For financial institutions managing hundreds of thousands of monthly inquiries, silence is expensive friction. When a user speaks, any delay beyond a few hundred milliseconds signals technical failure, not sophisticated processing. This keeps operational costs high and drives the 14% call abandonment rates seen by one of our clients before implementing AI.

This performance gap is the core of voice latency in finance – that silent “void” that occurs when a customer’s request for a balance check or a card freeze is met with a processing delay.

The State of AI in Finance 2025 report, co-authored by Master of Code Global and Infobip, reveals that while industry optimism is high, actual voice adoption is stalled at a mere 11%. Decision-makers currently rate this technology as a low priority (2.⅖), largely because an unresponsive interface destroys customer confidence in high-stakes environments.

In this article, we’re moving past the hype of AI “intelligence” to solve the engineering behind immediacy. We’ll show you how to bridge that 11% adoption gap and turn the “thinking pause” into a high-speed engine for customer retention and multi-million dollar savings.

Table of Contents

Key Takeaways

- Voice latency in finance is not a UX issue but a revenue and trust problem. Even sub-second delays signal failure to customers in high-stakes financial interactions, driving abandonment, higher handling costs, and reduced confidence in automated channels.

- The adoption gap is caused by performance, not ambition. While 67% of leaders prioritize Agentic AI, only 11% have deployed voice solutions. Concerns around responsiveness and reliability keep this technology sidelined despite significant AI budgets.

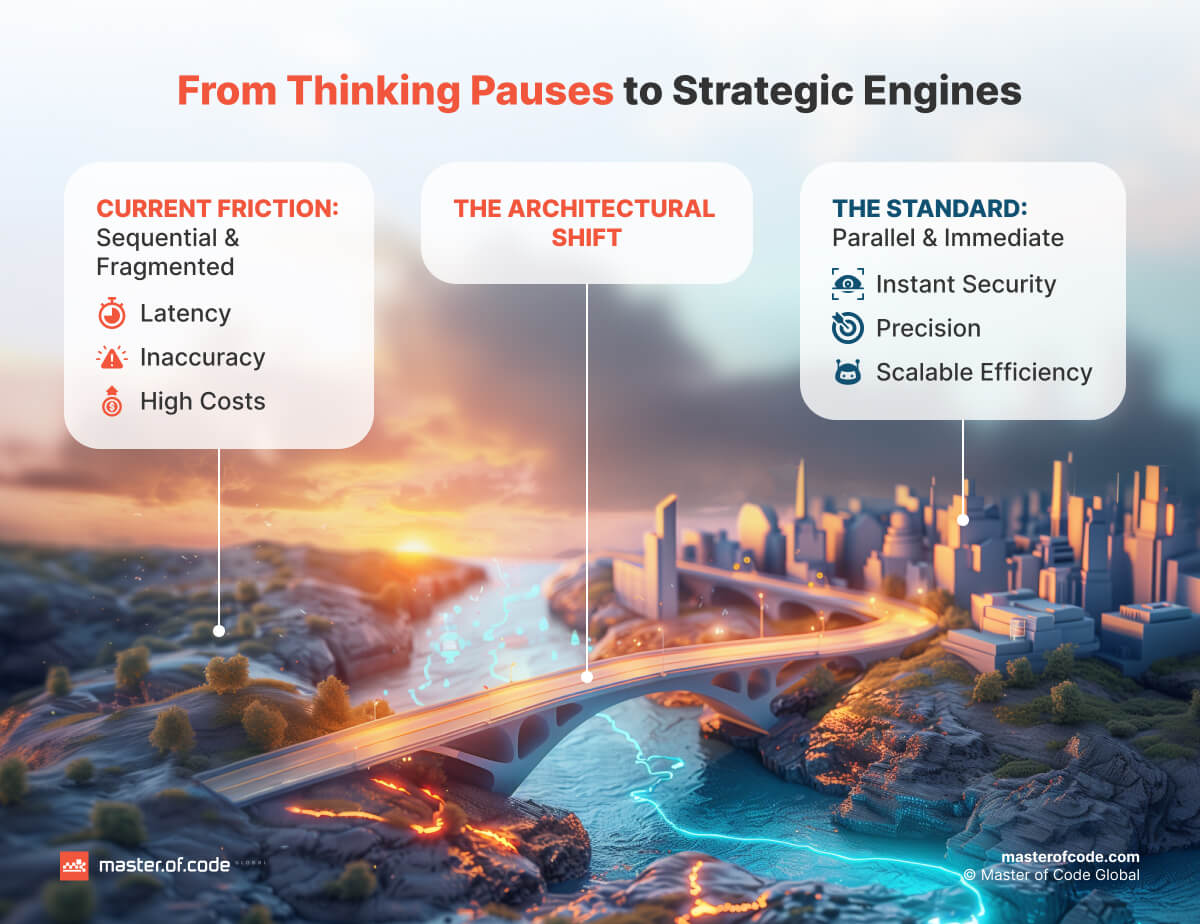

- Real-time voice AI for finance is technically achievable, but requires a different architecture. Traditional turn-based or streaming pipelines introduce fatal pauses. Speech-to-speech, parallel audio processing is essential to eliminate the “thinking gap.”

- Speed must coexist with security and accuracy. Low-latency voice systems can still meet regulatory and compliance standards when biometrics, verification, and NLU run concurrently in the background.

- Customer expectations are already shifting toward immediacy. As internal agent-assist tools become faster, users will demand the same real-time responsiveness from external voice channels.

Our Proprietary Survey Findings

The current state of AI in financial services is defined by a massive execution gap. While 67% of senior decision-makers identify Agentic AI as a high or very high priority for their organizations, voice AI latency and performance concerns have left voice interfaces largely on the sidelines. According to our research, only 11% of institutions have successfully deployed speech-enabled assistants for customer service.

This hesitation isn’t caused by a lack of budget – most organizations are spending between $1M and $5M annually on AI – but rather by a mismatch between expectation and reality. Leaders have assigned voice technology a low priority rating of just 2.2 out of 5. This reflects a widespread belief that the technology hasn’t yet reached the level of voice AI performance in finance required for high-stakes interactions.

The data reveals three specific barriers keeping voice at the bottom of the roadmap:

- The “Wait-and-See” Strategy: Two-thirds of leaders are holding back investment until the business case becomes undeniably stronger.

- The Trust Gap: Concern about the ethical use of AI is at an all-time high, with leaders rating their concern at 4.7 out of 5.

- The Performance Wall: In an industry where 56% of leaders already report being satisfied with their current (mostly text-based) AI solutions, the threshold for introducing a new, voice-first channel is incredibly high.

However, treating voice as a secondary priority is a risky move for innovation managers. The report shows that 97% of firms plan to expand agent-assist tools in the next two years. As these internal solutions become more immediate, the customer’s expectation for that same speed will inevitably spill over into external voice channels. Fighting voice latency in finance now is how forward-thinking firms will turn that 11% adoption rate into a dominant market share before the rest of the industry catches up.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Is Real-Time Voice AI Technically Possible?

To answer the board’s most frequent question: Yes, but not with the architecture most companies are currently using. In the world of professional finance, “almost instant” is effectively obsolete. To build a system that people actually use, you have to move beyond streaming vs turn-based pipelines. Such systems wait for the user to stop talking before they even begin to “think,” leading to a round-trip latency that kills conversational momentum.

Solving this requires a total deconstruction of the end-to-end latency stack. Our approach minimizes orchestration overhead by processing audio in parallel chunks rather than waiting for a full sentence to end. This transition to speech-to-speech latency optimization ensures the AI voice assistants for enterprises are preparing their response while the user is still finishing their thought.

For a regulatory-safe architecture, speed cannot come at the expense of precision. We engineer to solve the following technical hurdles:

- Barge-in Latency & Interruption Handling: If a client interrupts a finance AI agent to say “No, wait, I meant my savings account,” the system must pivot instantly. We optimize the feedback loop so the bot stops its current thread and adapts in under 200ms.

- The Psychology of the Pause: Sometimes, the math takes time. It’s vital to use filler sounds or “active listening” indicators to ensure the user never hits a wall of dead air.

- Elastic Infrastructure: In finance, concurrency spikes are a reality. Think of a market crash or a major service outage. A workable infrastructure should be designed to maintain performance even when thousands of callers hit the system simultaneously.

- Intelligent Fallback Logic: Reliability is just as important as speed. If a voice connection becomes unstable or a user moves into a high-noise environment, this feature can instantly trigger a transition to SMS or WhatsApp, ensuring the user journey continues without losing a single data point.

By tightening these latency budgets, we move from a machine that “replies” to an agent that truly “converses”. When the delay disappears, the technology becomes invisible, leaving only the service behind.

How We Can Solve Industry Pain Points

Today, speed is a proxy for competence. When an organization addresses voice AI latency, they aren’t just improving a metric; they are removing the friction that prevents high-value users from adopting automated channels. For top managers, the goal is to bridge the gap between “experimental” AI and the enterprise voice AI latency standards required for heavy-duty financial operations.

Pain Point 1: Security vs. Speed

The first one is non-negotiable, but traditional multi-factor authentication often adds seconds of perceived latency. A good architecture solves this by running advanced biometrics and knowledge-based verification in the background, simultaneously with the natural language understanding engine. This means that while the voicebot in banking is performing a friendly greeting, it is already verifying the caller’s identity in the “shadows” of the call, securing the session without the client ever feeling a “processing” lag.

Pain Point 2: High-Stakes Accuracy

When a customer asks for a balance or a currency conversion, the real-time financial voice systems must deliver data that matches the millisecond-precision of global markets. Generic, off-the-shelf bots often suffer from latency under load, leading to slow responses or outdated information during periods of high market volatility. By using domain-specific models, we maintain strict latency SLAs for voice agents, ensuring that transaction disputes or credit limit requests are processed with the immediate precision your brand promises.

Pain Point 3: The Cost of Repetition

Human-led outreach is becoming too expensive to sustain at scale, costing institutions over $14M annually for routine tasks (a real case from our client). Generative AI for finance changed the math for them by handling over 156,000 monthly calls autonomously. This allows your human experts to move from repetitive data entry to complex relationship building. Even during sudden traffic surges, the system ensures that your operational costs plummet as your service capacity scales to meet demand.

Examples of Successful Voice AI Implementation in Finance

Case Study 1: The Enterprise-Grade Credit Inquiry Agent

A leading EU financial institution faced a scaling crisis: over 285,000 monthly calls were overwhelming a 600-agent workforce, with 65% of inquiries involving predictable, routine tasks. Long wait times and a 14% abandonment rate were draining $14.8 million in annual labor costs.

Master of Code Global developed a custom Voice AI agent capable of managing 58 different conversational paths: from balance checks to dispute processing. By prioritizing account protection through multi-layered voice biometrics and ensuring deep backend connectivity, the system now handles 156,000+ monthly calls autonomously.

- Financial Impact: Achieved $7.7M in annual cost savings.

- Speed & Quality: Maintained a 94% first-call resolution rate and an 88% customer satisfaction score.

- Operational Gain: Reduced peak-period wait times by 41%, allowing human agents to focus on complex financial counseling.

Case Study 2: The Multi-Lingual FAQ Powerhouse

For a rapidly growing retail bank, traditional call center models couldn’t keep pace with a surging customer base. They needed an advanced, speech-enabled solution that could understand intent rather than just keywords.

We designed an AI-powered FAQ Voicebot that integrated seamlessly with the bank’s existing CRM. The solution provided 24/7 support and multilingual capabilities, ensuring that global expansion didn’t come at the cost of service consistency.

- Volume Control: Successfully drove a 26% reduction in call center volume.

- Accuracy: Delivered a 94% accuracy rate in answering complex FAQs.

- Efficiency: Achieved a 79% first-call resolution rate for common inquiries, significantly lowering the cost per interaction.

Why Master of Code Global Is Your Partner, Not Just a Vendor

Successful digital transformation in banking requires a partner that moves beyond the limitations of “off-the-shelf” APIs. These systems often underestimate the rigorous tuning needed for high-stakes environments, where cold starts and processing delays can alienate a high-net-worth client in seconds. At Master of Code Global, we integrate directly with your core systems to ensure your intellectual property remains secure while eliminating the “computational stutter” that leads to customer churn.

Our “Zero Sprint” methodology de-risks your investment by using a fixed-price Proof of Concept to validate performance in a secure “playground” before sensitive data is involved. This phase of AI voice bot development provides the technical scoping and architectural plans necessary to justify ROI to your board without the traditional risks of a full-scale rollout. We treat every AI voice assistant like a “new hire,” requiring structured onboarding and performance tracking to meet the same strict KPIs as your human staff.

To maintain trust, we transition “Black Box” AI into transparent, auditable systems supported by ISO 27001-certified workflows and niche financial expertise. We implement advanced latency observability tools that provide real-time visibility into every conversational thread, allowing us to proactively mitigate latency degradation before it impacts the user experience. With 20 years of B2B experience, collaborating with top brands, we’ve proven to be a partner dedicated to your long-term market strength.

Closing Thoughts

It seems that low-latency voice systems are no longer just a “nice-to-have” feature. Now they become a definitive statement about your brand’s technological maturity. In a market where 67% of leaders still relegate voice tech to the bottom of their roadmap, immediacy becomes your primary differentiator.

When a client’s call is answered instantly, you aren’t just responding. Instead, you are projecting the stability and precision that the financial sector demands. By delegating rule-based repetition to an intelligent agent, you allow your human staff to focus on empathy and high-value financial counseling.

At Master of Code Global, we don’t only build models; we develop the tech partner infrastructure that bridges the gap between a “laggy” bot and a high-performance financial agent. Our team understands that trust is built in the milliseconds between a question and a response. This is why we can help you secure the market share that the 11% of early adopters are currently claiming, turning expensive silences into a $7.7M annual cost-saving engine.