Imagine your company’s requests handling as a vast, imposing mountain range. Peak after peak of documents, applications, and endless forms stretch as far as the eye can see. For many businesses, particularly in sectors like healthcare, automotive, and financial services, this isn’t just an image – it’s a daily reality. This towering landscape of paperwork embodies slow, grinding processes that devour resources, and, perhaps most critically, erode customer enjoyment.

Manual claim handling, which is common in many industries, results in average delays of 7–10 days, inflating operational costs due to the need for more human resources. In an age where speed and seamless experiences are paramount, are you still navigating this arduous terrain while your competitors are already soaring above it? If so, it’s time to explore the transformative potential of AI for claims processing.

Not merely another technology buzzword, artificial intelligence is the catalyst that can dismantle these inefficient systems, unlocking unprecedented speed, accuracy, and, ultimately, turning requests handling from a costly bottleneck into a strategic engine for profit and client loyalty. Prepare to discover how AI-powered claims processing can elevate your operations from a slow, uphill struggle into a streamlined, high-velocity ascent.

Table of Contents

The Claims Quagmire: Why Traditional Workflow Is Drowning Businesses

Are you losing sleep over the relentless climb of operational costs within your department? Does the phrase “lengthy claim resolution” send a shiver down your spine, knowing customer satisfaction is teetering on the brink with every passing day? Are your most valuable team members, the innovators and problem-solvers, bogged down in a soul-crushing cycle of manual data entry and error correction, when their minds could be igniting groundbreaking strategies? These aren’t just abstract concerns; they are the tangible realities of outdated claims management processes.

The consequences are stark: inflated labor expenses swallowing profits, error rates chipping away at accuracy and trust, and agonizing delays breeding frustration and brand erosion. For instance, in the healthcare sector, commercial health insurers have an average claims-processing error rate of 19.3%, which not only wastes billions of dollars but also frustrates patients and physicians. Negative reviews multiply, user loyalty dwindles, and churn becomes a looming threat.

Meanwhile, internal resources are stretched thin, employee burnout rises, and the crucial work of innovation and strategic growth gets perpetually sidelined. Is your company truly thriving, or merely surviving, trapped in this claims quagmire? It’s time to face the fact: traditional approaches are actively drowning your business potential.

Enter the Digital Alchemist: Transforming Lead into Gold in AI for Claims Processing

But what if you could fundamentally alter this narrative? What if the heavy burden could be transmuted, almost magically, into a strategic advantage? Picture a world where requests are no longer processed in days, but in minutes – a realm where accuracy soars, costs plummet, and client satisfaction is a consistent outcome. This isn’t wishful thinking, nor is it some distant science fiction fantasy. This is the promise of AI-based claims processing.

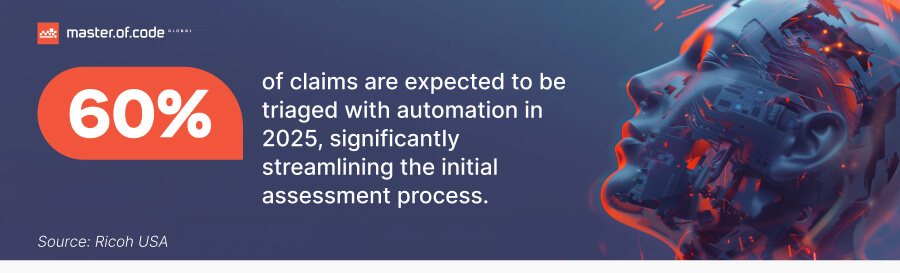

Artificial intelligence is about reinventing the entire case lifecycle from the ground up. For instance, digital tools can minimize low-value tasks, which currently consume about 30% of handlers’ time. Think of it as an alchemist, expertly turning the ‘lead’ of slow, error-prone, and costly processes into the ‘gold’ of efficiency and precision. With its power to automate, accelerate, and analyze with unparalleled accuracy, artificial intelligence doesn’t just tweak the existing system; it ignites a paradigm shift. Prepare to witness how AI in insurance claims is fundamentally transmuting it into a powerful engine for business growth and client loyalty.

Industry Spotlights: Specific Examples and Use Cases

Healing the Claims Process in Healthcare

The medical sector operates under immense pressure – balancing optimal patient care with stringent regulatory compliance and the constant need for rapid reimbursements. For providers, delays in requests handling translate directly into cash flow bottlenecks and strained resources that could be better allocated to patient well-being. AI in healthcare claims processing steps in as a vital ally, accelerating cases cycles to ensure quicker financial turnaround, meticulously reducing administrative errors that can trigger compliance issues, and enhancing communication throughout the often-opaque reports journey.

Think about fraud detection systems acting as vigilant guardians against fraudulent claims, safeguarding revenue and resources. Artificial intelligence can analyze both structured data and unstructured data, flagging anomalies in real-time while voice bots handle routine patient inquiries about request statuses. AI in health insurance claims is not just about efficiency; it’s about enabling better patient care through optimized approaches.

AI Claims Processing Automotive Industry

In the car sector, requests often arise from stressful, time-sensitive situations – accidents. Customers demand rapid resolution to get back on the road and minimize disruption to their lives. Traditional approaches can feel agonizingly slow, adding to client frustration and potentially impacting loyalty. AI injects much-needed velocity and empathy into this process. Image analysis can revolutionize damage assessment, providing instant evaluations based on uploaded photos, slashing appraisal times from days to minutes.

Simplifying the First Notice of Loss (FNOL) with voice bots guarantees immediate claim initiation, capturing crucial details efficiently and compassionately, right at the moment of need. Artificial intelligence facilitates quicker repair authorizations, making sure vehicles are back in user’s hands faster, and dramatically improving the overall consumer journey during a stressful post-accident period. AI claims processing is about transforming a moment of distress into a swift, supportive, and efficient resolution experience.

The Benefits Beyond Efficiency Metrics

Automation in insurance is about unlocking a cascade of strategic advantages that redefine business performance. Beyond improving customer satisfaction, it also reduces the discontent caused by slow settlements, which affects 60% of policyholders who have made recent submissions. Consider these transformative benefits of AI in insurance claims:

- Slash Operational Costs, Amplify Profit Margins: Envision dramatically reducing manual labor, minimizing mistakes, and accelerating processing times across your entire requests operation. AI makes this a reality, directly boosting your bottom line.

- Elevate Accuracy, Eradicate Errors: Achieve superhuman precision in claims assessment. AI algorithms meticulously analyze data, learn patterns, and flag anomalies, inherently improving accuracy and drastically reducing fraudulent payouts, safeguarding revenue, and boosting data integrity.

- Delight Clients, Cultivate Loyalty: Transform customer experience with faster claim resolutions, digital proactive communication, and personalized service interactions. Whether through an AI chatbot for insurance or voice bots, artificial intelligence makes sure that users receive instant support and become loyal advocates as a result.

- Scale with Agility, Not Headcount: Gain unparalleled business flexibility. The systems adeptly handle fluctuating claim volumes without requiring linear increases in staffing, enabling you to respond to market changes with intelligent scalability.

- Unlock Data-Driven Insights, Optimize Continuously: Overhaul your requests handling into a source of strategic intelligence. AI in insurance claims generates a goldmine of data, providing invaluable insights for process refinement, proactive risk management, and strategic decision-making that fuels continuous improvement and competitive advantage. With predictive analytics, companies can anticipate trends, detect potential fraud before it happens, and optimize workflows to boost efficiency and reduce costs.

Solution Spotlight: AI Tools in Your Requests Arsenal

Voice Bot for Automated Claims

What if there were an assistant that never sleeps, never takes a break, and is always ready to assist your customers? That’s the power of voice bots. These intelligent virtual assistants utilize sophisticated natural language processing to understand and respond to client inquiries via voice. Working around the clock, 24/7, bots adeptly handle a high volume of FAQs, giving instant answers to frequently asked questions about claim statuses, coverage details, or required documentation. Moreover, automation can reduce processing costs by 50–65%, further improving operational efficiency.

Crucially, they can also collect initial data directly from customers, guiding them through the first notice of loss journey with ease. Voicebot for insurance is designed to be exceptionally user-friendly and accessible, especially for those who prefer the immediacy and natural feel of speech interaction over navigating complex online forms. By automating these initial touchpoints, voice bots significantly reduce the burden on your call centers, freeing up human agents to focus on high-stakes cases and escalated issues, while simultaneously improving service availability and responsiveness, verifying help is always just one command away.

Generative AI in Claims Processing

Let’s say you could effortlessly produce clear, concise, and personalized communications and documentation for every request. Enter Generative AI in insurance. It’s a cutting-edge branch capable of creating new content – text, in this case – that is remarkably human-like and contextually relevant. In claims, this translates to a powerful ability to automate the generation of detailed reports, craft tailored email and letter communications to claimants, and even populate comprehensive FAQs and knowledge bases for self-service support.

Smart technology excels at streamlining documentation processes, safeguarding consistency in communication across all channels, and personalizing customer interactions at scale. You can instantly generate empathetic and informative responses to inquiries, or automatically create summaries of complex request details – all powered by AI for insurance claims.

AI Agents & Agentic AI for Autonomous Requests Processing

Looking towards the horizon of AI claims management, envision a future where all cases are processed autonomously, from initiation to resolution – this is the promise of AI agents for insurance. Moving beyond simple task automation, digital tools are intelligent, proactive entities capable of performing complex, end-to-end processes independently.

Agentic AI in insurance takes this further, imbuing these agents with decision-making capabilities, allowing them to intelligently adapt to varying scenarios, learn from experience, and proactively resolve issues without human intervention in many cases.

Frequently Asked Questions: Addressing Lingering Doubts

Q: How does AI improve the accuracy of claims processing?

Artificial intelligence dramatically elevates precision by leveraging advanced data analysis and pattern recognition. It meticulously examines vast datasets to identify anomalies, predict potential fraud, and minimize human error. By automating manual tasks and providing data-driven insights, AI for claims processing secures more precise request assessments and reduces costly mistakes.

Q: What is Generative AI in insurance claims processing?

Generative computing is a powerful tool capable of creating human-quality text. In this particular field, it automates the generation of unique communications, detailed reports, and comprehensive documentation. This refines workflows, gives consistent messaging, and improves customer engagement through tailored interactions.

Q: What types of cases can artificial intelligence handle?

AI for claims processing is remarkably versatile and adaptable. It can be deployed across diverse industries and manage a wide spectrum of request types, from simple, routine claims to complex and nuanced cases. Its adaptability makes it a robust solution for virtually any report resolution environment.

Q: Is AI implementation complex and disruptive?

While transformative, digital integration can be phased and strategically managed. We prioritize a smooth transition, offering comprehensive help and implementation strategies to minimize disruption. Our approach focuses on gradual installation and provides ongoing support to optimize your adoption journey and deliver top-notch customer experience.

Q: What about data security and privacy in AI claims processing?

Safety and fraud detection are paramount. Our solutions incorporate robust encryption, adhere to stringent compliance standards, and are built upon ethical digital practices. We emphasize data governance and establish the highest levels of security to protect sensitive information throughout the request handling.

Q: What is the expected ROI of AI in claims processing?

Expect a significant return on investment. Artificial intelligence drives ROI through substantial cost savings from reduced manual labor and errors, increased efficiency gains from faster processing, improved customer satisfaction boosting loyalty, and significant fraud reduction. Let’s discuss your specific needs to project your potential ROI in detail.

Concluding Thoughts

The journey to AI insurance claims processing excellence is no longer about incremental tweaks, but about embracing a fundamental shift. Beyond automating the mundane, it’s injecting intelligence, proactivity, and a heightened focus into every stage of the claim lifecycle. The future of report handling is here, and it is ready to transform your department from a reactive cost center into a proactive, strategic powerhouse driving competitive advantage and customer loyalty.

Are you ready to seize this groundbreaking opportunity? Take the first step towards claims processing excellence today. Let’s partner to build the intelligent, efficient, and user-centric future of your requests lifecycle, together.

Ready to build your own Conversational AI solution? Let’s chat!