Time is money, and in today’s swift-moving world, customers are no longer willing to spend it waiting in long queues or dealing with tedious processes. That’s where voice technology comes in—opening doors to a new era of speed and convenience in banking. Intelligent assistants are redefining what’s possible in the sector, offering instant service, effortless account management, and a personalized touch.

Indeed, as John Colón, VP of Global Enterprise Sales at Master of Code Global, eloquently puts it: “The industry is witnessing a revolution where voice bots are becoming pivotal in enhancing customer engagement, promising a future where financial transactions are as simple as a conversation.”

With that in mind, let’s investigate the rise of voice bots in banking and discover how they contribute to a faster, more convenient client experience. Come along as we dive deep into the details and unveil the formulas for success in this exciting new field.

Learn from 200+ finance executives about working AI solutions, risk management, and ROI they’re seeing.

Table of Contents

The Scene of Innovation: Understanding Voice Banking Technology

The way we bank has changed dramatically. Remember the days of queuing in long lines, just to speak to a manager for a basic balance inquiry? Thankfully, those days are fading fast. We’ve transitioned from traditional brick-and-mortar banking to the comfort of online and mobile operations. Now, we’re on the cusp of an even bigger shift—the era of speech-enabled finance. This is where voice Conversational AI takes center stage, establishing a new benchmark for personalized and hassle-free communication.

But why this sudden surge in this technology? It’s simple. In the relentless march of progress, consumers crave swiftness and user-friendliness. Research shows an impressive 74% of people prefer using voice for search queries, and almost half find speech-based assistants faster and more accessible than human interaction. Such a demand, coupled with advancements in AI and natural language processing (NLP), is driving the rapid adoption of voice bots in the banking sector.

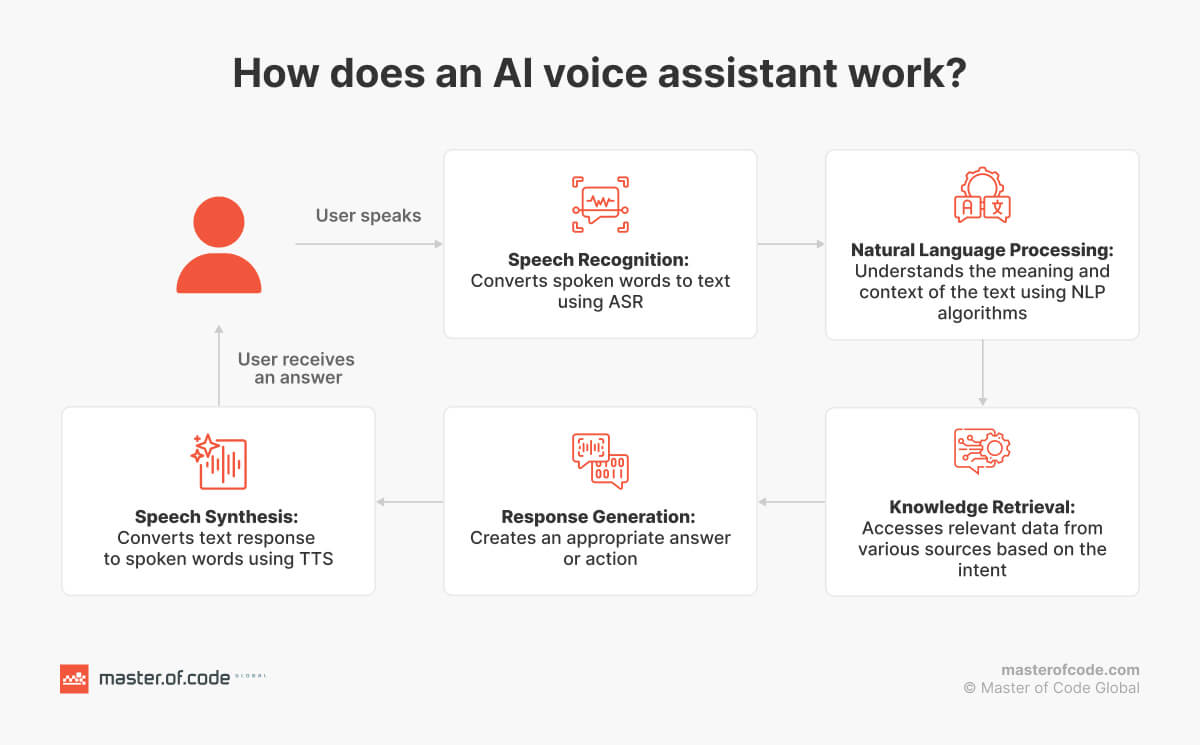

So, what exactly are these tools? Imagine a friendly and efficient virtual assistant, ready to give you a hand with user needs 24/7. Such chatbots for banking utilize a fascinating mix of technologies, including Automatic Speech Recognition (ASR) to understand spoken words, NLP to decipher the client’s intent, and Text-to-Speech (TTS) to respond in a natural, human-like manner. And underpinning it all is the magic of machine learning, allowing these systems to continuously evolve and improve their performance over time.

This isn’t just about meeting client expectations, though. Businesses are witnessing tangible benefits from voice assistants. Executives are laser-focused on employing it to enhance productivity (87%), unlock new business opportunities (77%), and drive revenue growth (62%). And they’re already reaping the rewards, with 83% reporting increased accessibility and speed, 77% seeing improvements in consumer support, and 74% highlighting the positive impact on brand identity and customer experience.

But the journey doesn’t stop there. With advancements in Generative AI, voice technology is poised to become even more powerful and personalized. Learn more about the exciting Gen AI use cases in banking here.

The future of finance is definitely speech-activated, and those who adopt it early will secure a dominant position in the market. Let’s explore how voice bots can empower your organization to stay in the lead.

Banking FAQ Voice AI Assistant

- 26% reduction in call center volume

- 94% accuracy rate in answering FAQs

- 79% first-call resolution rate for common inquiries

Master of Code Global partnered with a mid-sized retail bank to address overwhelming customer inquiries and rising operational costs. We developed an AI-powered voicebot that integrated with their CRM system and provided 24/7 multilingual support across all channels.

The Evidence File: Speech-Driven AI Benefits for Financial Institutions

Operational Efficiency Analysis

- Voice bots can help banks significantly reduce expenses by automating routine tasks and freeing up managers to focus on more complex issues. Picture streamlining customer service, reducing call center workload, and optimizing resource allocation—all thanks to the power of this technology.

- Unlike human agents, such systems can handle a virtually unlimited number of interactions simultaneously, ensuring your company effortlessly scales its services to meet peak demand and accommodate further expansion.

- These chatbots for banking never sleep. They provide uninterrupted service 24/7, 365 days a year, ensuring your clients receive instant support and assistance whenever they need it, regardless of time zones or holidays.

Customer Experience Findings

- Banking voice bots present quick, convenient, and personalized care, leading to higher satisfaction scores and increased loyalty. By offering timely aid and cutting down on wait periods, you create seamless and enjoyable processes for your consumers.

- Voice AI plays a critical role in helping banking streamline services by unifying support, self-service, and real-time assistance into a single conversational layer.

- These applications break down barriers to accessibility, adapting to varying needs and preferences. Whether it’s through multilingual answers or catering to individuals with visual impairments, voice technology ensures everyone has equal access to financial services.

- Say goodbye to long holds and frustrating phone menus. AI voice bots in banking deliver answers and efficient guidance on the spot, greatly optimizing response times and enhancing the overall user journey.

- Similar conversational patterns are already proving effective beyond finance — for example, voice solutions for dealership customer service apply the same principles to handle inbound calls, route service requests, and provide instant answers without long IVR menus, significantly improving customer satisfaction.

Now that we’ve laid out the advantages, let’s explore some compelling voice bot use cases in banking and see how these benefits translate into practical scenarios.

Case Files: Strategic Voice Bot Applications in Banking

Case File #1: Automated Account Services

AI voice bots in banking offer clients a wide array of functionalities when it comes to profile handling, such as:

- Balance inquiries and transaction history. Customers can easily check funds available, review past transactions for specific periods, analyze their spending patterns through operations categorization, and even set up real-time alerts for account changes. This effortless access to information is further enhanced by integration with mobile apps, creating a convenient hybrid experience.

- Bill payment and scheduling. Speech-based tools allow users to schedule recurring payments, modify existing ones with ease, receive confirmations and receipts, and get timely reminders for upcoming bills. Such agents can also quickly verify transfer amounts and ensure their finances are always on track.

Speaking of real-world examples, the U.S. Bank is leading the charge with its innovative digital assistant. This voice chatbot allows consumers to manage their accounts, make Zelle payments, scan deposit activity, select travel notifications, redeem rewards, add authorized users, and even lock or unlock their debit card—all through simple oral commands.

Case File #2: Credit Card Operations

Banking voice chatbots prove just as effective for managing services:

- Lost/stolen plastic. If it is misplaced or gets into unauthorized hands, the owner can instantly freeze the card with a simple command, preventing fraudulent activity. They can then smoothly order a replacement and even obtain a temporary virtual one for immediate use, all without having to navigate through complex menus or wait on hold.

- Credit limit modifications. AI voice bots in banking also enable people to request maximum borrowing capacity increases, temporarily adjust their threshold for distinct needs like travel, receive helpful messages about their credit utilization, and configure flexible billing arrangements.

Bank of America’s Erica is a prime example of such a bot in action. With Erica, customers can effortlessly monitor their balance, transfer money between accounts, locate particular transactions, and arrange appointments with bank representatives through intuitive interactions.

Case File #3: Investment and Portfolio Management

Voice banking is no longer confined to basic functions and is now making waves in the world of investments:

- Portfolio status updates. Staying in the loop with real-time stock price checks, exhaustive performance summaries, and timely market alerts are delivered straight to the client’s device. Voice confirmations for trade executions present an added layer of assurance and transparency.

- Investment advisory services. Beyond essential guidance, technology offers insightful fund efficacy comparisons, keeps users informed about dividend payment schedules, and provides concise industry news briefings for sound decisions.

Case File #4: Loan Processing Automation

Imagine a world where acquiring credit is as simple as speaking a few words—that’s the promise of voice-powered lending flow:

- Mortgage application management. Applying for a property loan becomes significantly easier with speech-activated assistance. Customers submit initial requests, receive timely reminders for document submissions, track their application status effortlessly, get instant notifications about rate locks, and even schedule closing dates.

- Personal loan services. Voice assistants in banking simplify the process of obtaining individual funding too. They provide quick eligibility checks, detailed interest rate comparisons, and convenient payment calculators. Other activities that are covered include identifying potential refinancing opportunities or securing the most favorable agreement terms.

Case File #5: Advanced Fraud Protection

Voice-assisted banking isn’t just about convenience; it’s also a powerful tool in the fight against scams. Here’s how speech-based technology enhances safety:

- Suspicious transaction verification: Bots can initiate real-time validation calls, confirm the geographic location of the transaction, and alert customers to unusual spending patterns, adding an extra layer of protection against fraudulent activity.

- Voice biometric authentication. Multi-factor identification, behavioral pattern recognition, and voice signature confirmation create a robust defense against unauthorized access and identity theft.

Master of Code Global has developed a cutting-edge voice AI agent for credit account inquiries, designed to automate and secure customer interactions. This intelligent assistant allows users to authenticate transactions, check balances, make payments, and more—using simple voice commands, all while ensuring robust fraud protection with advanced security protocols.

With over 156,000 calls handled autonomously each month, the AI agent boasts a 94% first-call resolution rate and an 88% customer satisfaction score. By reducing human workload, it saves $7.7M annually in operational costs, offering a secure and efficient experience for both customers and financial institutions.

In terms of real-world impact, HSBC UK’s Voice ID system has successfully prevented nearly £249 million in attempted fraud, demonstrating the significant security benefits of such apps.

Case File #6: International Banking Services

Speech technology is breaking down geographical barriers, offering a range of convenient services for globe-trotting clients:

- Foreign currency exchange. Customers who choose voice banking gain access to real-time forex rate details, complete conversion calculations on the fly, and track international transfers with ease.

- Travel notifications. Voice bots in banking also help users prepare for their journeys by activating their cards for overseas use, locating ATMs, providing information about transaction fees, and even connecting them with emergency assistance if needed.

Garanti Bank’s voice-activated mobile app, MIA, illustrates these capabilities. MIA allows consumers to perform various tasks, from checking their account balance to buying and selling foreign currency, using spoken commands. This innovative approach has earned Garanti Bank recognition from Efma and increased satisfaction rates.

The Expert Analysis: From Challenges to Success

While the potential of voice AI in banking is vast, it’s paramount to acknowledge the hindrances that come with this advanced technology.

Critical Implementation Roadblocks

- Technical Complexity

- Difficulties in seamlessly integrating voice bots with legacy systems can lead to data inconsistencies, security vulnerabilities, and work disruptions.

- Failing to properly align functionalities with existing protection protocols may expose sensitive records to unauthorized access and compromise regulatory compliance.

- Operational Hurdles

- Inadequate staff training and support causes resistance to new processes, hindering the successful integration of voice banking.

- Privacy concerns, unfamiliarity with technology, and a lack of trust hinder acceptance from clients.

- Insufficient performance monitoring results in undetected errors, missed opportunities for optimization, and a decline in overall efficiency.

- Customer Experience Challenges

- Inaccurate voice recognition, particularly with diverse accents and dialects, triggers frustration and negative feedback.

- Such assistants may struggle to understand complex queries, resulting in irrelevant or incorrect responses.

- A poorly executed handoff disrupts the user journey and creates unfavorable perceptions of the service.

Master of Code Global’s Strategic Solutions

Navigating the complexities of voice assistant development in banking requires a trusted partner. Our company, Master of Code Global, empowers financial institutions to overcome these challenges with our proven implementation process, from discovery and assessment to deployment and optimization.

We bring unparalleled expertise, ISO-certified processes, and a custom solution design approach to mitigate risks and ensure a frictionless launch. Our dedicated change management support facilitates staff adaptation and drives customer adoption.

Furthermore, our unique Embeddable Voice Assistant R&D accelerates time-to-market for speech-based solutions, enabling rapid prototyping and easy integration with existing systems. This framework, built on a foundation of technologies like Swift, Kotlin, and Azure, allows our engineers to create highly customized and scalable applications that deliver exceptional user journeys.

Future Case Projections: The Evolution of Voice Banking

From exploring the challenges to envisioning the possibilities, we’ve covered a lot of ground! Now, let’s take a glimpse into the future of voice assistants. The infographics below reveal the exciting transformations ahead, with expert predictions from our masters and key industry forecasts.

Closing Brief: The Voice Bot Verdict

The future of the sector is spoken, not typed. As the lines between the physical and digital worlds blur, voice bots in banking will become the bridge that connects customers to their financial goals with unprecedented ease and personalization. Let’s contribute to this shift together. Are you in? Get in touch with us today to discover partnership opportunities and how Master of Code Global can help you excel.

Ready to build your own Conversational AI solution? Let’s chat!