Your best M&A analyst is a star. But they can’t review 50,000 pages of data room documents before their morning coffee.

An AI agent can.

In finance, speed isn’t just a competitive edge – it’s survival. And the volume of information is exploding: by the end of 2026, global data creation is projected to hit 175 zettabytes, with financial services among the top three contributors.

Yet, despite all the dashboards, automation tools, and outsourced grunt work, decision-makers are still drowning in documents. Due diligence takes weeks. Audit trails hide critical risks. And that promising deal? It might slip through the cracks because your team didn’t have time to parse the fine print.

The problem isn’t talent. It’s scale.

When you hear “AI agents in finance,” you probably think of trading algorithms or chatbot assistants.

But the real transformation is happening deeper in the stack – in core operations where decisions carry weight and delays cost millions.

This isn’t another trend piece about what might happen.

It’s a field guide to what’s already working: how agentic AI is reviewing thousands of contracts, surfacing insights no analyst has time to find, and driving ROI in areas you didn’t think were automatable.

Table of Contents

So, What Are AI Agents, in a Nutshell?

Forget the technical mumbo-jumbo. You don’t need to understand how machine learning works under the hood to see the value here.

Think of an AI agent as a hyper-competent junior analyst you can hire, onboard in minutes, and who never sleeps. It doesn’t need hand-holding. You don’t give it instructions like “click here” or “filter this column.” You give it a goal – and it gets to work.

Let’s say your goal is:

“Monitor our top 20 portfolio companies. Alert me with a full summary if any news event could affect their debt covenants.”

A typical assistant might need steps.

An AI agent just needs the objective.

It reads the news, connects the dots, scans filings, and packages the relevant signals. If it doesn’t understand something, it doesn’t panic – it loops in a human for review. Then it learns. Fast.

This is the shift: AI isn’t just a tool anymore. It’s a thinking teammate. One that can scan a database of 500,000 financial records while your human analysts focus on strategy. One that flags inconsistencies in SEC filings while you’re in a board meeting.

And just like any great team member, it gets better over time. The more it works within your environment, the more context it builds – and the more valuable it becomes.

That’s the power of AI agents in finance industry: not automation, but autonomous execution with real business intent. It’s what makes artificial intelligence not only viable, but essential.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

The Core Benefits of AI Agents in the Finance Industry

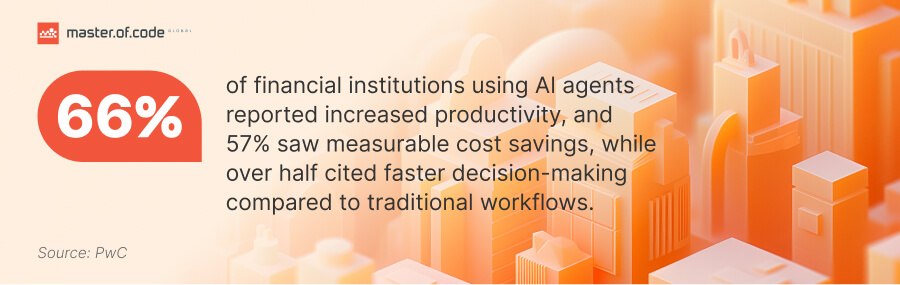

Why should business leaders care about finance chatbots powered by agentic technology? Because they don’t just improve workflows – they reshape them. Let’s break it down by outcomes that matter to the bottom line:

Radical Efficiency & Cost Reduction

AI agents in finance don’t nibble at costs – they slash them. What used to take weeks now takes hours. In fact, financial institutions leveraging agentic automation achieve up to a 90 % drop in processing time and 70 % cost savings – freeing analysts from manual grind to concentrate on growth and strategy.

Supercharged Human Expertise

Your top talent shouldn’t be buried in spreadsheets. AI agents in finance take on the repetitive load – from processing loan applications to triaging audit data – empowering employees to prioritize strategic, high-impact work. Bloomberg reports that these tools can handle up to 80% of analysts’ workloads, shifting the focus from grunt tasks to tactical client engagement and deal structuring.

Proactive Risk & Compliance

Regulatory pressure is rising, and the cost of missing something is brutal. With AI agents in finance continuously scanning for anomalies, legal exposures, and reporting gaps, you move from reactive fire drills to real-time compliance enforcement. Companies adopting this approach have already seen expenses drop by nearly 30%, thanks to automation and ongoing monitoring.

Discovery of New Revenue Streams

Data is the new alpha – if you can find it fast enough. AI agents can surface patterns, sentiment shifts, and correlations buried deep in financial records or market chatter. That means early signals for deal origination, cross‑sell potential, or portfolio rebalancing, before your competitors spot them. Financial institutions using predictive analytics report an average 250–500% ROI within the first year – a direct payoff from spotting hidden insights faster and acting sooner.

Proven AI Agents in Finance Use Cases

Here’s what this looks like in action – real problems, real improvements, already happening inside forward-thinking teams. These AI agents use cases in finance deliver measurable ROI.

Compliance That Actually Sees Context

Traditional compliance systems rely on blunt keyword matching, generating endless false positives and wasted analyst hours. Digital agents take it further. They analyze intent, tone, and context across emails, chat logs, and filings, flagging genuine risk, not innocent phrases. The result? Fewer false alarms, faster issue resolution, and better regulatory alignment without the overhead.

Autonomous Financial Planning & Analysis (FP&A)

Month-end reports are too late, and often too shallow. AI agents in finance now monitor budgets, forecast cash flow, and examine variances in real-time. They ingest ERP data, surface anomalies instantly, and even draft commentary for review. Finance teams no longer wait 30 days to fix a problem – they catch it as it happens.

Next-Level M&A Intelligence

Due diligence is a race against time and human capacity. AI agents flip the script. They read every document in the data room, notice red flags across contracts, identify discrepancies in earnings reports, and highlight potential synergies or liabilities – all before your team has had their morning meeting. They go deeper, surfacing insights that even seasoned analysts might miss.

These aren’t pipe dreams. They’re production-ready solutions already deployed at hedge funds, private equity firms, and corporate departments looking to outpace the old playbook.

Finance AI Agents in Different Companies: What We Build & For Whom

We offer AI agent development services across the finance spectrum – from nimble startups to global enterprises. And here’s the truth: one size never fits all. Every stage of growth brings a different set of pressures. That’s why our digital agents are tailored, not templated.

AI Agents in Corporate Finance

The chief financial officer’s co-pilot for strategic planning and real-time performance management.

When you’re responsible for steering financial direction, you can’t afford blind spots. Our custom enterprise AI agent solutions integrate directly into your business intelligence stack to deliver real-time variance analysis, flag performance drift, and monitor key metrics continuously. They report numbers and proactively surface what’s off and why. For CFOs juggling board prep, investor updates, and daily fire drills, this is the silent partner that never drops the ball.

AI Agents in Finance Startups

The ultimate force multiplier, giving lean teams institutional firepower.

You’ve got five people doing the job of twenty. Our built-from-scratch agents help you scale without bloating payroll – handling market intelligence, pipeline scoring, investor data review, and more. They triage inboxes, prep pitch decks, and turn fragmented data into actionable insights. Think of it as hiring a multi-skilled analyst who’s already trained on your stack, works 24/7, and never burns out.

AI Agents in Finance Enterprises

The intelligent integration layer for automating at scale.

Legacy tech? No problem. Our tailor-made agents bridge data silos, ingesting information from ERPs, CRMs, and document repositories to enforce compliance, streamline audits, and monitor risk in real time. It’s like orchestration, across departments, systems, and geographies.

Top 7 Selected Examples of AI Agents in Finance

Our Client Success: Voice AI-Powered Credit Account Management

A major financial institution approached Master of Code Global seeking to enhance their customer service capabilities while cutting down on operational costs. Their challenge was handling the high volume of routine credit account inquiries efficiently and securely. We delivered a cutting-edge Voice AI solution that automates the entire process, from authentication to transaction processing, all through natural, human-like voice interactions.

The impact was immediate. The Voice AI agent now manages over 156,000 calls monthly, achieving a 94% first-call resolution rate. This automation resulted in $7.7M in annual savings, while customers rated their satisfaction at an impressive 88%. By automating routine tasks, the institution not only boosted efficiency but also improved the customer experience significantly.

Our Client Success: Microsoft-Native AI-Powered Knowledge Assistant

A leading member-owned banking institution approached Master of Code Global to improve internal efficiency and streamline knowledge management. Their staff was spending excessive time manually searching for policy information and responding to regulatory inquiries. We engineered a Microsoft-native AI-powered knowledge assistant integrated with Microsoft Teams, allowing staff to access critical information through natural, conversational dialogue. The assistant was trained in financial terminology, ensuring accurate, real-time responses to both simple and complex queries.

The results were remarkable. The time spent searching for policy information was reduced by 85%, internal support tickets related to procedures decreased by 42%, and 93% of AI responses were rated as accurate and helpful. This solution not only automated the process but also empowered staff to work more efficiently, enhancing productivity and improving internal service quality.

Our Client Success: Agentic AI-Powered Revenue Engine

One of our fintech clients – a mid-sized lending company – implemented an agentic analytics platform to unify fragmented data across their ad tools, CRM, and financial systems. Master Of Code Global engineered a custom AI assistant and web-based dashboard that not only consolidated data but also attributed revenue back to specific marketing efforts in real time.

Instead of guessing at performance, their team gained precise visibility into true customer acquisition costs (CPA) and Return on Marketing Investment (ROMI). The result? A 35% increase in ROMI within six months, turning what was once disconnected reporting into a real-time engine for profitable growth.

Our Client Success: RCS Tool For Fintech

A financial services client partnered with us to optimize their customer communication using a unified RCS Business Messaging solution. We integrated the platform with their existing systems to enable seamless, context-aware conversations across channels: no more restarting interactions or repeating information.

The AI-enhanced experience allowed users to transition effortlessly between automated flows and live agents within a single thread. The impact was immediate: a 42% drop in customer service calls and a 300% improvement in average issue resolution time – redefining support from reactive to responsive.

JPMorgan Chase — COIN & IndexGPT Suites

JPMorgan’s COIN platform (Contract Intelligence) slashed manual legal document review – estimated to save over 360,000 hours annually – with near-zero error rates. Their IndexGPT tool generates thematic investment baskets via GPT‑4, improving index creation speed and scaling client offerings efficiently.

Morgan Stanley — AIAssistant, Debrief & AskResearchGPT

Over 98% of the brand’s wealth-advisor teams now use its internal AI Assistant daily. Document access rates jumped from 20% to 80%, and meeting summaries via “Debrief” save advisors ~30 minutes per client meeting. The firm also launched AskResearchGPT across Investment Banking and Research, improving report summarization and query response from more than 70,000 proprietary reports.

Morgan Stanley — DevGen.AI for Legacy Modernization

Their internally developed DevGen.AI tool has translated legacy code to modern specifications, saving over 280,000 developer hours in 2026 alone, freeing engineers for higher-value AI and data projects.

The Hard Questions: Navigating AI Agents in Finance Regulations

Okay, let’s address the elephant in the room: risk, rules, and what’s next.

Deploying AI agents in finance sector isn’t just about speed and scale – it’s about doing it right. This is a highly regulated industry for good reason. One missed flag, one biased output, one undocumented decision – and you’re in hot water with regulators, stakeholders, or worse.

Can You Trust the “Black Box”?

We get it. One of the biggest hesitations around AI agents is transparency. That’s where Explainable AI (XAI) comes in. We design agents that don’t just give answers – they show their reasoning. You see the inputs, logic path, and justification behind every recommendation. No mystery. No magic. Just traceable, auditable logic you can actually stand behind.

The Reality of AI Agents in Finance Regulations

This isn’t a barrier. It’s the baseline.

A strong artificial intelligence deployment doesn’t try to “bolt on” compliance at the end. It’s baked in from day one – with GDPR, SEC, and regional financial authority rules built into the architecture.

Our custom-developed agents come with human-in-the-loop controls for all critical decision points. They generate real-time audit trails, document every action, and offer full data lineage to ensure accountability. You’ll always know:

- What it did

- Why it did it

- And who had final oversight

When done right, regulatory frameworks can be a blueprint for resilience. And with the right partner, you’ll meet those expectations with confidence, not compromises.

The Future: AI Agents in Finance Trends

Digital agents are the start of a fundamental shift in how work gets done. And while the current gains are impressive, what’s coming next is even more transformative.

The Rise of Multi-Agent Systems

Today, you might deploy a single AI agent to monitor risk or automate reporting. But soon, you’ll see entire teams of bots working together – each one specialized, each one communicating with the others. Picture this: one agent tracks macroeconomic indicators, another models portfolio impact, and a third drafts strategic recommendations – all before your 9 AM meeting. It’s collaborative intelligence at enterprise speed.

This architecture is already well proven outside of financial services. A manufacturing AI agent, for example, typically operates as part of a coordinated multi-agent system—one agent forecasting demand, another optimizing production schedules, and a third managing quality or maintenance signals. Many AI agent development companies apply the same orchestration principles in finance, where specialized agents collaborate across risk, compliance, analytics, and decision support rather than working in isolation.

Deep Integration with Decentralized Finance (DeFi)

The walls between traditional finance (TradFi) and DeFi are already starting to blur. The next generation of Generative AI for fintech will move across both ecosystems, executing yield strategies, monitoring smart contracts, and reconciling on-chain data with enterprise systems. It’s already happening at forward-leaning hedge funds and fintechs.

Conversational AI in finance is also evolving – from reactive chat interfaces to proactive assistants that surface insights, manage workflows, and engage clients with tailored financial intelligence. These agents are becoming essential in improving the customer journey and supporting internal teams.

Hyper-Personalization at Scale

Forget segmentation. With enough context, Generative AI in finance will enable truly one-to-one financial experiences – whether it’s client reporting, credit analysis, or investment guidance. Agents will tailor insights, communication, and services to each individual’s history, behavior, and needs. It’s wealth management without the wealth manager.

At Master of Code Global, we’re already building for this future. If you’re ready to go beyond the basics, we’ll help you design AI systems that not only keep up but keep you ahead.

Our Approach: From Discovery to a Deployed Strategic Asset

Let’s be blunt – generic AI doesn’t solve high-stakes financial problems. Off-the-shelf bots and cookie-cutter automations might help you shave a few hours off reporting. But if you’re aiming to truly transform how your finance team operates, you need more than a plug-and-play tool.

You need an agent designed for your unique workflows, systems, and strategic goals. That’s exactly what we deliver with finance AI consulting.

Our Proven Process: Discovery + Proof-of-Concept (PoC)

We don’t start with a sales pitch.

We start with a question: What’s the highest-impact problem we can help you solve first?

Discovery

It begins with a deep-dive workshop – led by our AI strategists and finance domain experts. We map out your specific use case, current workflows, technical landscape, and performance KPIs. The goal: define a measurable business case you can take to your internal stakeholders.

Proof-of-Concept (PoC)

Next, we create a proof of concept in just a few weeks. Not a static slide deck, but a working demonstration that uses your data or connects to select systems in a controlled environment. You’ll see the core functionality in action, assess feasibility, validate potential ROI, and gather the evidence needed to secure buy‑in—without committing to full‑scale development.

If it doesn’t deliver value, you walk away smarter – no long-term commitment.

Why Partner With Us?

It comes down to experience and outcomes.

- 1,000+ AI and automation projects delivered

- Deep specialization in financial services, from M&A to compliance

- Cross-functional teams blending AI, UX, integration, and security

- A process built for speed, flexibility, and accountability

We don’t simply “develop.” We co-create intelligent systems that drive performance, not just automate tasks. Whether you’re a fintech disruptor or a legacy institution reimagining operations, we meet you where you are and build what you actually need.

The bottom line? You bring the challenge.

We’ll bring the agent that solves it.

Conclusion: Stop Drowning in Data. Start Making Decisions

Your top analyst can’t read 50,000 documents before lunch. A digital agent can – and does.

Finance leaders today face a clear choice: stick with a human-scale model that’s too slow for modern markets, or embrace human expertise amplified by AI. It’s about freeing them to do what only they can do – think critically, act strategically, and lead decisively.

The old way means bottlenecks, blind spots, and burned-out talent.

The new way means faster insight, smarter action, and a competitive edge.

If you have a problem you think is a fit for an AI agent, let’s talk.

We offer a Discovery call to map out a potential Proof of Concept and see if there’s a real business case.

No fluff, no hard sell – just a practical conversation.

You bring the challenge.

We’ll show you what’s possible.

FAQ

How do AI agents in finance personalize investment advice?

Intelligent agents analyze individual client profiles, portfolio history, risk tolerance, and even real-time market signals to deliver unique insights. Unlike static dashboards, these agents adapt continuously, flagging shifts in asset performance, rebalancing recommendations, and tailored alerts that match each client’s evolving needs.

What role do AI agents play in decentralized finance (DeFi)?

In DeFi, digital agents act as autonomous strategy executors. They monitor smart contracts, optimize yield farming, rebalance liquidity pools, and track on-chain risks across multiple protocols – all without human intervention. This allows finance teams to bridge TradFi and DeFi environments seamlessly, with more speed and visibility.

What kind of internal data and team do I need to get a project like this started?

You don’t need to overhaul your entire system. We start with what you already have – structured reports, CRM exports, or access to relevant APIs. As for your team, all you need is a clear business objective and one or two stakeholders ready to collaborate. We handle the rest, from data mapping to integration.