someone through onboarding, conversational AI completes the job instantly and learns from every interaction to get better over time.

Just look at Erica, Bank of America’s virtual assistant. It has handled over 2 billion interactions and serves more than 42 million clients, resolving most requests in under 44 seconds. That’s efficient support delivery, without increasing your headcount.

For a deeper look at how banks and fintechs are scaling CX with automation, read more about chatbots in finance.

AI-Powered Customer Personalization

Imagine knowing exactly what your client needs before they ask. That’s the kind of impact AI can have. Say a customer’s rent just went up and their monthly spending spikes. Instead of waiting for them to call in, your system flags the change and proactively offers budgeting tips or a savings plan, automatically, and in the right tone. These personalized touches build trust. They turn your bank into more than a service provider, they make you a financial partner. The result? More loyalty, more engagement, and a longer lifetime value.

Centralized Data & Catalog Management

Financial institutions have tons of information. But when it’s scattered across tools, teams, and formats, it becomes a blocker, not a driver.

AI helps bring it all together by creating a unified, searchable catalog. That means faster model training, easier compliance audits, and quick access to trusted resources.

And it matters: 69% of AI initiatives fail to scale due to fragmented, messy data and disconnected systems. A breakdown rooted more in poor infrastructure than in algorithms. When your data is well-structured and accessible, every other function, from forecasting to personalization, can truly make a measurable difference.

Automated Loan & Underwriting Decisions

Loan processing doesn’t have to be slow, manual, or full of guesswork. AI speeds things up by analyzing creditworthiness, verifying documents, and assessing risk in seconds not days. It brings consistency to underwriting, reduces human bias, and fosters faster, more accurate lending decisions. The outcomes are better customer experience, fewer delays, and stronger portfolio performance.

Here is one of the most compelling AI in finance examples: Upstart approves 27% more loans than traditional models and offers 16% lower average APRs (Annual Percentage Rates) for approved borrowers.

Financial Operations Automation (AP/AR)

Employees spend hours every week chasing invoices, matching payments, and sorting out small errors that slow everything down. AI handles all of that: quietly, accurately, and in real time. It keeps your accounts payable and receivable flowing without the usual friction. Approvals get done faster, exceptions are flagged automatically, and no one’s stuck babysitting spreadsheets.

The results speak for themselves: teams using automation are saving up to 90% of their time, reclaiming 60% of their capacity for more strategic work, and cutting financial ops costs by nearly 25%. Less manual effort, more meaningful impact.

Algorithmic Trading & Portfolio Management

When milliseconds can make or break millions, waiting to react isn’t an option. That’s why top investment firms use AI to spot signals, track markets in real time, and ensure smart trading decisions in an instant.

Two Sigma is a standout example. From the start, they’ve built their company like a tech firm, running hundreds of AI models across stocks, macro trends, and fast-moving markets. Their team of over 1,600 people, including 250 PhDs, develops systems that adjust portfolios automatically as data, news, and sentiment shift.

With $60 billion under management, they’ve proven that algorithmic trading is reliable, scalable, and built for the long game. For firms looking to stay competitive, AI isn’t just a nice-to-have anymore. It’s the new standard.

Intelligent Knowledge Management & Search

Everyone’s been there, scrolling through endless folders, Slack threads, or email chains just to find that one report. It’s not just frustrating, it’s a resource drain. AI changes the game. It scans, tags, and organizes everything from internal docs to real-time data feeds, then pulls up exactly what you need with a simple search. Ask a question like you would a teammate, and the right answer appears instantly.

No more bottlenecks. No more guessing where the file lives. Just fast, clear access to the knowledge that keeps your business moving. Because when your team spends less time looking, they have more time thinking, deciding, and doing.

Master of Code Global in Action: Client Success Stories

It’s one thing to have a strategy; it’s another to make it work in the real world. That’s where we come in. At Master of Code Global, we help financial organizations turn ideas into results they can actually measure.

From saving time to reducing spend and building smarter services, our specialists assist businesses in putting AI to good use. These stories show what’s possible.

Microsoft-Native AI FAQ Chatbot for Financial Institution

A leading member-owned banking institution approached Master of Code Global with the goal of improving internal operational efficiency. During our assessment, we identified a critical challenge: staff was spending too much time manually searching for policy information and responding to complex regulatory inquiries. Rather than rushing into a solution, we decided to build a strong foundation first.

We integrated Microsoft-native AI into their existing Microsoft Teams platform, allowing staff to access knowledge bases, document repositories, and policy information through natural, conversational dialogue. The AI assistant was trained in financial terminology, ensuring precise and relevant responses. Additionally, robust fallback mechanisms were implemented to handle ambiguous queries.

The impact was immediate. The time spent searching for policy information was reduced by 85%, and internal support tickets related to procedural questions decreased by 42%. Moreover, 93% of AI responses were rated as accurate and helpful by users. The AI solution didn’t just automate processes—it empowered staff to work smarter, faster, and more efficiently, while improving internal service quality.

Automated Voice Assistant for Credit Account Inquiries

A financial institution approached Master of Code Global with the challenge of enhancing customer service while reducing operational costs. The goal was clear: automate routine credit account inquiries without compromising security or the customer experience. Our solution was to develop an enterprise-grade Voice AI agent that could autonomously handle authentication, transaction processing, and account updates through natural voice interactions.

We started by integrating the system with the bank’s core platforms, ensuring seamless and secure communication. The Voice AI was trained to handle complex customer requests, with built-in fraud protection mechanisms to safeguard sensitive information. The result was transformative. The Voice AI agent autonomously handled over 156,000 calls per month, achieving a 94% first-call resolution rate. With $7.7M saved annually in operational expenses, customer satisfaction soared to 88%, proving the AI’s effectiveness in streamlining credit account management.

A Comprehensive AI Architecture Review

When an asset management firm sought to future-proof their GenAI ecosystem, they turned to Master of Code Global for a comprehensive audit. The firm needed to ensure their existing AI infrastructure was ready to scale, improve system performance, and identify any security risks before production growth.

We developed a tailored evaluation framework to thoroughly assess their GenAI architecture, reviewing everything from data handling to system integration. Our audit revealed an 87% potential for performance improvement, pinpointed 8 security vulnerabilities, and outlined strategic infrastructure changes that could increase system capacity by three times. The end result was a fully optimized AI environment, primed for future expansion while ensuring robust security and enhanced performance.

AI Revenue Engine for Finance

A North American B2B lending company came to Master of Code Global with one goal: explore AI to sharpen their competitive edge. But during an AI readiness audit, we uncovered a deeper issue. Their critical business data was scattered across disconnected systems, making it nearly impossible to track which marketing efforts were truly paying off. Instead of jumping into automation, we built a solid foundation. We integrated data from ad dashboards, CRM, and the core lending system into a single, intelligent analytics platform. Then we added a custom Agentic AI assistant to surface insights, flag anomalies, and deliver performance snapshots in plain language.

The impact was fast and measurable. Within six months, the company saw a 35% boost in marketing ROI, a 22% drop in customer acquisition costs, and recovered 15+ hours per week that teams had spent manually stitching together reports. The AI didn’t just support decisions, it made smarter growth a daily reality.

Advanced RCS Messaging for a Global Fintech

A global cross-border payment provider was struggling with a messy communication system. Over time, their channels had multiplied—email, SMS, app alerts, portal messages—creating confusion for both customers and support teams. Clients were getting frustrated, satisfaction was slipping, and costs kept climbing.

Our team stepped in with a smarter solution: a unified RCS Business Messaging platform. It brought every dialogue, automated or human, into a single thread, no matter how it started. Customers could ask questions, confirm payments, and solve issues right inside their native application, while agents saw the full conversation history in one place.

The impact was immediate. Customer service calls dropped by 42%, satisfaction scores jumped 27%, and employees were resolving issues 3x faster. With 94% read rates on critical alerts and $1.2M saved annually, messaging went from a pain point to a competitive advantage.

AI Voicebot for Banking Support

As this mid-sized retail bank grew, so did the volume of inquiries. Account questions, loan updates, password resets—it all hit the client care unit at once. Wait times increased, service felt patchy, and customers noticed.

They didn’t need more agents. They needed a smarter way to handle the basics, fast. That’s where we stepped in. Working closely with their team, we built a voice assistant that speaks their clients’ language—literally. It answers the most common queries in real time, understands the intent behind a request, and even knows when to loop in a human if things get tricky.

It’s always on, day or night, and talks in multiple languages, keeping pace with their growing and diverse audience.

In just months, the bank saw:

- A 26% drop in call center load;

- 94% accuracy on FAQ responses;

- A 79% first-call resolution rate.

That’s less waiting, more doing, and a customer experience that scales without sacrificing quality.

Embeddable Voice Assistant

When one of our clients asked how to add voice functionality to their mobile app without starting from scratch, we saw an opportunity to build something reusable. Most such solutions are either locked into ecosystems or too bulky to embed natively.

So, we created our own embeddable voice assistant. It’s a lightweight, modular framework built in Swift (iOS) and Kotlin (Android), with full compatibility across React Native and Flutter. The tool is fast, flexible, and easy to tailor to any brand tone or customer journey.

With this instrument, we can now prototype and provide custom experiences in a fraction of the usual time. Whether it’s voice-guided shopping, hands-free healthcare access, or in-app assistance, our framework makes it possible without trade-offs.

Key Benefits:

- Speeds up development and time-to-market;

- Seamlessly blends into any app’s UI and UX;

- Fully customizable speech tone, speed, and branding;

- Works across industries and platforms.

The framework now powers multiple client projects and continues to evolve with each use. Voice is no longer a future add-on; it’s a feature we can deliver today.

Strategic AI & CAI Workshops

A leading consumer lending and insurance company wanted to offer 24/7 support, but they didn’t just want a chatbot. They wanted the skills to develop and scale their own. Master of Code designed hands-on workshops for two business units, covering everything from conversation design to technical implementation using Microsoft Azure, LUIS, and Bot Framework.

Together, we launched two chatbots and built internal capabilities to:

- Identify and prioritize use cases

- Design intuitive, brand-aligned conversations

- Deploy and manage bots independently

- Plan for future scaling

Today, they’re running smarter support with full control over their chatbot roadmap and the expertise to grow it.

The Future of AI in Finance: Key Predictions

In this sector, staying competitive isn’t just about using today’s tools; it’s about planning for tomorrow’s challenges. From embedded finance to intelligent agents that can take action on their own, the next few years will reshape how financial institutions work, grow, and support their customers. The leaders won’t be those who just upgrade their tech, but those who rethink how everything connects from data to decisions.

The Shift to Agentic AI Systems

We’re moving past basic automation. The next generation of AI will do more than follow instructions: it will make decisions, adapt on the fly, and handle complex tasks without constant input. Some banks are already piloting AI agents that catch fraud, answer customer questions, and maintain synchronization across systems with minimal oversight. In time, these solutions will become like small digital teams, working behind the scenes to keep operations running smoothly.

Unified Data Ecosystems

Embedded finance, like offering loans or payments inside apps and platforms, is growing fast, from $146B in 2025 to a projected $690B by 2030. But more touchpoints mean more data silos. That’s why financial companies are focusing on bringing everything together: merging their systems, partner APIs, and customer interactions into one connected, AI-ready ecosystem. The goal: faster decisions, better service, and fewer blind spots.

Generative AI for Decision-Making

This technology isn’t just for content anymore; it’s becoming a decision support system. Banks are using it to model market shifts, generate investment ideas, and make sense of complex regulations. With the AI software market expected to hit $800B by 2030, teams that learn how to apply this tech in day-to-day planning will move faster and stay more flexible in uncertain times.

Fintech leaders looking to turn that potential into measurable ROI can explore this roadmap to see what’s working today.

This shows how impactful AI applications in financial services can be when used strategically.

AI Architecture as a Competitive Edge

Old systems can only take you so far. To really benefit from AI, companies need to rethink how their tech is built. That means shifting to flexible, modular strategies that make it easy to test, scale, and stay in control. The firms that reevaluate their stack now will be the ones setting the pace, able to evolve, expand, and lead as the next wave of innovation hits.

Your AI Implementation Roadmap with Master of Code Global

Adopting AI shouldn’t feel like a leap into the unknown. At Master of Code Global, we guide you through every phase with a structured, partnership-led approach, designed to minimize risk, maximize ROI, and keep your objectives front and center.

Phase 1: Discovery + Proof of Concept (Our Strategic Starting Point)

This is where the journey begins and where we stand out. Our Discovery + PoC service helps you explore high-impact use cases, test feasibility in your environment, and build the internal momentum needed for long-term success.

Discovery includes:

- Collaborative workshops to align goals;

- Stakeholder interviews to capture on-the-ground insights;

- Business process analysis to uncover automation and intelligence opportunities;

- Strategic roadmap to guide your AI investment.

PoC covers:

- Isolating a use case with measurable value;

- Testing with real data and real users;

- Validating ROI and earning stakeholder buy-in.

90% of our PoC projects move into full-scale delivery because we make sure they’re rooted in strategy, not guesswork.

Phase 2: Full-Scale Development & Integration

Once the proof is there, we scale up with confidence. Our engineering teams build robust, secure AI systems designed to integrate seamlessly into your tech ecosystem.

This phase includes:

- Agile, iterative development cycles

- Custom AI model creation (LLMs, NLP, ML)

- Integration with existing tools like CRMs, ERPs, and data warehouses

- Enterprise-grade security and compliance protocols

Phase 3: Ongoing Optimization & Governance

AI isn’t a one-and-done deployment. We stay with you to make sure it evolves with your business and continues delivering value.

Our long-term support includes:

- Continuous performance monitoring and reporting

- Model retraining and tuning based on real-world usage

- Strategic consulting for expansion and new use cases

- Governance practices to align with ethical and regulatory standards

Conclusion: Seizing Your Strategic Advantage

Every day you wait, the gap grows between those improving outcomes with smart technology and those stuck solving the same old problems the same old way. AI isn’t just about tools or trends. It’s about making better decisions, faster. About using what you already have: your data, your people, your processes, and putting it to work more intelligently.

That’s where AI consulting in finance comes in, helping you navigate complexity, reduce risk, and unlock value with clarity and speed.

We’re here to help you move with purpose. Big decisions start with simple conversations. Get in touch to see what we can build together.